When it comes to classifying automotive parts made of plastic,

one of the options is HS:392630 (Fittings for furniture, coachwork, or the like:)

I wonder why HS tariff used the terms of “coachwork”??

It should be “automotive”??

And also many people may wonder what kind of items are classified as “Fittings for Coachwork”?

So I retrieved items which are classified as “Fittings for Coachwork”(HS:3926.30)

from many customs ruling database.

Below is the list of the items classified as “Fittings for Coachwork”(HS:3926.30)

“Fittings for Coachwork”(HS:3926.30)

door handle

Czech Customs:CZBTI37/086941/2018-580000-04/01

cable guide

German customs:DE239/17-1

cable guide

German customs:DE686/17-1

cover mounted behind the interior trim of motor vehicle door

German customs:DE966/17-1

panel for window frames

German customs:DE4899/16-1

belt deflector

German customs:DE4949/17-1

cover assembly hole are directly and permanently mounted on motor vehicles behind the inner panel on the body of the left door

German customs:DE8666/17-1

entry bar made of molded plastic

German customs:DE14779/16-1

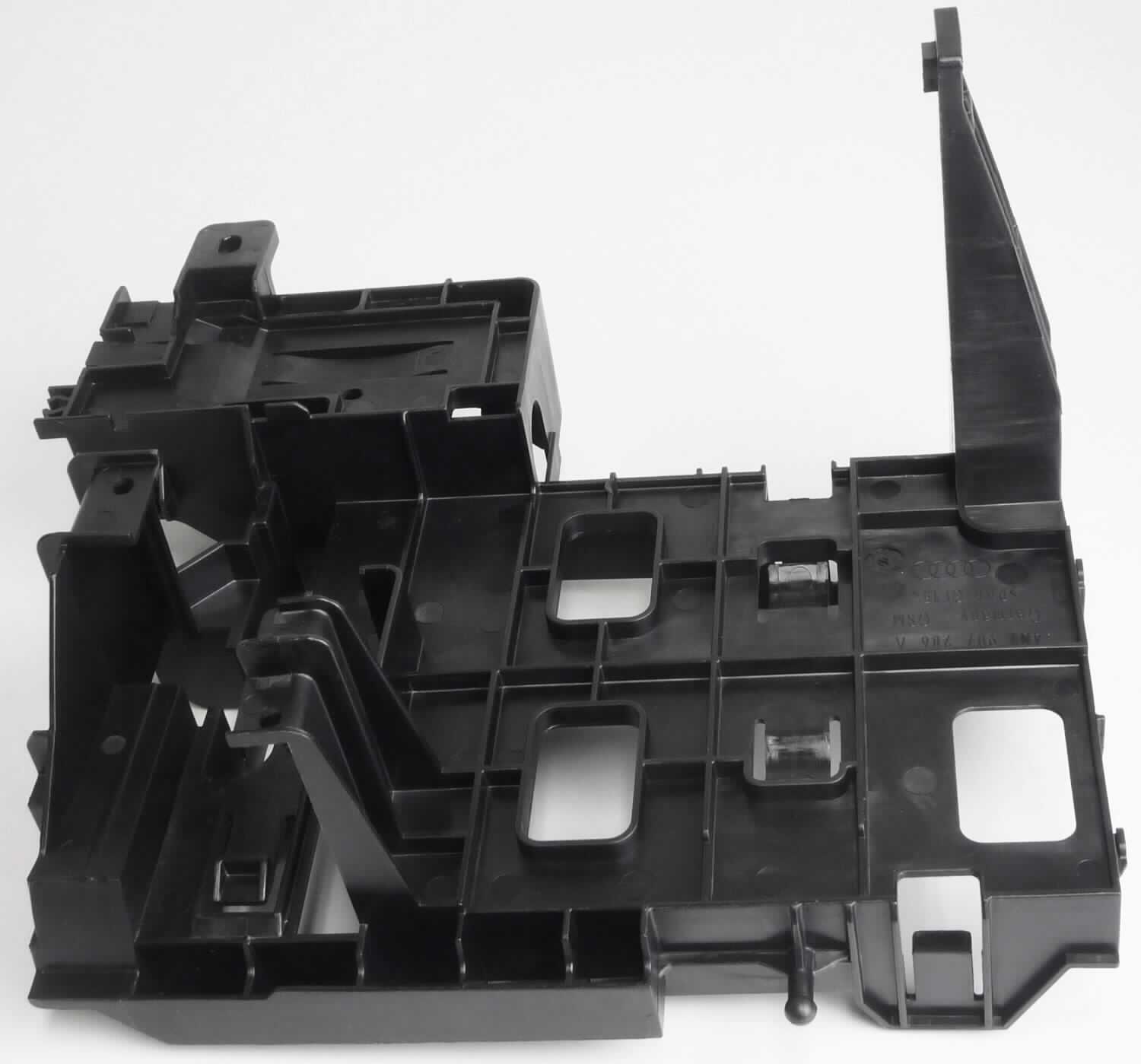

mounting bracket used to hold control units

German customs:DEBTI1836/18-1

The approximately 32.4 x 24.4 x 10.4 cm shaped product is essentially eleven Recesses for relay socket and plug couplings and a large main compartment for a control unit provided

