Vehicles are provided for in Chapter 87 of the HS tariff code.

Many of the parts and accessories for such vehicles are also classifiable in Chapter 87, but there are many exceptions.

In this article, you can see auto parts HScode list of 100 to make it easy to classify.

Auto parts under HScode

| Description | hs code | Image |

| Air conditioners | 8415.20 |  |

| Alternators | 8511.50 |  |

| Antennas | 8529.10 |  |

| Antifreeze | 3820.00 |  |

| Batteries | 8507.10 |  |

| Bearings, ball and/or roller | 8482.40 |  |

| Bearing housings and housed bearings | 8483.20 |  |

| Bearings, plain shaft type | 8483.30 |  |

| Belts of rubber | 4010.35 |  |

| Bodies (including cabs) | 8707.10 |  |

| Bolts & other fasteners of iron or steel | 7318.29 |  |

| Brake friction material of mineral substance | 6813.81 |  |

| Bushings (if plain shaft bearings) | 8483.90 |  |

| Cable, electrical (insulated) | 8544.30 |  |

| Cable, non-electrical, of steel | 7312.10 |  |

| Capacitors | 8532.22 |  |

| Camshafts & crankshafts | 8483.10 |  |

| Carpets, tufted | 5703.20 |  |

| Carpets, woven, not tufted or flocked | 5702.42 |  |

| Chain of iron or steel (including timing chain) | 7315.11 |  |

| Chain sprockets | 8483.40 |  |

| Chassis fitted with engine | 8706.00 |  |

| Cigarette lighters | 9613.80 |  |

| Circuit breakers | 8536.10 |  |

| Clamps of iron or steel for hoses | 7326.20 |  |

| Clutch friction material of mineral substance | 6813.89 |  |

| Compressors | 8414.80 |  |

| Control Boxes & panels | 8537.10 |  |

| Decals | 4908.90 |  |

| Defrosters & demisters | 8512.40 |  |

| Distributors & ignition/starting equipment | 8511.40 |  |

| Engines, diesel | 8408.20 |  |

| Engines, gasoline | 8407.34 |  |

| Engine parts, not provided for elsewhere | 8409.91 |  |

| Fans & Blowers | 8414.59 |  |

| Filters | 8421.23 |  |

| Fittings & mountings of base metal | 8302.30 |  |

| Fittings & mountings of plastic | 3926.30 |  |

| Fittings of iron or steel for pipes & tubes | 7307.23 |  |

| Flexible tubing of base metal | 8307.10 |  |

| Floor mats of rubber | 4016.91 |  |

| Pulleys | 8483.50 |  |

| Fuel injectors | 8409.99 |  |

| Punps for piston engines | 8413.30 |  |

| Fuses & similar electrical apparatus | 8536.10 |  |

| Gears | 8483.40 |  |

| Gauges | 9026.20 |  |

| Generators | 8511.40 |  |

| Handles & knobs of plastic | 3926.30 |  |

| Rubber parts and accessories | 4016.99 |  |

| Harnesses, electrical | 8544.30 |  |

| Heaters, electrical | 8516.29 |  |

| Horns & other sound or visual signaling equipment | 8512.30 |  |

| Hoses of rubber | 4009.12 |  |

| Hydraulic cylinders | 8412.21 |  |

| Integrated circuits | 8542.31 |  |

| Lamps | 8539.32 |  |

| Lenses of glass, signaling & optical | 7014.00 |  |

| Lighting equipment | 8512.20 |  |

| Locks & keys | 8301.20 |  |

| Magnets & electromagnetic articles | 8505.20 |  |

| Manuals & other printed matter | 4901.10 |  |

| Mirrors | 7009.10 |  |

| Motors, electric | 8501.31 |  |

| Motors, hydraulic or pneumatic | 8412.39 |  |

| Nameplates, signplates, etc.parts thereof of base metal | 8310.00 |  |

| Nuts & other fasteners of iron or steel | 7318.16 |  |

| Pins, cotter or dowel, & fasteners of iron or steel | 7318.24 |  |

| Printed circuit boards, blank | 8534.00 |  |

| Printed circuit boards, populated | 8537.10 |  |

| Vacuum pumps | 8414.10 |  |

| Pumps for liquids | 8413.30 |  |

| Radios, with tape & CD players | 8527.91 |  |

| Relays & similar electrical apparatus | 8536.49 |  |

| Resistors, electrical | 8533.21 |  |

| Rivets of iron or steel | 7318.23 |  |

| Rivets of base metal | 8308.20 |  |

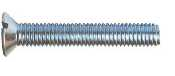

| Screws & other fasteners of iron or steel | 7318.15 |  |

| Seals of plastic | 3926.90 |  |

| Seals of rubber | 4016.93 |  |

| Seats, cushions & other articles of furniture | 9401.20 |  |

