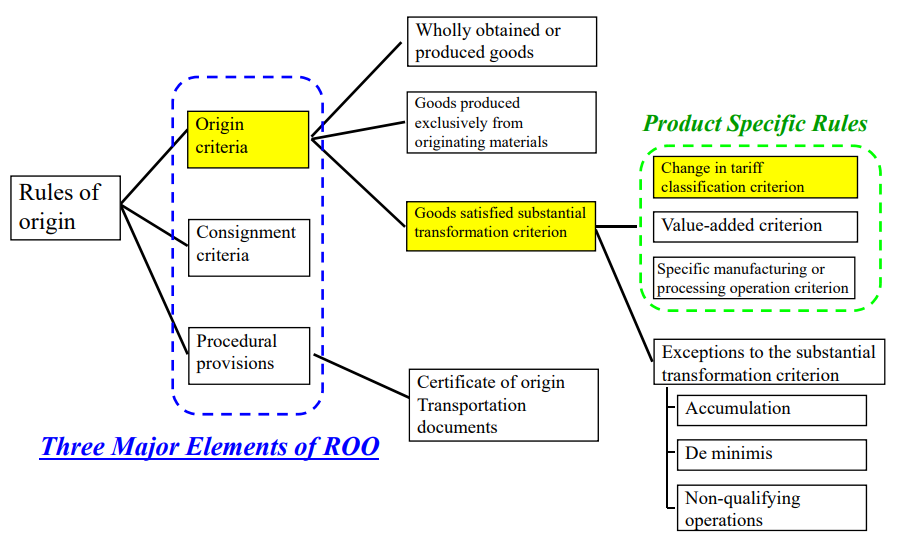

When the HS code of a good differs from all HS codes of non-originating materials,

the good is qualified as an originating good.

This method is called “Change in tariff classification criterion(CTC)”

Retrieved from: Outline of Rules of Origin for EPA in Japan

Table of Contents

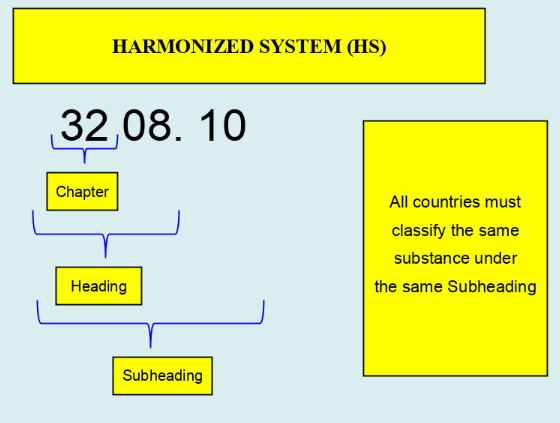

Harmonized System(HS)

Before explaining “Change in tariff classification criterion(CTC)”,

basic knowledge of Harmonized System(HS) is needed.

The Harmonized Commodity Description and Coding System, generally referred to as “Harmonized System” or simply “HS“ is a multipurpose international product nomenclature developed under the auspices of the World Customs Organization (WCO), an independent intergovernmental body.

The tariff schedule containing the headings, subheadings and the corresponding number codes, the notes to the Sections, of the Chapters and the Subheadings, as well as the General Rules for the interpretation of the HS.

THE HS CONTAINS

〇21 SECTIONS

〇96 CHAPTERS

〇1.200 HEADINGS

〇5,000 six figure groups called Subheadings

〇124 CONTRACTING PARTIES AND ONE CUSTOMS UNION.

〇202 COUNTRIES USE THEIR TARIFF SCHEDULE.

GOVERNMENTS USE HS FOR:

〇Exchange of trade data.

〇Establish duties and other taxes.

〇Control of regulated substances.

〇Development of Rules of Origin.

〇Preparation of statistics.

〇Price and quota controls.

〇Economic research and analysis.

All the HS codes can be searched from the WCO webpage.

All countries must classify the same substance under the same Subheading

〇Chapter (2Digits)

〇Heading (4Digits)

〇Subheading (6Digits)

Retrieved from:Identifying: World Customs Organization (WCO) Harmonized Codes

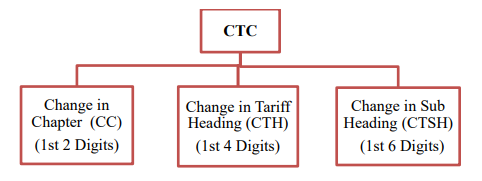

“Change in tariff classification criterion(CTC)” method is applicable only to non-originating materials. To qualify under this origin criterion, non-originating materials that are used in the production of the good must not have

the same HS classification (e.g. Chapter level, Heading level or Sub Heading Level) as the final good.