German customs:DEBTI3532/18-1

door handle

German customs:DEBTI13185/18-1

universal mount for example, Mobile phones or iPods with two self-locking clamping devices

German customs:DEHH/15/09-1

door handle

German customs:DEHH/1118/05-1

Plates and emblems for tourist cars

spain customs:ESBTI2017SOL0000000000749

automotive plastic wheel attachment

French customs:FR-E4-2006-002796

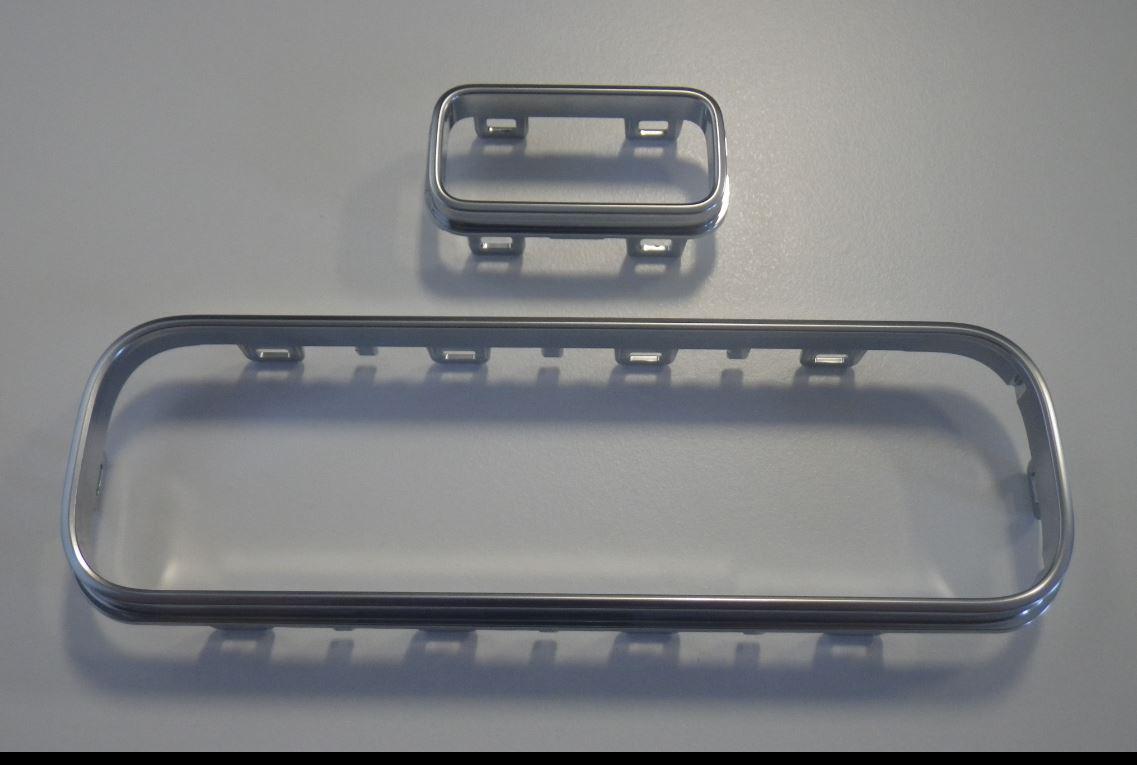

Chrome-plated plastic edging for the power window block mounted on the car door next to the driver

Latvia customs:LVBTI2019-91

Interior door handle

Slovakia customs:SK13409/09/5219/28

Plastic but not “Fittings for Coachwork”(goes to 8708)

Even though the items below are made of plastic, they are essential parts of automobiles and satisfy all three of the following conditions:(Section XVII GENERAL(III))

(a) They must not be excluded by the terms of Note 2 to this Section

(b) They must be suitable for use solely or principally with the articles of Chapters 86 to

