No software is required. You can search for it by the internet browser.

No additional fee is required. You can search for it for free.

The INVOICE will be automatically sent to the email address used at the time of purchase.

If you do not receive it, please contact us via the contact form.

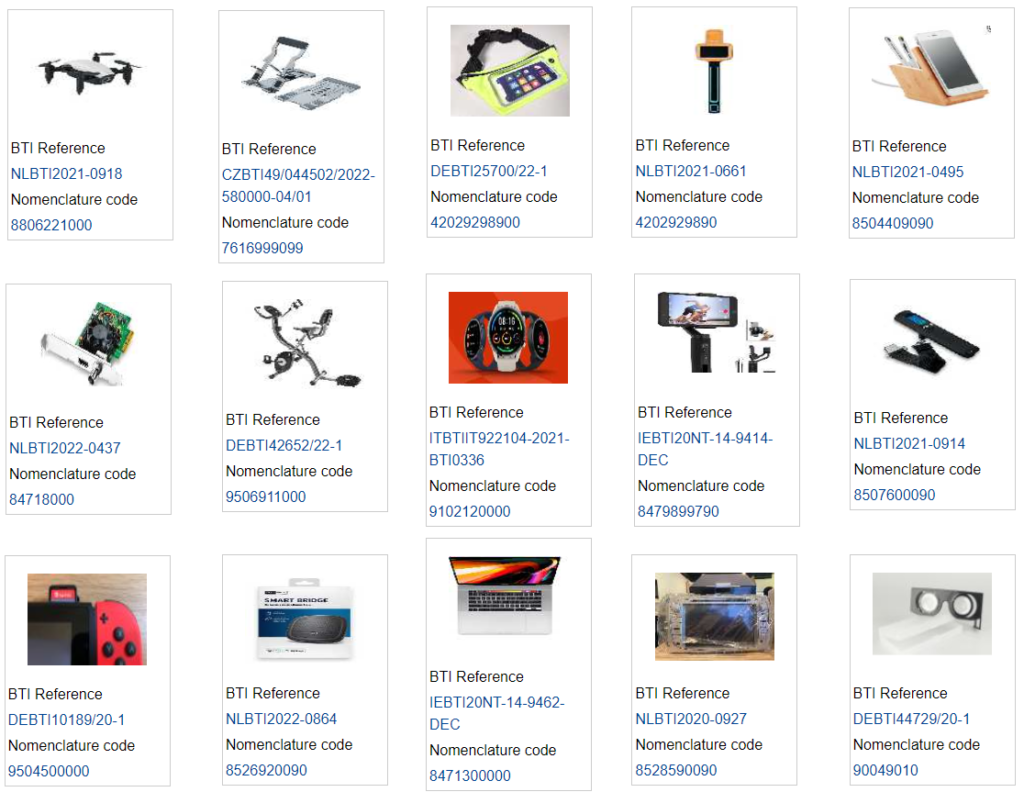

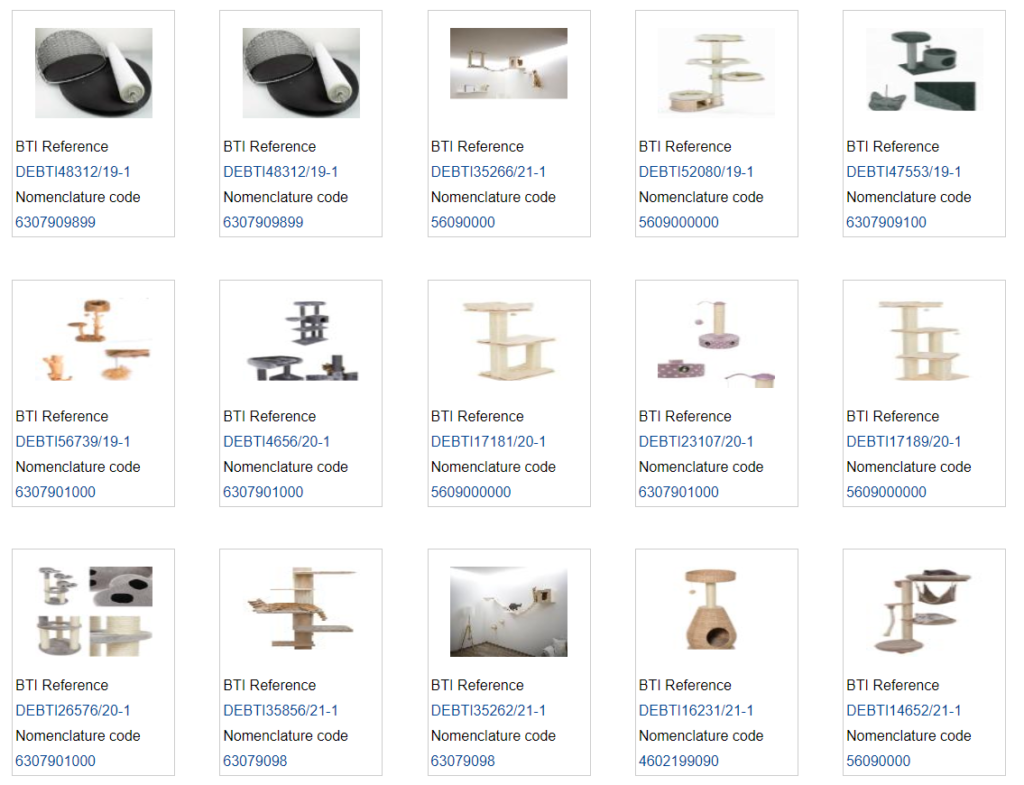

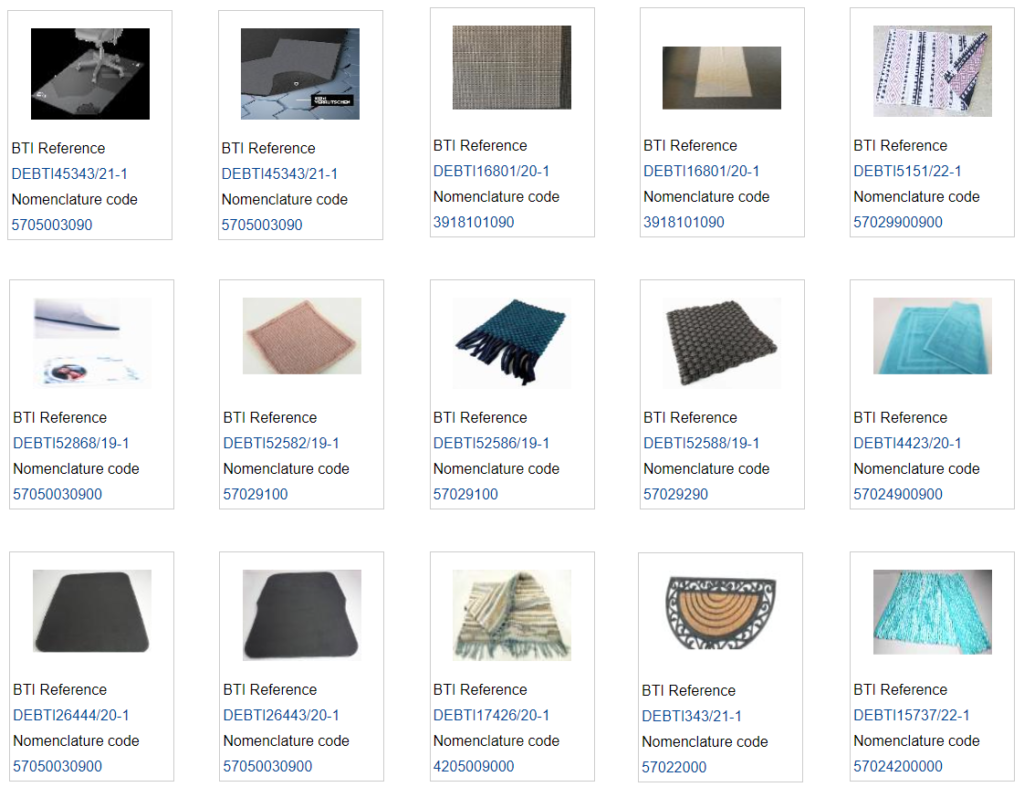

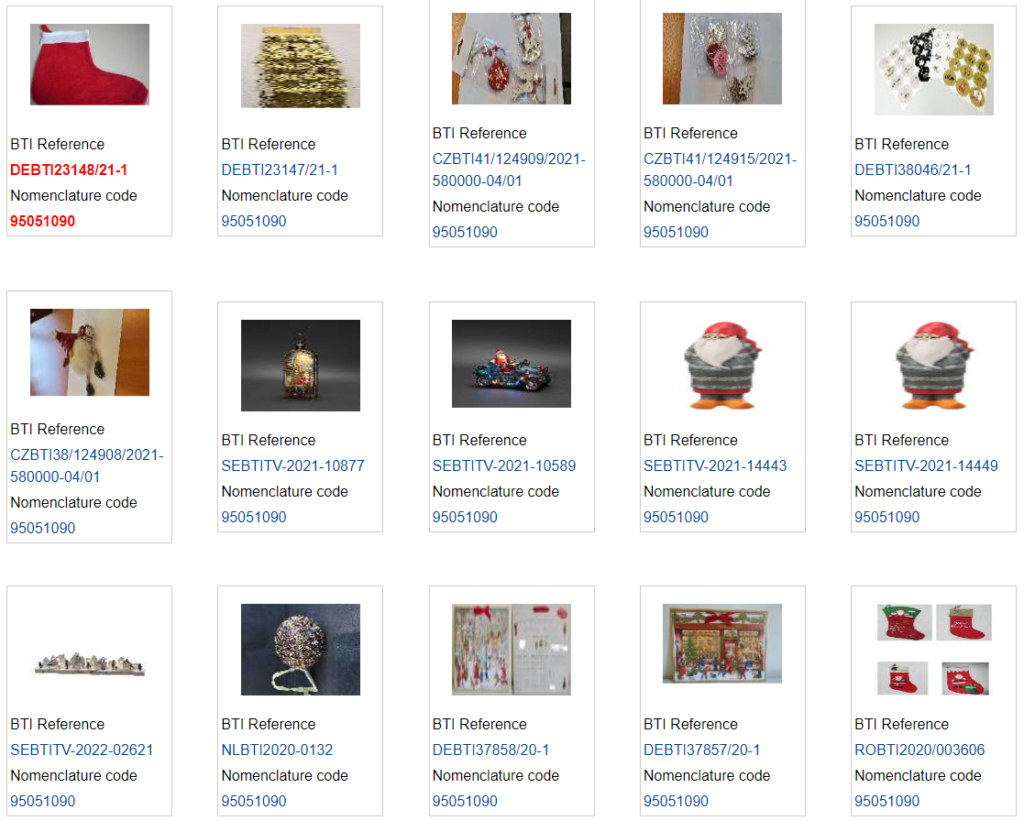

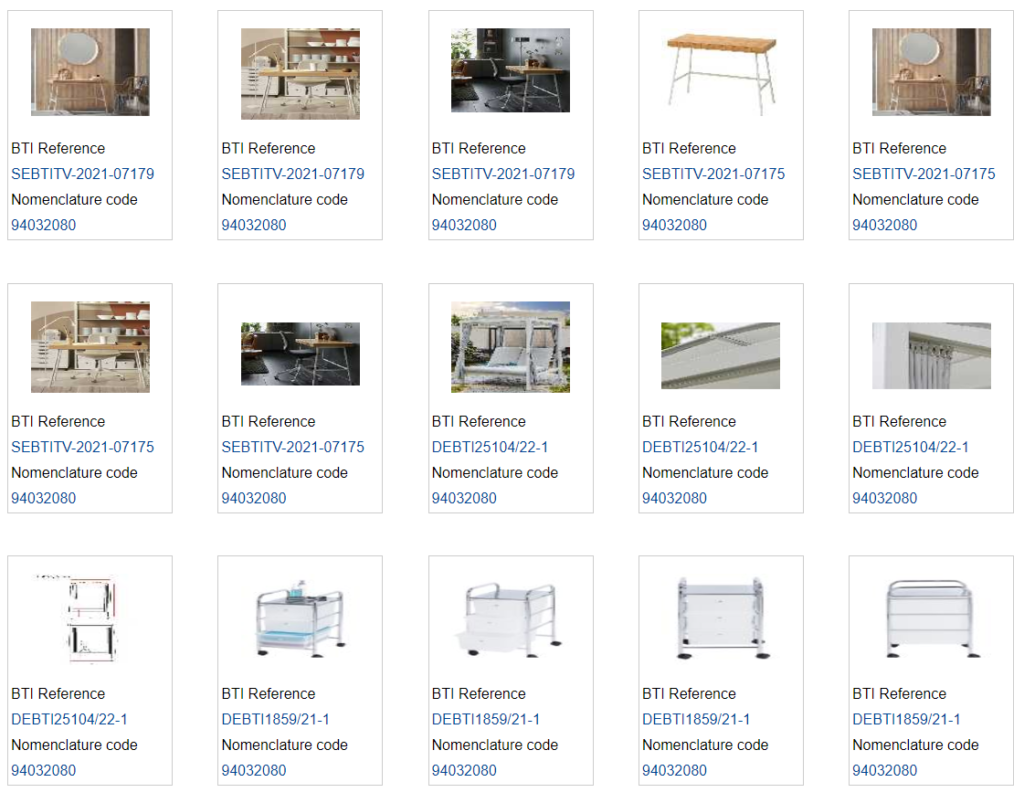

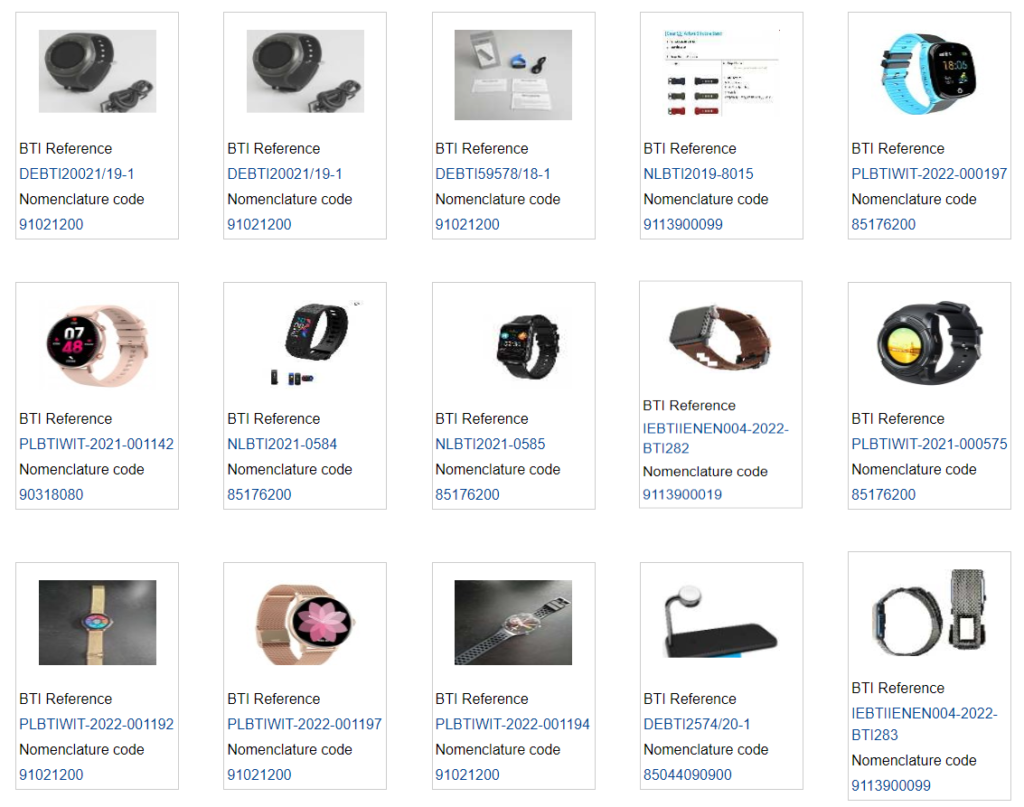

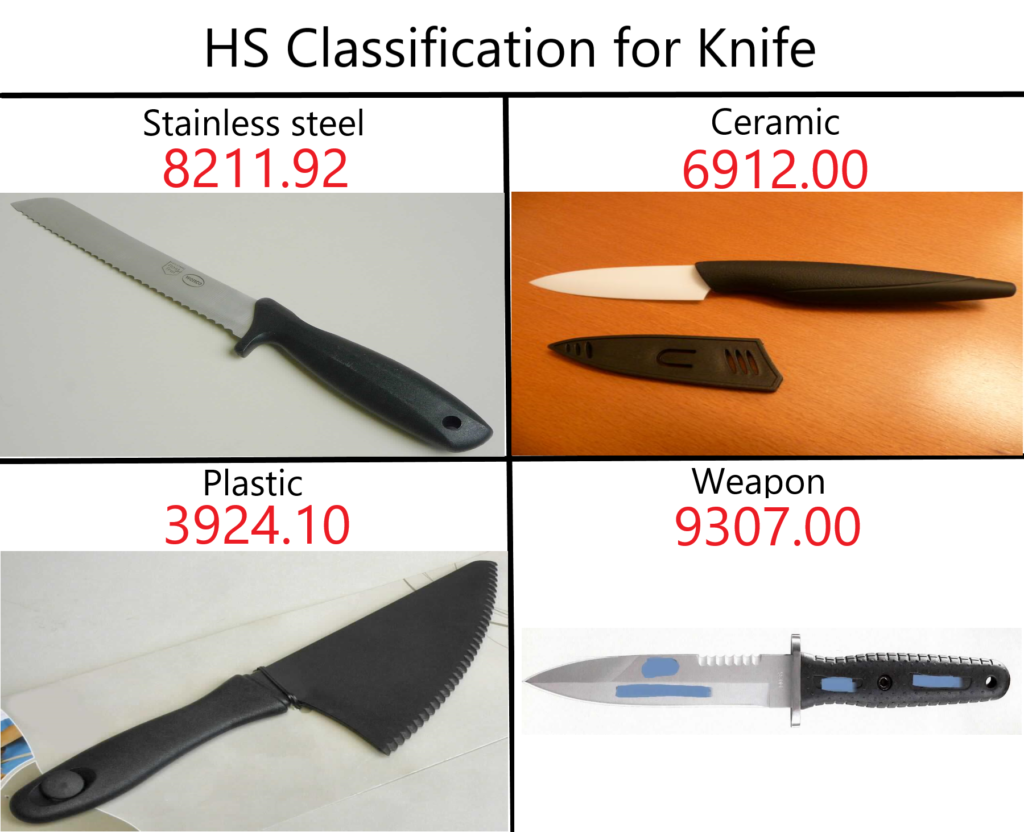