Retrieved from:Identifying:Handbook on Rules of Origin for Preferential Certificates of Origin

Depending on the Free Trade Agreement (FTA) requirements, the good would

have to undergo either a change in Chapter, Heading or Sub Heading level in order to qualify

for preferential treatment under the FTA.

Therefore, to use this method, manufacturers and/or exporters are required to know the HS

classification of the final good and the non-originating raw materials.

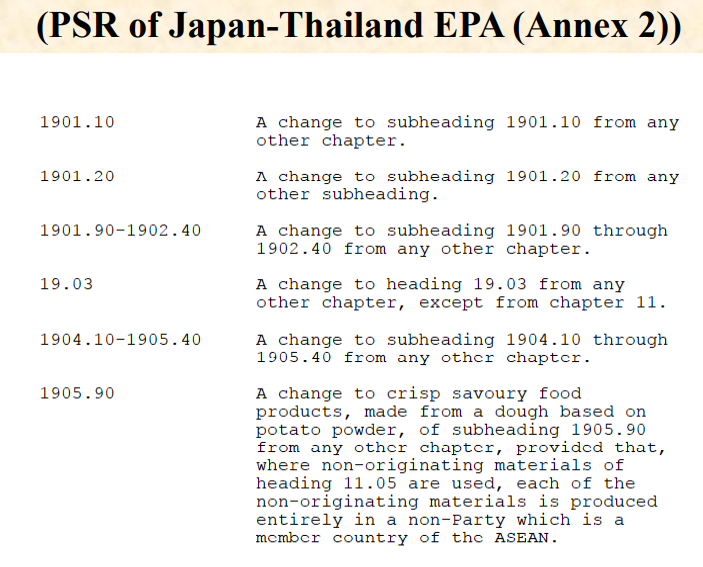

Product-Specific Rules (PSR)

Even if the materials from third countries (non-originating materials) are used in the production, goods

are considered as originating when the goods satisfy the requirement set out in the product-specific rules (PSR).

PSR is generally provided as an annex to each EPA.

In most of the EPAs, PSR is stipulated in the form of either: “change in tariff classification”,

“qualifying/regional value content”, “specific manufacturing or processing”, or a combination of these.

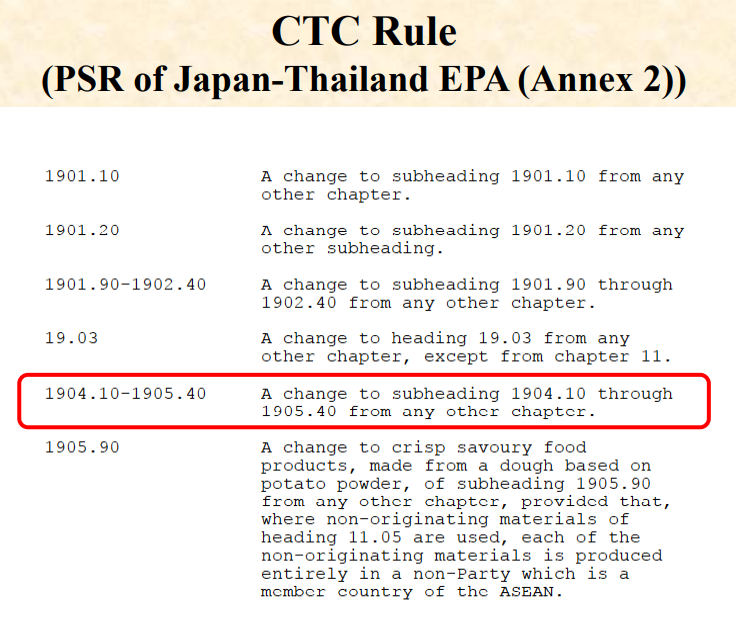

Here is an example of PSR stipulated in the Annex to EPA.

If the materials from third countries (non-originating materials) are used in the production,

Usually, we need to check PSR stipulated in the Annex to EPA.