88

(c) They must not be more specifically included elsewhere in the Nomenclature

Therefore they are not classified as HS:3926.30

The plastic blower for cars

Slovakia customs:SK12536/16/02

Parts of a steering column

ドイツ税関(DE):DE892/17-1

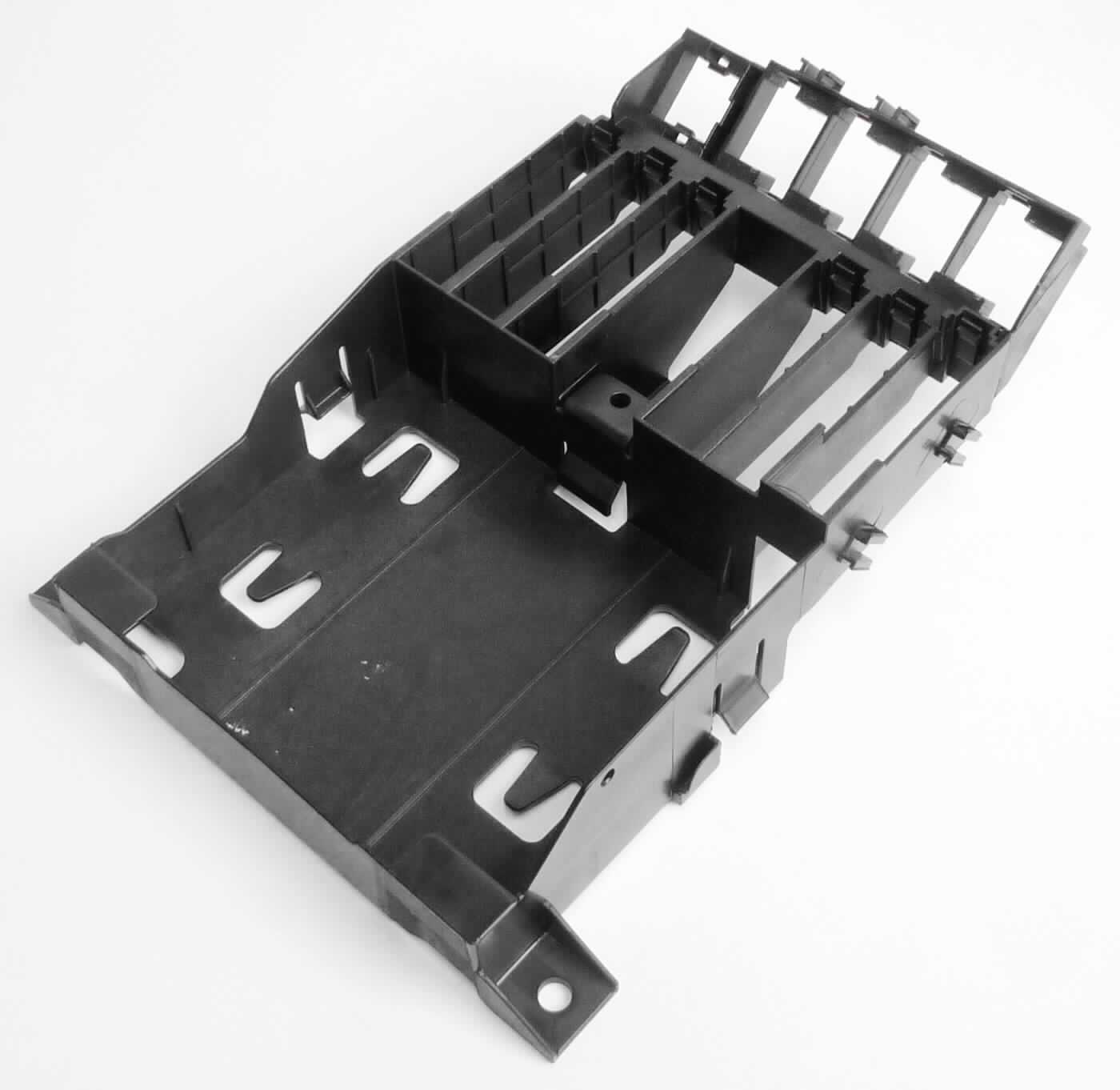

CONSOLE

United Kingdom customs:GB501958157

Glove box

German customs:DE4894-16-1

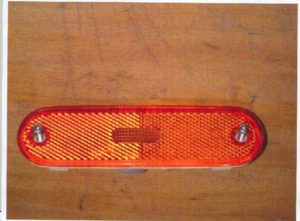

Reflector for motor vehicles

Belgium customs:BED.T.251.513

DOOR COMPARTMENT (ASHTRAY)

Italy customs:ITBTIIT-2017-0430M-314100

Retrieved from:European Union Website

“Fittings for Coachwork” is a vague term. I looked for the definition of it but could not find it.

Here is just my opinion to differ from them.

plastic parts for automotive which work directly for the automotive mechanism goes to 8708.

On the contrary plastic parts for automotive which works as Accessories, like connecting, attach, fix something to the place, etc goes to 3926.30(fittings for coachwork)

Since there is no clear definition for it, I determine them by items picture obtaining from the customs ruling database.

Please refer to the above pictures to see the difference between auto parts made of plastic 3926 and 8708.