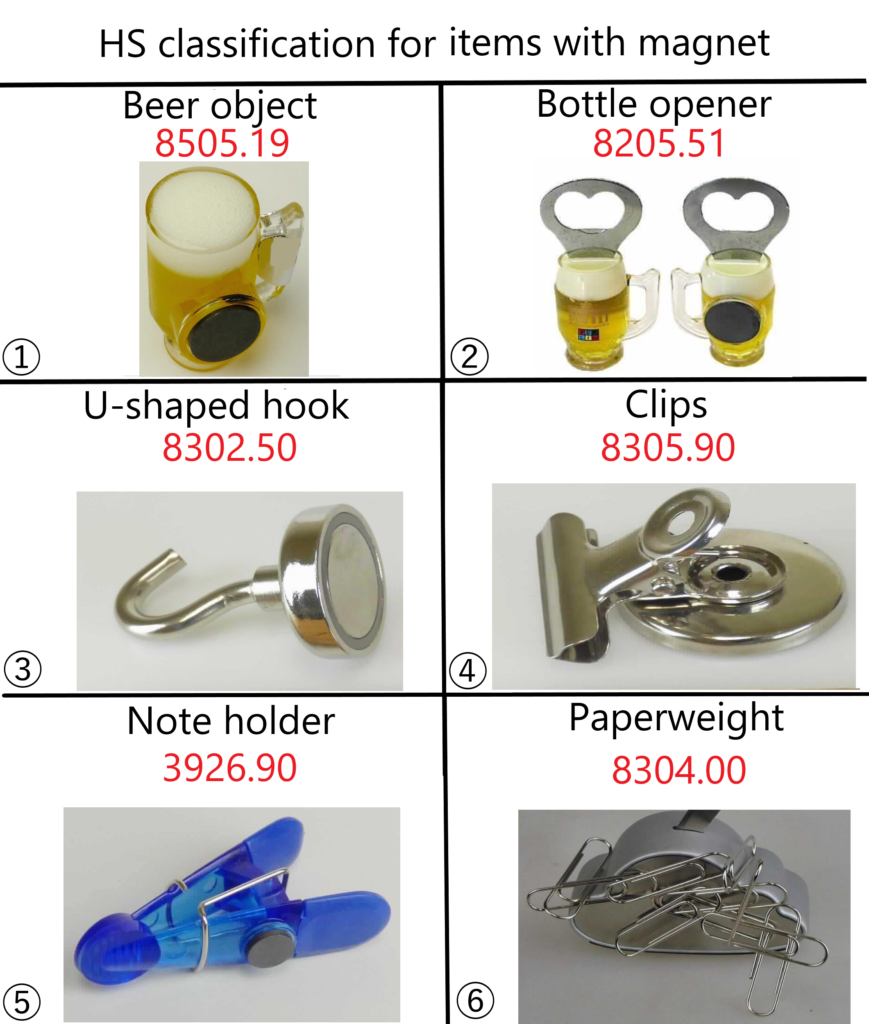

Below is the results of Image search for HS classification.

Search from many country's Ruling Database

Here is the list of countries that you can refer HS database.

United States, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Rep., Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, United Kingdom Canada China Japan India Colombia Australia Taiwan Türkiye (Turkey) Ukraine Israel Mauritius Peru Armenia Belarus Kazakhstan Kyrgyzstan Russia Ecuador Thailand Korea Norway Brazil Philippines Uruguay.