How to read Product-Specific Rules(PSR)

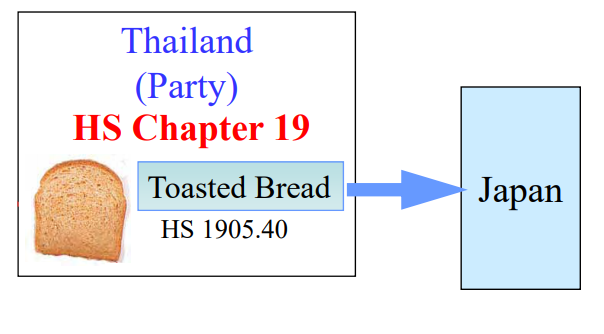

e.g. under Japan-Thailand EPA

In this situation, we need to check if a toasted bread can be qualified as an originating

good of Thailand Under Japan-Thailand EPA.

Retrieved from: Outline of Rules of Origin for EPA in Japan

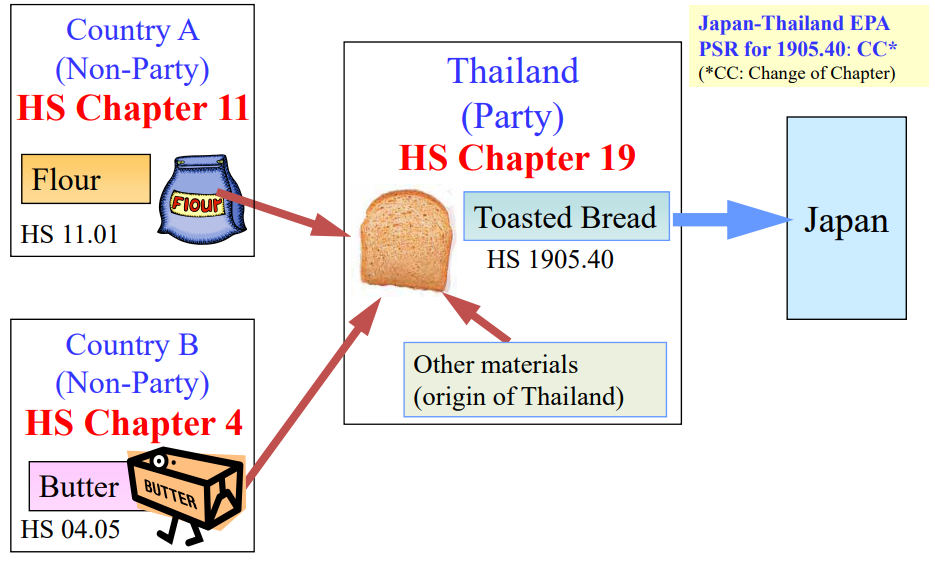

It looks like the toasted bread is Thailand origin, but found out that the materials

from third countries (non-originating materials) are used in the production.

Retrieved from: Outline of Rules of Origin for EPA in Japan

The Flour and Butter are non-originating since they are imported from Non-Parties to Japan-Thailand EPA

The Toasted Bread is classified under 1905.40 while the Flour is classified

under chapters 11 and The Butter is classified under chapters 04 respectively.

The Toasted Bread is an originating good under Japan-Thailand EPA because

a change from chapters 11 and 04 to chapter 19 has occurred.

