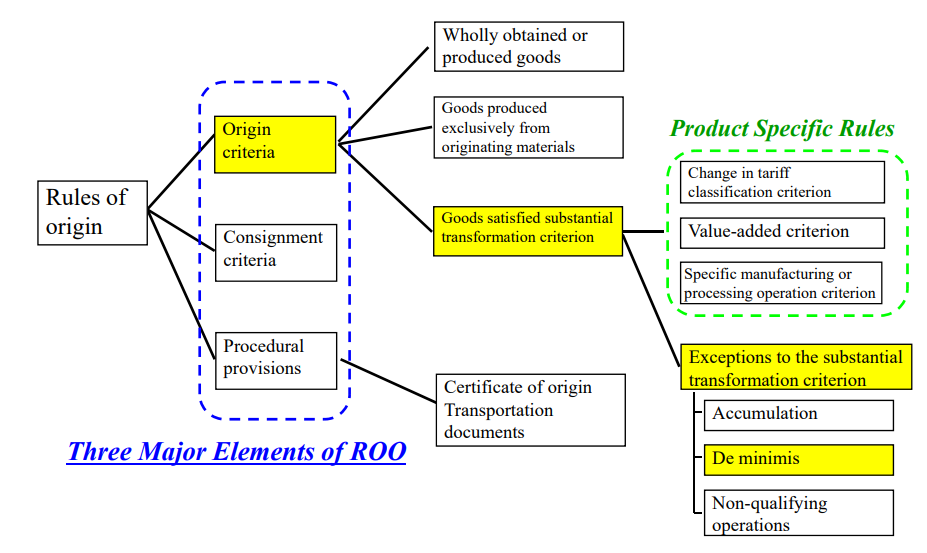

Goods that do not satisfy the CTC requirement can still be considered as an

originating good provided those non-originating materials that did not undergo

the required CTC satisfy the de minimis rule.

The De Minimis/tolerance rule varies among the different FTAs.

For example, the de minimis rule in ATIGA allows for a 10% FOB tolerance level of

non-originating materials that do not meet the CTC requirement for all goods.

Retrieved from: Outline of Rules of Origin for EPA in Japan

Non-originating materials used in the production of a good that do not satisfy

Product-Specific Rule(PSR) for the good shall be disregard, provided that the

totality of such materials does not exceed “specific percentages” in value, etc.

Note: “Specific percentage” and “goods applicable for de minimis/tolerance” differs in

accordance with each EPA.

Note: The de minimis/tolerance rule only applies to Change in Tariff Classification (CTC).

Specifically, it applies to non-originating materials that do not meet the CTC requirement.

The difference in each FTA

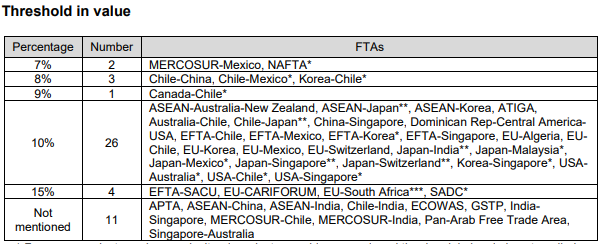

The use of the de minimis/tolerance rules may be based on the value or the weight of the

goods; sometimes the rules do not apply for specific product categories or are only applied

under certain restrictions.

This rule is called “de minimis” rule in the ATIGA, the NAFTA and the TPP contexts and

“tolerance” rule in the PAN-EURO-MED origin system.

The meaning of the “tolerance” rule in the PAN-EURO-MED context and “de minimis” rule

in the ATIGA, the NAFTA and the TPP origin systems is in fact the same.

“De Minimis”, a Latin expression meaning “about minimal things” stems from the locution

“de minimis non-curat praetor” meaning “The praetor (government official) does not concern

himself with trifles” or “de minimis non curat lex” meaning “the law does not concern itself

with trifles”.

De minimis/tolerance rules alleviate the origin determination requirement in the ATIGA, the

NAFTA, the PAN-EURO-MED and the TPP origin systems are applied in a similar way, but with

different percentages and calculation bases (e.g., ex-works price, FOB price or total cost).

* For some products such as agricultural products, machinery or mineral the de minimis rule is not applied.

** For some agricultural products, the percentage is 7%.

*** For some agricultural products, the percentage is 10%.

Retrieved from:Comparative Study on Preferential Rules of Origin

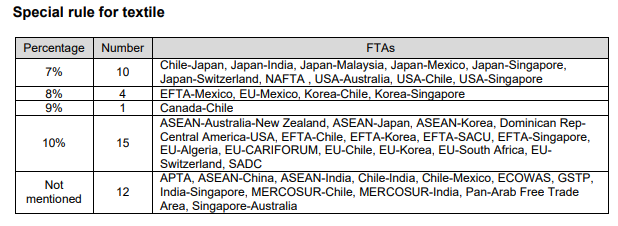

Example of “JTEPA” De Minimis

FTA: Japan-Thailand EPA

Good: Tomato ketchup(HS:2103.20)

PSR: Change in Chapter(CC) except from chapter 7 or 20

De minimis Rule under JTEPA: The total value of non-originating materials

used in the production of the good that have not undergone the required CTC does

not exceed 7% of the FOB.

Tomato ketchup produced through the manufacturing process as the chart in this slide,

it can not be qualified as an originating good of Thailand because onion is classified in

“Chapter 7”. Therefore it does not satisfy CTC rule.

But if the value of onion is lower than the designated percentage

(7 % for JapanThailand EPA) comparing with the value of tomato ketchup, it can be

qualified as an originating good of Thailand by applying De Minims.

Retrieved from: Outline of Rules of Origin for EPA in Japan

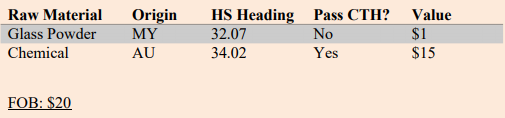

Example of “AJCEP” De Minimis

FTA: ASEAN-Japan Comprehensive Economic Partnership (AJCEP)

Good: Solar paste (HS 3207.30)

PSR: A Change in tariff classification at the 4-digit level of Harmonized System(CTH)

De minimis Rule under AJCEP: The total value of non-originating materials

used in the production of the good that have not undergone the required CTC does

not exceed 10% of the FOB.

Assessment: The glass powder is the only non-originating material that does not meet the

CTC requirement under AJCEP. The glass powder used is 5% of the FOB value (less than

10% of the FOB). As such, the solar paste is an originating good under AJCEP upon

applying the de minimis rule.

Retrieved from:Handbook on Rules of Origin for Preferential Certificates of Origin