Many records include images and comprehensive details, backed by authoritative decisions. Simply enter the keyword for the item you’re targeting and select a similar item’s record to ascertain the HS code. This method enables you to efficiently find the correct HS code. Without it, would you resort to spending your entire day perusing the Tariff-related documents all day long?

Search results for “Cat tree"

Search results for “Carpets"

Search results for “Christmas goods"

Search results for “Metal furniture"

Search results for “Smart Watch"

About the author

Taichi Kawazoe

Author of Visualsearch for HS classification.

Experience

As a qualified customs broker accredited by Yokohama Customs for over a decade, I disseminate expertise in HS classification to a LinkedIn audience exceeding 10,000 followers.

Mission

providing support to customs professionals and trade practitioners worldwide on HS classification and FTA rules of origin.

Works

Creating HS classification article in LInkedin.

Purchase the book

Many records include images and comprehensive details, backed by authoritative decisions.

Simply enter the keyword for the item you’re targeting and select a similar item’s record to ascertain the HS code.

This method enables you to efficiently find the correct HS code.

Without it, would you resort to spending your entire day perusing the Tariff-related documents all day long?

No software is required. You can search for it by the internet browser.

No additional fee is required. You can search for it for free.

If you have any questions or need assistance, please don’t hesitate to reach out to us from contact form.

The Benefits of The book

Benefit 1

You can determine HScode with ImageSearch on the world Customs ruling database.

Benefit 2

Avoid overpayment of duties due to classification dichotomy or misclassification.

Benefit 3

Make the most of the opportunity to benefit from free trade agreements to reduce tons of customs duties.

Customers reviews

Feedbacks from HS classifiers.

Purchase the book

Many records include images and comprehensive details, backed by authoritative decisions.

Simply enter the keyword for the item you’re targeting and select a similar item’s record to ascertain the HS code.

This method enables you to efficiently find the correct HS code.

Without it, would you resort to spending your entire day perusing the Tariff-related documents all day long?