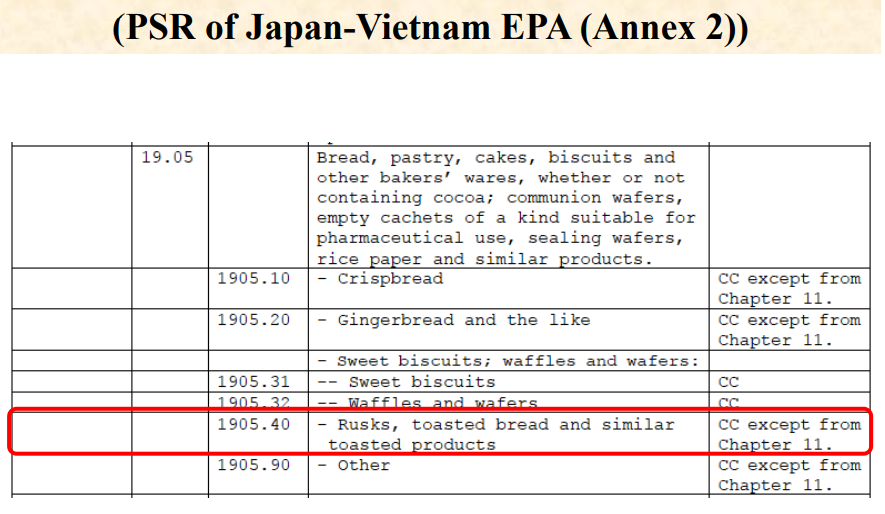

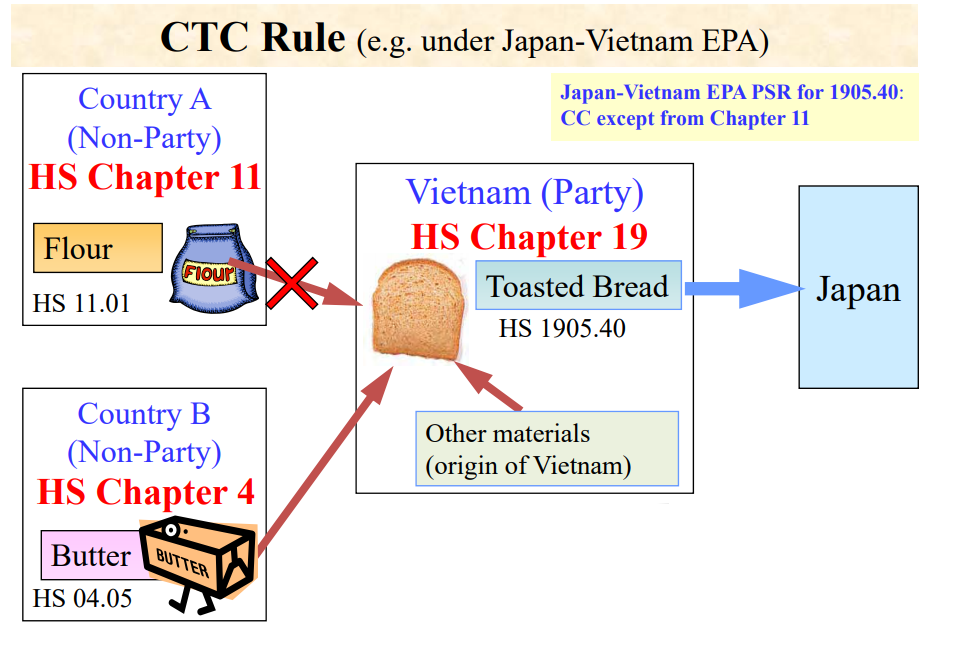

e.g. Japan-Vietnam EPA

Example of under Japan-Thailand EPA The Toasted Bread is considered as an originating good.

Here is another example of Japan-Vietnam EPA.

Even the same production, The Toasted Bread is not considered as an originating good under Japan-Vietnam EPA,

because “PSR of Japan-Vietnam EPA” is different from “PSR of Japan-Thailand EPA”.

Here is PSR of Japan-Vietnam EPA (Annex 2)

PSR for toasted bread is “CC except from Chapter 11” of CTC rule (require Chapter in Change).

In this production Flour (HS Chapter 11) is used as a non-originating material.

It does not satisfy the PSR.

Without applicable exceptions to the substantial transformation criterion

toasted bread can not be qualified as an originating good of Vietnam.

e.g. under Japan-Singapore EPA

Good: Strawberries Jam (HS 2007.99)

PSR: A Change to heading 20.07 from any other Chapter (CC).

The strawberries jam is classified under chapter 20 while the strawberries

fruit and sugar are classified under chapters 08 and 17 respectively. The strawberries fruit

and sugar are non-originating since they are imported from Korea and Australia

respectively (Non-Parties to JSEPA). The strawberries jam is an originating good under

JSEPA because a change from chapters 08 and 17 to chapter 20 has occurred.

e.g. under Korea-Singapore EPA

Good: Crocodile Leather Handbag (HS 4202.21)

PSR:A Change to heading 42.01 through 42.03 from any other Heading (CTH).

The crocodile leather (HS Heading 41.15) is a non-originating material as it

is imported from Indonesia, a non-Party to KSFTA. The leather handbag is an originating

good under KSFTA because a change from HS Heading 41.15 to HS Heading 42.02 has

occurred.

e.g. under Japan-Thailand EPA

Good: soya sauce (HS 21.03)

PSR: Change of heading (change in the first 4 digits of the HS)(CTH)

The Soya beans (HS Heading 12.01) is a non-originating material as it

is imported from USA, a non-Party to Japan-Thailand EPA. The Soya sauce is an originating

good under Japan-Thailand EPA because a change from HS Heading 12.01 to

HS Heading 21.03 has occurred.

Here is an example of an item which does not satisfy the ROO in CTC case

In the case of not fulfilling the CTC rule