| Crankshaft | 8483.10 |  |

| Sparkplugs | 8511.10 |  |

| Speedometers & odometers | 9029.10 |  |

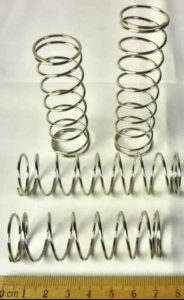

| Springs of steel | 7320.20 |  |

| Springs of copper | 7419.99 |  |

| Studs & other fasteners of steel | 7318.15 |  |

| Switches & similar electrical apparatus | 8536.50 |  |

| Tape & CD players without a radio | 8519.81 |  |

| Thermostats, without valves | 9032.10 |  |

| Tires | 4011.10 |  |

| Tool (Hand tools) Kit | 8206.00 |  |

| STATIC CONVERTERS | 8504.40 |  |

| Turbochargers | 8414.59 |  |

| Universal joints | 8483.60 |  |

| Valves | 8481.30 |  |

| Washers & other fasteners of iron or steel | 7318.22 |  |

| Windshield window safety glass | 7007.11 |  |

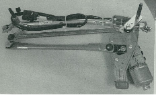

| Windshield wipers | 8512.40 |  |

| Wrenches | 8204.11 |  |

Retrieved from:European Union Website , U.S. Customs and Border Protection

*When consulting the above list, please keep in mind that it is being offered for

reference purposes only and does not guarantee accuracy of classification.

THE HEADINGS OF CHAPTER 87

Altogether there are sixteen different four-digit tariff headings or main groupings in Chapter 87. These are:

For those concerned with things “automotive,” the principal headings of interest are 8701-8708. Heading 8701 covers all tractors except those of heading 8709 (the term “tractors” is defined in Note 2 to Chapter 87 as “vehicles constructed essentially for hauling or pushing another vehicle, appliance or load” and includes, in subheading 8701.20, road tractors which pull semi-trailers). Heading 8702 covers motor buses and coaches.

Heading 8703 covers vehicles for transporting people, like cars.

Heading 8704 covers vehicles for transporting goods.

Heading 8705 covers special purpose motor vehicles other than those principally designed for the transport of persons or goods (e.g. garbage trucks, even those with compactors, would go in 8704 if their principal function is to transport trash).

It does not, however, cover self-propelled wheeled machines in which the chassis and the working machine are specially designed for each other and form an integral mechanical unit (road graders go in Ch. 84).

Heading 8706 covers chassis with engines for all the foregoing vehicles, but does not include chassis fitted with engines and cabs (they go in headings 8702-8704).

Heading 8707 covers bodies, including cabs, for the foregoing vehicles. And lastly, heading 8708 covers parts and accessories for these motor vehicles. In general, articles are “parts” if they cannot be used on their own but must be combined with other articles to form goods capable of fulfilling an intended function; “accessories” are articles that are not needed to enable the goods with which they are used to fulfill their intended function.

Pretty simple stuff, right? Wrong! As anyone who has followed the ups and downs of

sport utility vehicle classification over the years knows, it’s not so easy sometimes to

determine which heading a given article should have for tariff purposes. If a multipurpose vehicle is suitable for carrying both passengers and cargo, and has characteristics associated with both cars and trucks, should it go in 8703 or 8704? U. S. Customs for many years considered two-door sport utility vehicles like the Nissan Pathfinder to be motor vehicles for the transport of goods, which made them subject to a 25% duty. This position was eventually overturned by the courts, however, and such vehicles are now classifiable with motor cars and other motor vehicles principally designed for the transport of persons.

What items excluded from Chapter 87

There are General Rules of Interpretation (GRIs for short) that govern tariff classification.

For another, the legal notes to Section XVII, which includes Chapter 87, exclude many items that would seemingly go there.

