Rules of Origin (ROOs) help to determine the “Nationality” of goods in

order to reduce Customs Duty.

Lower tariff rate (Preferential Customs Duty rate on FTA) is applied to

originating goods of the exporting Party .

Table of Contents

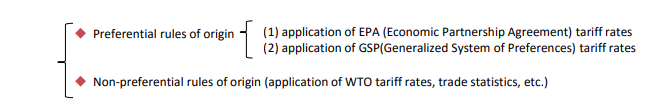

Types of Rules of Origin

Rules of origin are categorized into

preferential rules of origin

and

non-preferential rules of origin.

Preferential rules of origin include the rules for the application of the Preferential

Customs Duty rates under Economic Partnership Agreements(EPA) or FTA

and the rules for the application of the preferential Customs Duty rates under the

Generalized System of Preferences (GSP).

Non-preferential rules of origin are applied to determine the country of origin for

the purposes other than granting of preferential Customs Duty treatment

(such as the application of WTO tariff rates, trade statistics, etc.).

ROOs for Preferential treatment

It establishes the goods’ eligibility for preferential treatment under a

Free Trade Agreement (FTA).

Goods that satisfy the ROOs under an FTA may be considered as an originating

good and be allowed to pay lower or no import Customs Duty when imported into a

Party under the FTA.

ROOs vary from FTAs to FTAs. As such, a good which qualify for a FTA may not

be able to qualify as an originating good in other FTAs

Wait wait !!

Any goods imported from the countries concluded FTA or EPA can not always

apply the preferential tariff rate on FTA for your trade.

Why can’t we enjoy the lower tariff rate on FTA for all imported goods

from countries concluded FTA?

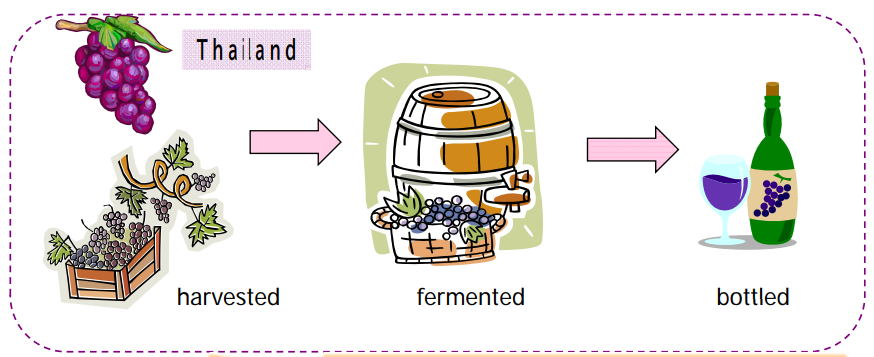

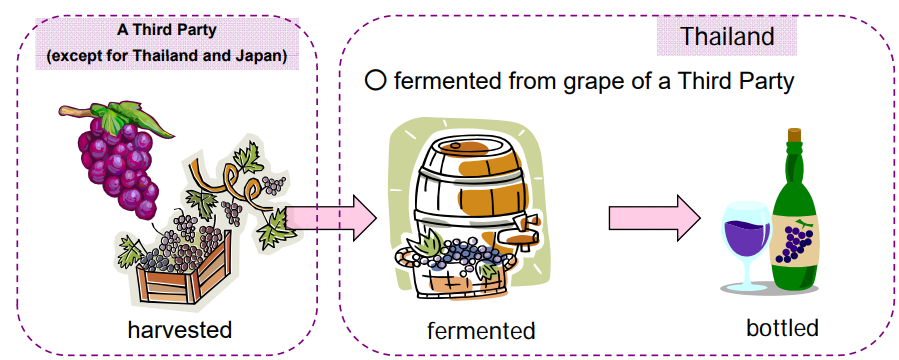

Let’s consider the example of “wine” for our understanding!

Example of Wine’s Rules of origin

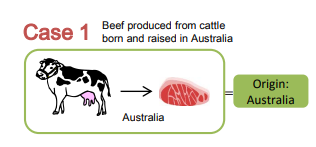

Case 1

A bottle of wine through all processes above in Thailand makes us think that

this wine is an originating good of Thailand.

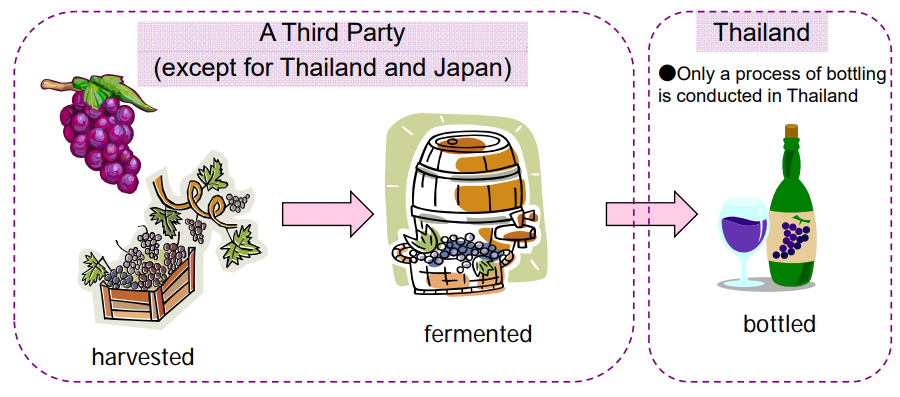

Case 2

A bottle of wine through processes above may make us think that

this wine is not an originating good of Thailand.

