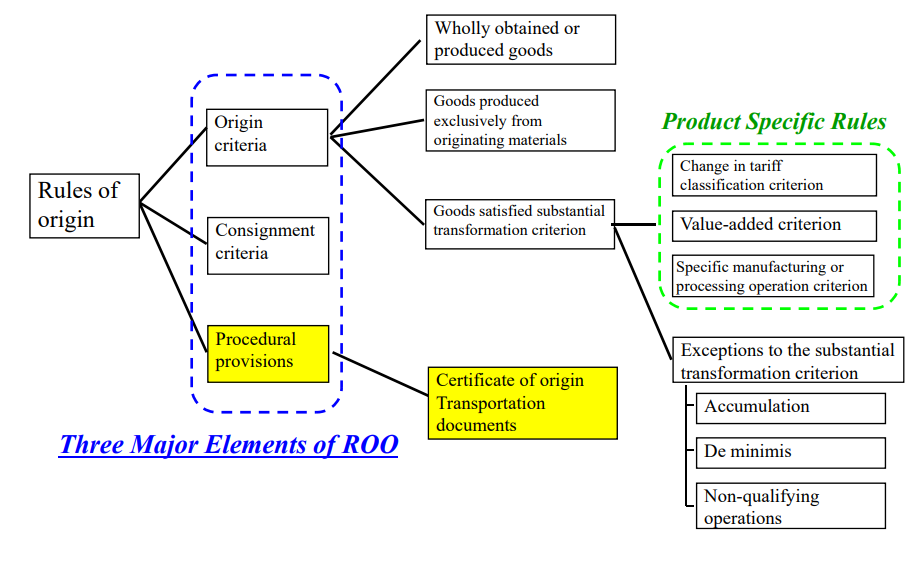

Procedural Provisions are the course of action to be followed when applying the

preferential tariff rates.

Origin procedures include the claim for the preferential tariff treatment at the

time of importation by the importer.

Retrieved from: Outline of Rules of Origin for EPA in Japan

Retrieved from: Outline of Rules of Origin for EPA in Japan

The preferences granted under a free trade agreement are limited to products

fulfilling the origin rules of the respective agreement.

All origin legislations contain provisions on how the preferential origin of a good

can be proven and certified.

There are various ways to certify the preferential origin of goods with different

approaches for certification of the preferential origin in the ATIGA, the NAFTA,

the PAN-EURO-MED and the TPP Origin Systems.

Table of Contents

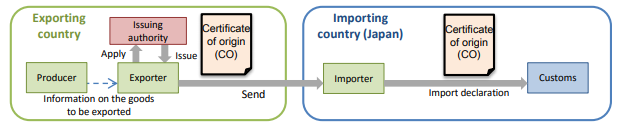

Third Party Certification System

Under the third party certification system, the exporter applies for a certificate

of origin (CO) to the CO issuing authority of the exporting country and sends the

CO to the importer.

The importer makes the claim for the preferential tariff treatment with the CO

issued by the CO issuing authority of the exporting country.

If the exporter is not the producer of the exported goods, the exporter may apply

for a CO with the information from the producer on the originating status of the goods.

Retrieved from: OUTLINE OF RULES OF ORIGIN

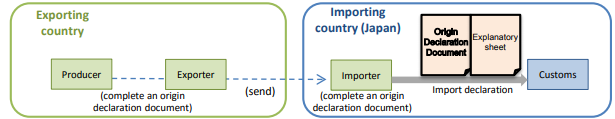

Self-Certification System

Under the self-certification system, the importer declares that the goods are

originating goods by submitting an origin declaration document which may be

completed by either the importer, exporter, or producer of the goods.

It is introduced under the JapanAustralia EPA, along with the third party certification

system above.

When claiming preferential tariff treatment with the selfcertification, submission of an

explanatory sheet on the originating status of the good is generally required in addition

to the origin declaration document.

Retrieved from: OUTLINE OF RULES OF ORIGIN

Approved Exporter Self-Certification System

Under the approved exporter self-certification system, the importer presents to

Customs the origin of the good by submitting an origin declaration made by an

approved exporter on an invoice or other commercial document.

The exporting country certifies their exporters as eligible to make an origin

declaration and informs the importing country (i.e. Japan) of the approved exporters.

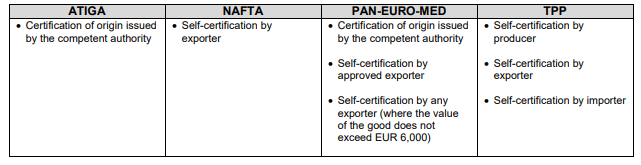

Comparison of Origin Certification System

Comparison of Origin Certification System in the ATIGA, the NAFTA,

the PAN-EURO-MED and the TPP origin systems

Retrieved from:Comparative Study on Preferential Rules of Origin

In the PAN-EURO-MED Origin System 16 articles are dealing with the certification

of the originating status of goods. There are different kinds of proofs of origin

available for traders with different issuing procedures.

There are also exemptions possible where there is no obligation to certify the

originating status of a good.

The NAFTA origin legislation contains 4 articles regarding the certification of

origin in Section A (“Certification of Origin”) under Chapter Five: Customs

Procedures requiring that NAFTA parties establish a certificate of origin.

The NAFTA provisions on certification distinguish obligations for importers and

exporters and contain exceptions to prove the originating status by a certificate of origin.

The ATIGA Origin System has 31 rules (under Annex 8) regarding the certification

of origin of goods and other related administrative matters.

The ATIGA origin legislation contains a simple form (Form D in Annex 7) of

proofs of origin and certification requirements. It also contains exceptions to prove

the originating status by a certificate of origin.

In the TPP Origin System the certification of origin is regulated in Chapter 3,

Section B: Origin Procedures. The certification of origin must be in writing

(including electronic format) but need not follow a prescribed format as long as

it contains a set of minimum data requirements set out in Annex 3-B (Chapter 3)

to the Agreement.

In addition, there are various ways how government authorities are involved in

the issuing of certificates of origin.

The competent authorities of the Parties to the PAN-EURO MED Agreement are

directly or indirectly involved in the issuing of certificates of origin through the

authentication of certificates or the approval of exporters who can be authorized

by the customs authorities of the exporting country to issue proofs of origin

themselves without former authentication by the customs authorities

(invoice declarations irrespective of the value of the consignments).

The NAFTA certificates of origin are issued on the basis of self-certification by the

exporter/producer and the NAFTA certificates do not need to be authenticated by

a competent authority.

The government authorities in the ATIGA Origin System are directly involved in the

issuing of certificate of origin.

The ATIGA Origin System does not contain any approved exporter system.

Under the TPP Agreement the importer can make a claim for preferential treatment

based on a certification of origin completed by the exporter,

producer or importer (self-certification).

Thus there is no need for the certification of origin to be authenticated by a

government authority.