Section XVII note2

The expressions “parts” and “parts and accessories” do not apply to the following articles、whether or not they are identifiable as for the goods of this Section:

(a) Joints、washers or the like of any material(classified according to their constituent material or in heading 84.84)or other articles of vulcanised rubber other than hard rubber(heading 40.16);

(b) Parts of general use、as defined in Note 2 to Section XV、of base metal(Section XV)、or similar goods of plastics(Chapter 39);

(c) Articles of Chapter 82(tools);

(d) Articles of heading 83.06;

(e) Machines or apparatus of headings 84.01 to 84.79、or parts thereof、other than the radiators for the articles of this Section; articles of heading 84.81 or 84.82 or、provided they constitute integral parts of engines or motors、articles of heading 84.83;

(f) Electrical machinery or equipment(Chapter 85);

(g) Articles of Chapter 90;

(h) Articles of Chapter 91;

(ij) Arms(Chapter 93);

(k) Lamps or lighting fittings of heading 94.05; or

(l) Brushes of a kind used as parts of vehicles(heading 96.03)

Before getting into specifics, however, a clarification of what constitutes a “vehicle” would appear to be in order. The term “vehicle” is derived from the Latin word “vehiculum.”

It means a carriage or conveyance. The type of vehicles which go in Chapter 87 are, for the most part, those whose main function is to transport people or things from one place to another (three exceptions: tractors, special purpose motor vehicles and armored fighting vehicles).

Mobile machines, in which a propelling base forms an integral part of a machine designed for handling, excavating, etc.,are not considered, for tariff purposes, to be

vehicles of Chapter 87. Fork lift trucks, excavators, bulldozers, front-end loaders and the like are classifiable in Chapter 84 along with other “Machinery and Mechanical

Appliances.”

PARTS AND ACCESSORIES

As complicated as vehicle classification can be, however, it’s usually much easier than

trying to classify parts and accessories for them. For, while heading 8708 reads “Parts

and accessories of the motor vehicles of headings 8701 to 8705,” it does not cover all

such parts.

In order for motor vehicle parts or accessories to be classifiable under heading 8708, they must satisfy all three of the following conditions:

- They must be identifiable as being suitable for use solely or principally with

motor vehicles of headings 8701-8705. - They must not be excluded by Section XVII, Note 2.

- They must not be more specifically provided for elsewhere in the HTSUS.

As we said in the beginning, classification is governed by six GRIs. Of these, the most

important is the first one. GRI 1 provides that “classification shall be determined according to the terms of the headings and any relative section or chapter notes.”

If you can classify goods using it, there is no need to refer to the others which follow in sequential order.

Since the provisions for motor vehicles in Chapter 87 are incorporated in Section XVII of the HTSUS, the legal notes to that section are particularly important. It is from there, in fact, that the first two conditions given above are derived.

The third condition is based on GRI 3(a) which states that when goods are classifiable under two or more headings, theheading which provides the most specific description shall be preferred. The Additional U.S. Rules of Interpretation, which follow the GRIs in the HTSUS, reinforce this principle by providing in paragraph 1(c) that “a provision for parts of an article covers products solely or principally used as a part of such articles, but a provision for “parts” or “parts and accessories” shall not prevail over a specific provision for such part or accessory.” Unless one is dealing with parts which have multiple applications on motor vehicles of Chapter 87 and machines of Chapter 84, the first of these conditions is not likely to be a problem.

Most parts used on cars and trucks are, after all, usually used only on motor vehicles–not other machines. The second condition, however, is another story.

The exclusions listed in the notes to Section XVII are many and, to the untrained observer, easy to overlook. Among other things, these notes exclude all joints, washers or the like of any material; articles of vulcanized rubber other than hard rubber; parts of general use, as defined in Note 2 to Section XV (whether made of base metal or plastic) and gears and other transmission equipment of heading 8483 which are integral components of engines or motors (clutches, gears, torque converters. Other vehicle transmission equipment of heading 8483 which is not an integral component of engines or motors goes in heading 8708).

In a similar vein, one must also keep in mind that some automotive parts and accessories which are specifically provided for in other chapters may still be classifiable in heading 8708 if they are excluded by other section or chapter notes.

One not only has to be aware of Section XVII’s notes, but those of other sections and chapters that might apply.