Case 3

How about this case?

People have lots of different opinions in this case.

IMPORTER A:

I think the wine is originating good of Thailand because thinking the wine is

originating good of Thailand because fermentation decides the taste of wine.

IMPORTER B:

I know that. But the quality of grape also decides the taste of wine,

so I doubt the wine is originating good of Thailand.

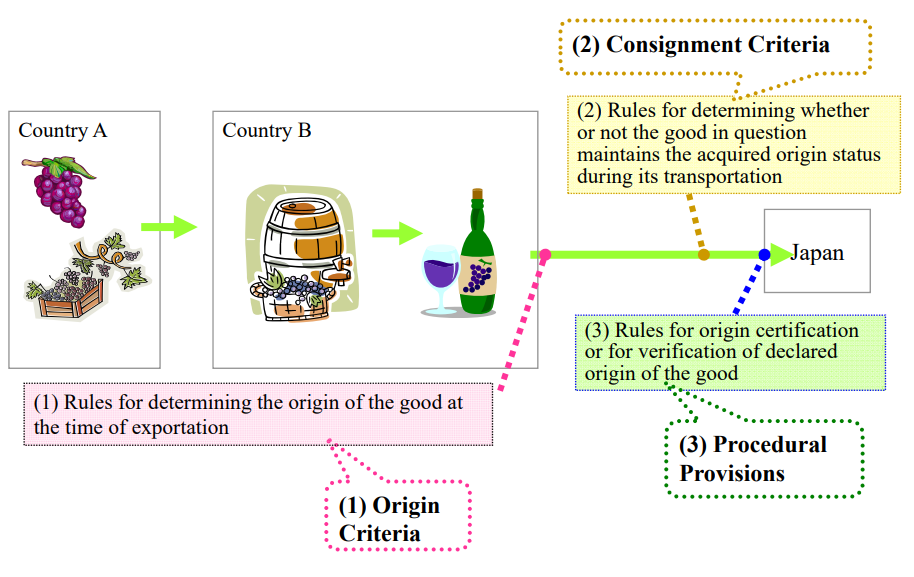

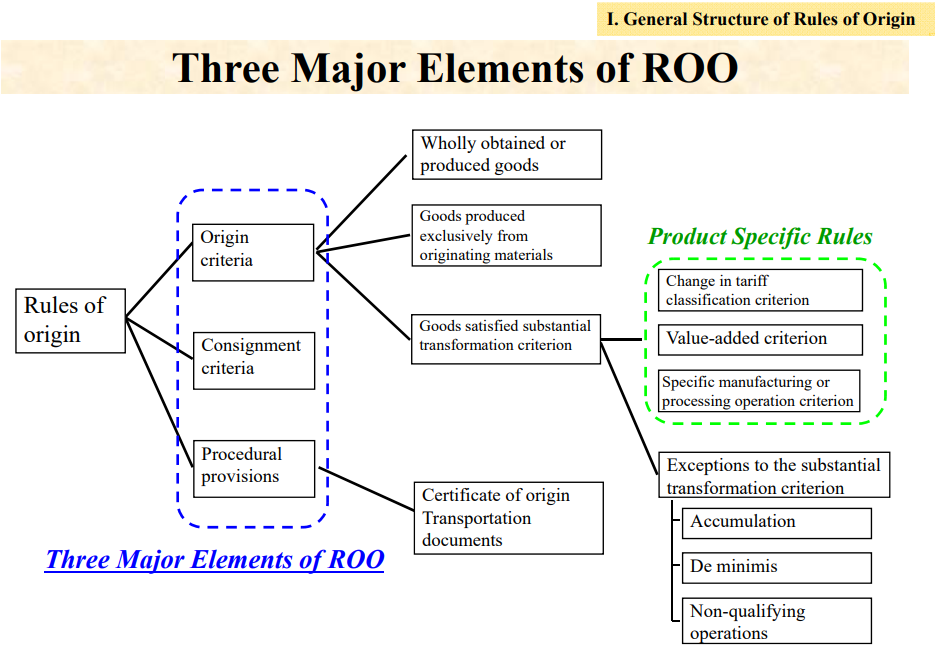

Satisfy the origin criteria stipulated in ROO

A rule is necessary to decide which process should be a bottled wine of a Party under FTA.

If only one country is involved in the production of a good,

it is fairly straightforward to determine the country of origin

On the other hand, if more than one country is involved in the production,

there must be a rule to determine which country is the origin of the good.

Rules of origin also play a role in ensuring that the preferential customs duty rates

are applied only to the originating goods of the eligible countries

(i.e. anti-circumvention).

This rule is called “Origin Criteria” and a good which satisfies the

origin criteria is called as “an originating good of a Party”.

A good is considered to be originating if it meets the origin criteria stipulated

in the Rules of Origin (ROO) chapter of a Free Trade Agreement (FTA)

If you want to use preferential Customs Duty rate on FTA for goods,

the goods should satisfy the origin criteria to apply such Customs Duty rate.

Images retrieved from:

Outline of Rules of Origin for EPA in Japan

Handbook on Rules of Origin for Preferential Certificates of Origin