No software is required. You can search for it by the internet browser.

No additional fee is required. You can search for it for free.

The INVOICE will be automatically sent to the email address used at the time of purchase.

If you do not receive it, please contact us via the contact form.

In this book you will learn...

The complexity of HS codes can easily lead to misclassification. Surveys indicate that approximately 30% of all declarations are misclassified. Misclassification or dichotomy in HS classification can have several repercussions:

This book provides insights on how to circumvent these issues by accurately determining the appropriate HS codes, thereby streamlining trade procedures and maximizing the advantages of reduced customs duties through effective HS classification methods.

In this guide, you will discover:

1.Strategies for efficiently searching online for the correct HS code,

ensuring smooth customs clearances, avoiding delays, and preventing unnecessary inspections by customs authorities.

2.How to fully utilize Free Trade Agreements to significantly reduce customs duties,

which can lead to substantial profit increases in ongoing trading activities.

3.Methods to prevent the overpayment of duties caused by misclassification or classification dichotomy. This approach involves leveraging the World Customs

HS decision database to obtain reliable information for defining the

HS code of your target item.

The database offers access to item descriptions, images, and the assigned HS codes, searchable by item keywords.This book is an essential resource for customs brokers, HS classifiers, trading companies, manufacturers, suppliers,

trading consultants, and anyone involved in trade.

It is also an invaluable guide for beginners just starting with HS classification, aiming to impart the knowledge gained from exploring Worldwide Customs decision databases.

Through this book, I aim to share my experiences and the expertise I’ve acquired in this field.

The worst scenario of inadequate HS classification

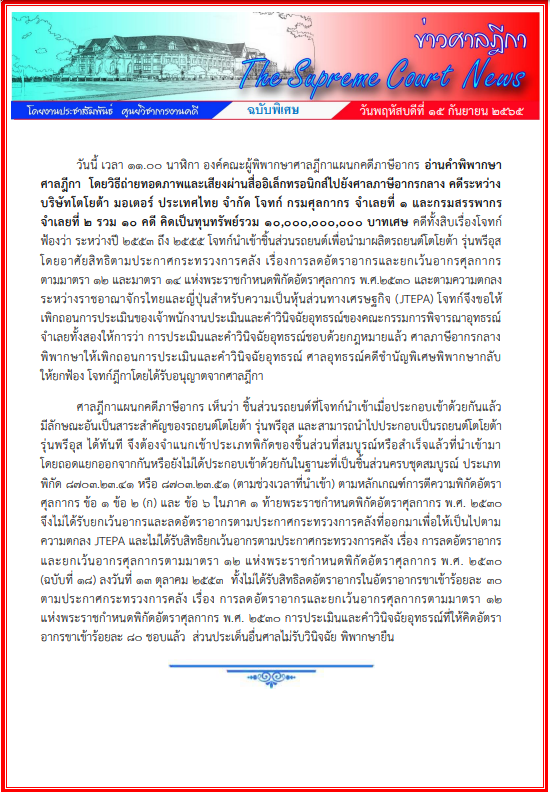

This real-life example demonstrates the dire outcomes of HS misclassification, which can result in losses amounting to millions of dollars. In a notable case, the Supreme Court of Thailand ruled against a leading Japanese automaker, Toyota, mandating a payment of $272.11 million due to incorrect HS classification.

Source: Reuters

In the beginning, TOYOTA intended to export Automobiles to Thailand.