Chapter 39, for example, has a note which excludes parts of vehicles of Section XVII.

Consequently, a plastic hose or tube which is a finished auto part would go under 8708

rather than 3917 which is a specific provision.

It is also important to keep in mind that legal notes in one place may be offset in another section or chapter. The aforementioned Chapter 39 legal note excluding parts of Section XVII vehicles does not mean that plastic gaskets or plastic mountings and fittings for doors, windows and coachwork go in 8708. Such articles are excluded from Chapter 87 by the exclusionary notes to Section XVII which cover “joints, washers or the like of any material” and “parts of general use.”

Parts Of General Use

The term “parts of general use,” incidentally, is one that is often misunderstood by

importers and exporters who come across the phrase. Contrary to what a lot of people

think, it does not mean “parts which have multiple applications” or “parts which have no principal use.” Made-to-order parts that are suitable for only one particular application and are not good for anything else, can still be “parts of general use.”

The term has a very precise legal definition which may be found in Note 2 to Section XV. For purposes of Section XVII, it means the following types of articles whether made of iron or steel, some other base metal, or plastic:

In this definition, many HS codes are scattered throughout the definition.

Hence still unclear what “parts of general use” mean.

Below is an image list of “parts of general use” for each HS code defined in Explanatory Note Section XV note 2.

HS7307: Tube or pipe fittings

(for example, couplings, elbows, sleeves), of iron or steel:

HS7312: Stranded wire, ropes,

cables, plaited bands, slings and the like, of iron or steel, not electrically insulated:

HS7315: Chain and parts thereof, of iron or steel:

HS7317: Nails, tacks, drawing pins, corrugated nails, staples

HS7318: Screws, bolts, nuts, coach screws,

screw hooks, rivets, cotters, cotter pins, washers (including spring washers) and similar articles, of iron or steel

HS: 7318.21: Spring washers and other lock washers

HS8301: Padlocks and locks

HS8302:Base metal mountings, fittings and similar articles

suitable for furniture, doors, staircases, windows, blinds, coachwork, saddlery, trunks, chests, caskets or the like; base metal hat racks, hat-pegs, brackets and similar fixtures; castors with mountings of base metal; automatic door closers of base metal; and base metal parts thereof:

HS8308: Clasps, frames with clasps,

buckles, buckle-clasps, hooks, eyes, eyelets and the like, of base metal, of a kind used for clothing or clothing accessories, footwear, jewelry, wrist watches, books, awnings, leather goods, travel goods or saddlery or for other made up articles; tubular or bifurcated rivets, of base metal; beads and spangles, of base metal:

HS8310: Sign plates, name plates,

address plates and similar plates, numbers, letters and other symbols, and parts thereof, of base metal, excluding those of heading 9405

HS:8306 Bells, gongs and the like,

nonelectric, of base metal; statuettes and other ornaments, of base metal; photograph, picture or similar frames, of base metal; mirrors of base metal; and base metal parts thereof:

