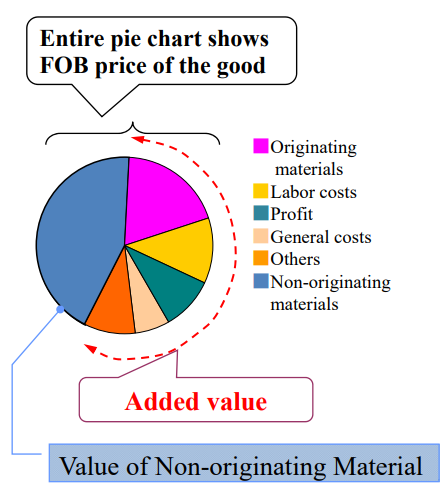

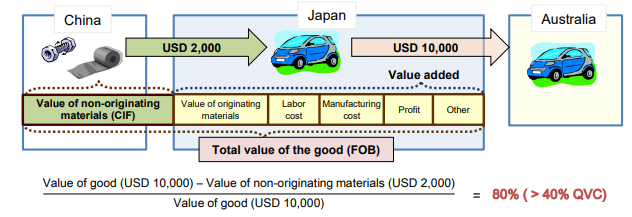

When the value added to a good through the production in a Party satisfies some

value content, the good can be qualified as an originating good of the Party.

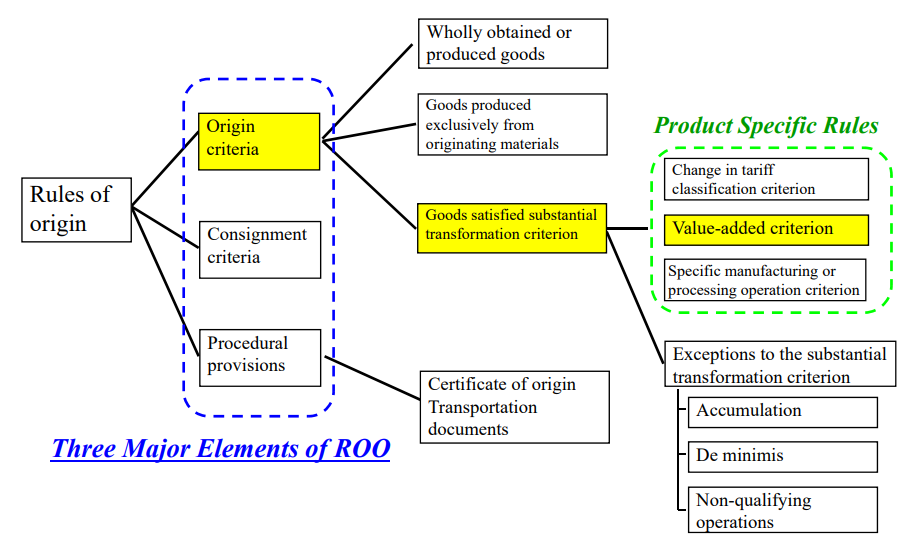

Retrieved from: Outline of Rules of Origin for EPA in Japan

Retrieved from: Outline of Rules of Origin for EPA in Japan

Regardless of changes in its tariff classification, a good is considered as originating when

the value of the product is increased up to a specified level expressed by an ad valorem percentage.

Retrieved from: Outline of Rules of Origin for EPA in Japan

RVC is the Regional Value Content of a good, expressed as a percentage.

QVC is the Qualifying Value Content of a good, expressed as a percentage.

(RVC and QVC are same meaning words)

VNM is the value of non-originating materials used in the production of a good.

Table of Contents

Method of “Value-added criterion”

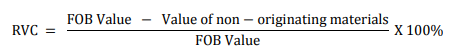

The rules-based on a value-added/ad-valorem criterion may largely be

described in two distinct ways:

1.Build-down method

a maximum allowance for non-originating materials

(maximum third country content allowance), meaning that a final product can be

considered as an originating product provided that the foreign inputs do not

exceed a certain threshold; or

2.Build-up method

a minimum requirement of domestic content (minimum local content

requirement)

Example Case study of “Value-added criterion”

Build-down method Case

Product-Specific Rules(PSR) for a passenger vehicle of heading 87.03 under

Japan-Australia EPA:

the value added in the country of manufacture (Qualifying Value Content) is not

less than 40% and the last process of production has been performed in the

exporting party

The QVC(RVC) of the vehicle is 80%. As the vehicle meet the ROO requirement under

Japan-Australia EPA, it is an originating good.

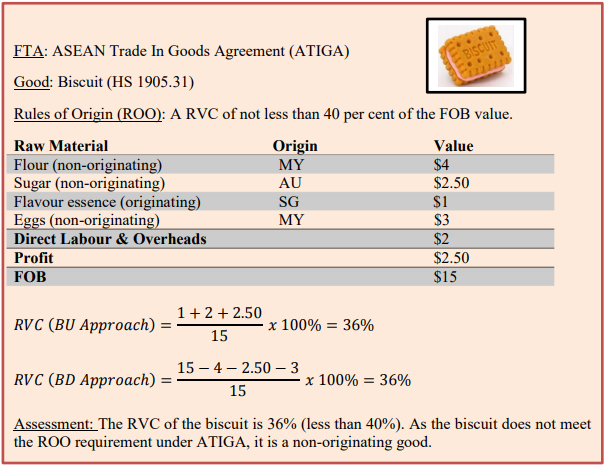

Build-up and Build-down method Case

Product-Specific Rules(PSR) for a Biscuit of heading 1905 under

ASEAN Trade In Goods Agreement(ATIGA):

A RVC of not less than 40 percent of the FOB value.

The RVC of the biscuit is 36%(less than 40%). As the biscuit does not meet

the ROO requirement under ATIGA, it is a non-originating good.

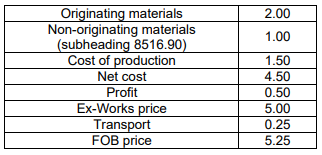

Comparison of Build-up and Build-down

Hair curling iron (8516.32) Case

An electric smoothing iron (subheading 8516.40) is made in TPP Party A from

non-originating parts (8516.90).

The value of the materials and costs associated with the production of the good are

as follows:

Retrieved from:Comparative Study on Preferential Rules of Origin

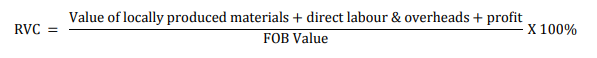

(a) Using the build-up method

Regional value content requirement (build-up method)

In case of the build-up method, the value added requirement (regional value

content of not less than 35 per cent) can also be used.

RVC = 2.00 x 100 / 5.25 ≈ 38.1%

This rule is fulfilled since the RVC is 38.1% when using the build-up method.

(b) Using the build-down method

Regional value content requirement (build-down method)

The value added requirement according to the build-down method (regional value

content of not less than 45 per cent) can be used.

FOB price US $ 5.25; the value of the non-originating smoothing iron parts is US

$ 1.00.

RVC = (5.25-1.00) x 100 / 5.25 ≈ 81%

This rule is fulfilled since the RVC is 81% when using the build-down method.