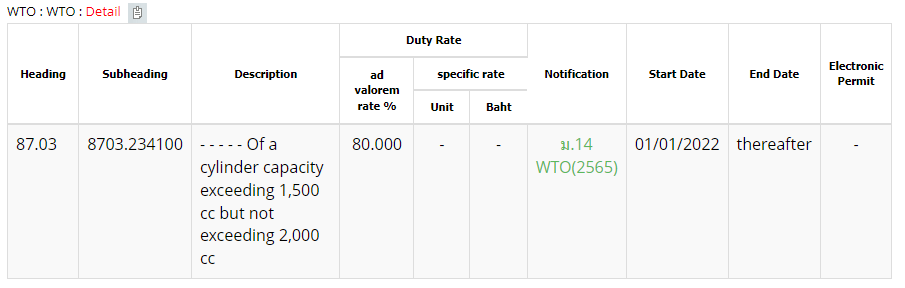

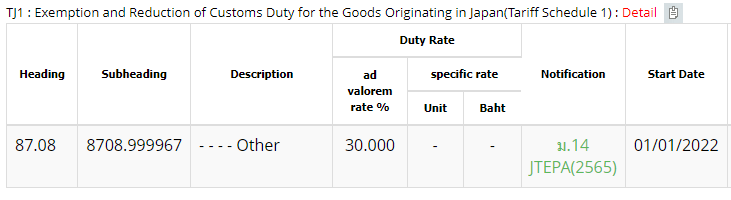

In this case, the tariff rate for Automobiles(HS:8703.23) is 80%(see the image)

The duty rate for automobiles (HS:8703.23) is steep at 80%, and there is no Free Trade Agreement (FTA) preferential treatment between Thailand and Japan for this category. Conversely, under the FTA between Thailand and Japan, “Automobile parts” (HS:8708) benefit from a reduction in duty rates from 60% to 30%.

and then reassemble them into complete cars after customs clearance.

Had Toyota exported complete automobiles to Thailand, they would have faced an 80% duty rate.

However, by disassembling them into parts, they reduced the duty rate to 30%, effectively cutting customs duties by half.

This approach, known as Tariff Engineering, was employed from 2010 to 2012 for over 20,000 vehicles at Toyota’s Gateway factory.

Yet, this tactic proved to be risky.

Subsequently, Thai customs challenged this practice, arguing that the imported items were not mere parts since

they could be reassembled into complete automobiles, classifying them as “Completely Knocked Down” units.

To comprehend why customs considered these parts as complete automobiles, it’s essential to consult the

“General Rules of Interpretation (GRIs).”

The dispute between Thai customs and Toyota was protracted and eventually escalated to the courts.

On September 15, 2022, the Supreme Court of Thailand affirmed a lower court’s decision, concluding that

Toyota’s local subsidiary owed the government 10 billion baht ($272.11 million) in additional taxes for importing components

that did not qualify for a reduced tariff.

The judgment by the Thailand Supreme Court is detailed below.

Sometimes I hear that “to reduce duty rate, disassemble the commodity into parts to import and reassemble them in the

targeting country, Wow this is a smart way of Tariff Engineering”

But this is the inadequate solution for reducing the duty rate that most people easily come up with.

In short term, it might work I admit, but customs officers are not foolish in overlooking this behavior. Therefore it turned out

to be a nightmare one day.

In order to avoid this nightmare, I strongly recommend reading this book.

Purchase the book

Many records include images and comprehensive details, backed by authoritative decisions.

Simply enter the keyword for the item you’re targeting and select a similar item’s record to ascertain the HS code.

This method enables you to efficiently find the correct HS code.

Without it, would you resort to spending your entire day perusing the Tariff-related documents all day long?

No software is required. You can search for it by the internet browser.

No additional fee is required. You can search for it for free.

The INVOICE will be automatically sent to the email address used at the time of purchase.

If you do not receive it, please contact us via the contact form.

As a customs professional, you will have the capability to create documents such as these.

I have been distributing illustrated HS classification knowledge on SNS besed on the method of Imagesearch for HS classification.

If you use this method, it can help you classify HS codes smoothly and serve as a valuable source of case studies for your cliants.

It can also be a great way to disseminate useful information on web media and attract attention from many trade practitioners because many of them face common problems with HS classification.

Purchase the book

The database consists of 29 countries Customs HS classification decisions containing 300,000 records.

Many of them have images and detailed information with the authority of the decisions.

Just type the keyword of the targeting items and choose a similar item’s record to determine HS.

With this method, you can find the appropriate HS code effectively.

Without this method, how do you determine HS code?

Reading Tariff and Explanatory note all day?

No software is required. You can search for it by the internet browser.

No additional fee is required. You can search for it for free.

The INVOICE will be automatically sent to the email address used at the time of purchase.

If you do not receive it, please contact us via the contact form.