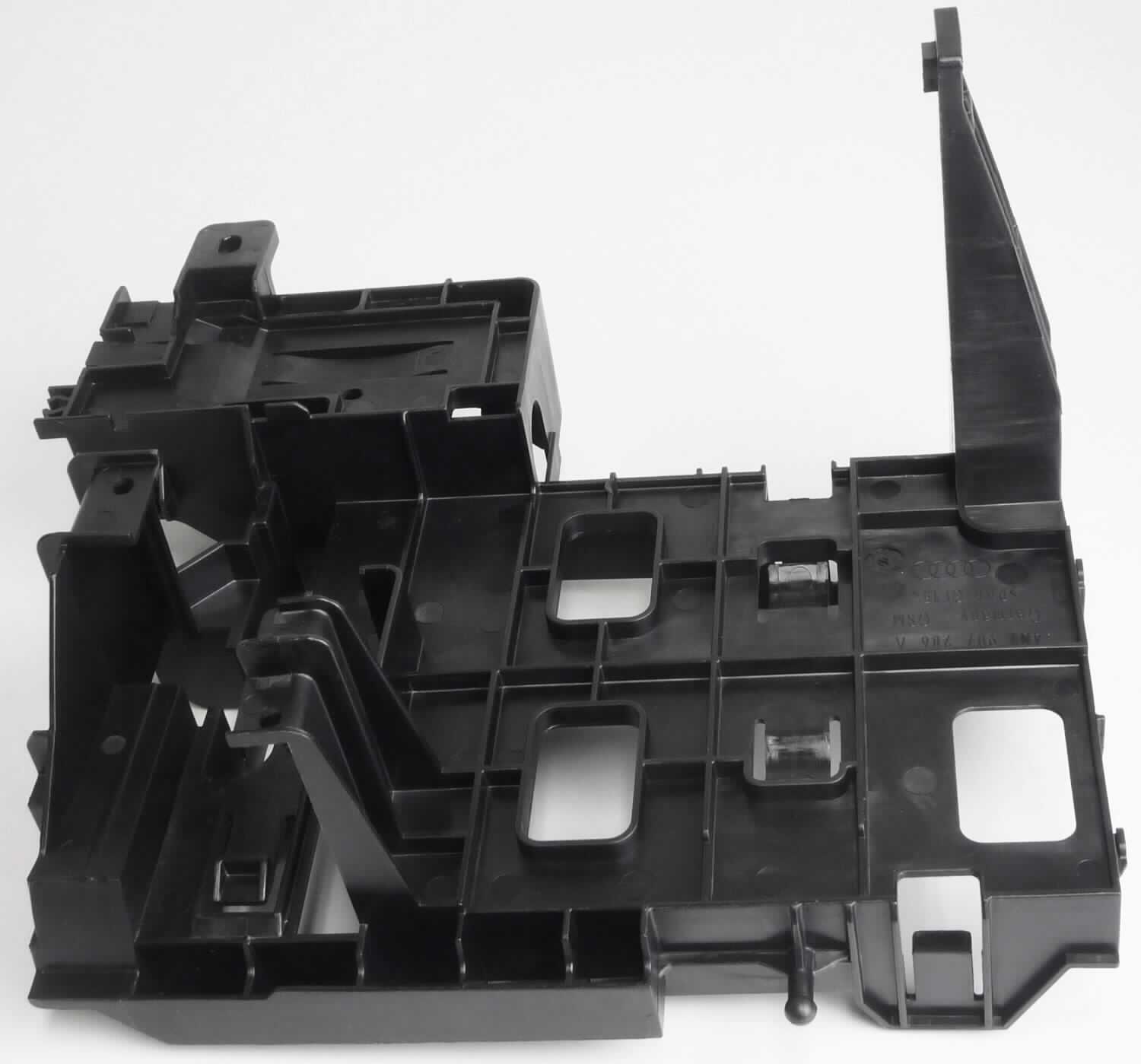

What is Fittings for Coachwork(plastic autoparts) HS:392630

When it comes to classifying automotive parts made of plastic,

one of the options is HS:392630 (Fittings for furniture, coachwork, or the like:)

I wonder why HS tariff used the terms of “coachwork”??

It should be “automotive”??

And also many people may wonder what kind of items are classified as “Fittings for Coachwork”?

So I retrieved items which are classified as “Fittings for Coachwork”(HS:3926.30)

from many customs ruling database.

Below is the list of the items classified as “Fittings for Coachwork”(HS:3926.30)

Examples of “Fittings for Coachwork”(HS:3926.30)

door handle

Czech Customs:CZBTI37/086941/2018-580000-04/01

cable guide

German customs:DE239/17-1

cable guide

German customs:DE686/17-1

cover mounted behind the interior trim of motor vehicle door

German customs:DE966/17-1

panel for window frames

German customs:DE4899/16-1

belt deflector

German customs:DE4949/17-1

cover assembly hole are directly and permanently mounted on motor vehicles behind the inner panel on the body of the left door

German customs:DE8666/17-1

entry bar made of molded plastic

German customs:DE14779/16-1

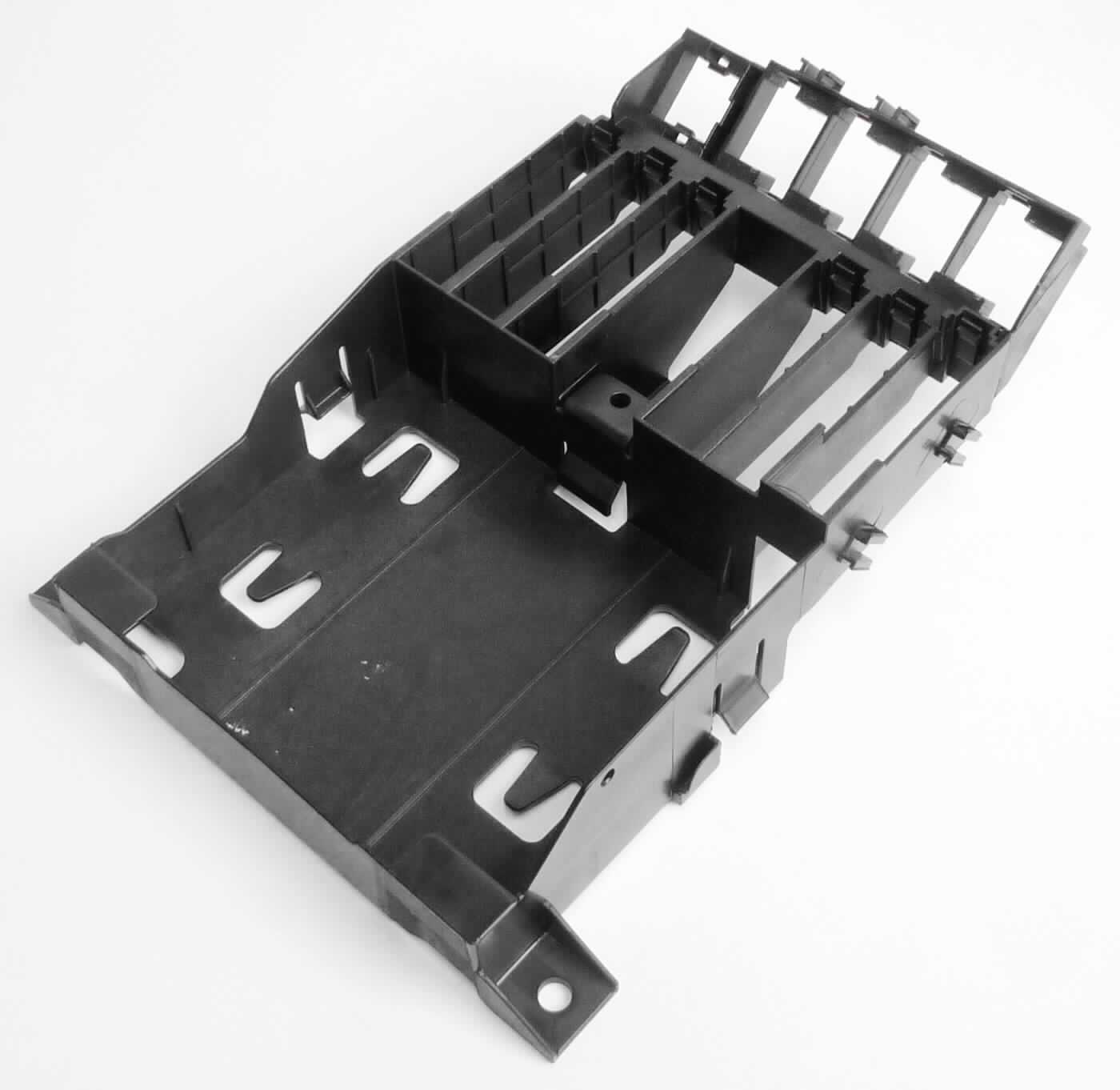

mounting bracket used to hold control units

German customs:DEBTI1836/18-1

The approximately 32.4 x 24.4 x 10.4 cm shaped product is essentially eleven Recesses for relay socket and plug couplings and a large main compartment for a control unit provided

German customs:DEBTI3532/18-1

door handle

German customs:DEBTI13185/18-1

universal mount for example, Mobile phones or iPods with two self-locking clamping devices

German customs:DEHH/15/09-1

door handle

German customs:DEHH/1118/05-1

Plates and emblems for tourist cars

spain customs:ESBTI2017SOL0000000000749

automotive plastic wheel attachment

French customs:FR-E4-2006-002796

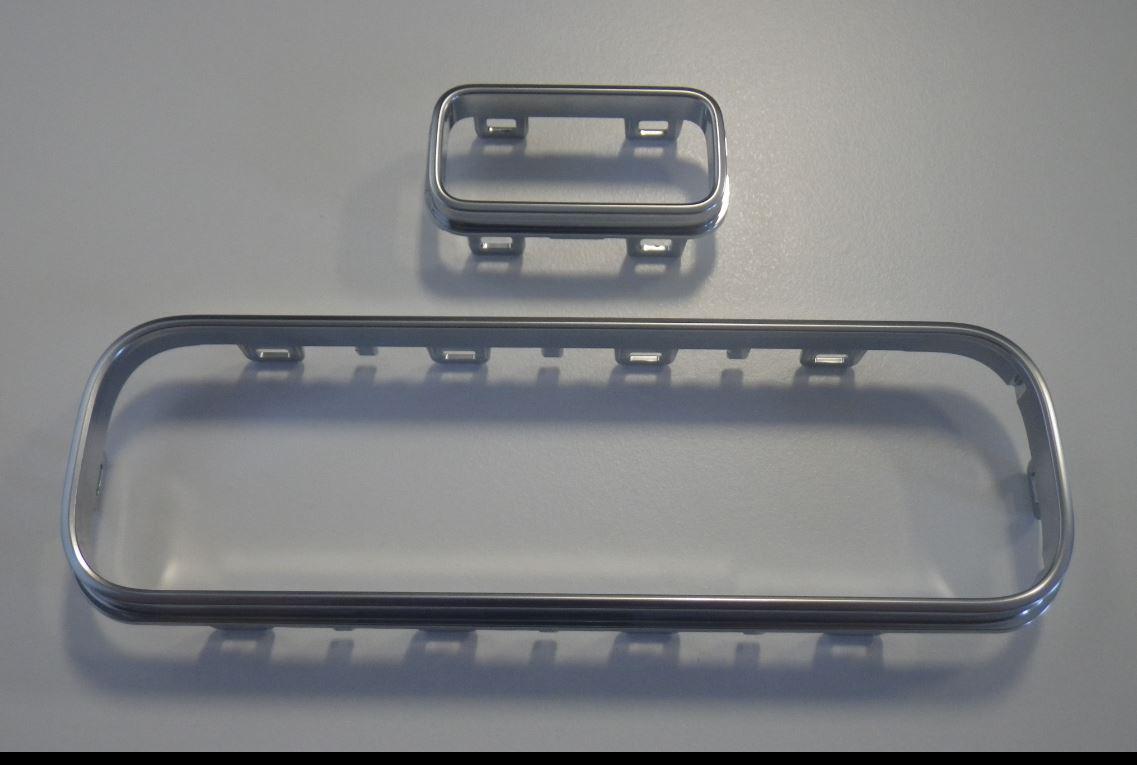

Chrome-plated plastic edging for the power window block mounted on the car door next to the driver

Latvia customs:LVBTI2019-91

Interior door handle

Slovakia customs:SK13409/09/5219/28

Plastic but not “Fittings for Coachwork”(goes to 8708)

Even though the items below are made of plastic, they are essential parts of automobiles and satisfy all three of the following conditions:(Section XVII GENERAL(III))

(a) They must not be excluded by the terms of Note 2 to this Section

(b) They must be suitable for use solely or principally with the articles of Chapters 86 to

88

(c) They must not be more specifically included elsewhere in the Nomenclature

Therefore they are not classified as HS:3926.30

The plastic blower for cars

Slovakia customs:SK12536/16/02

Parts of a steering column

German customs(DE):DE892/17-1

CONSOLE

United Kingdom customs:GB501958157

Glove box

German customs:DE4894-16-1

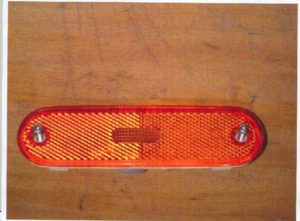

Reflector for motor vehicles

Belgium customs:BED.T.251.513

DOOR COMPARTMENT (ASHTRAY)

Italy customs:ITBTIIT-2017-0430M-314100

Retrieved from:European Union Website

“Fittings for Coachwork” is a vague term. I looked for the definition of it but could not find it.

Here is just my opinion to differ from them.

plastic parts for automotive which work directly for the automotive mechanism goes to 8708.

On the contrary plastic parts for automotive which works as Accessories, like connecting, attach, fix something to the place, etc goes to 3926.30(fittings for coachwork)

Since there is no clear definition for it, I determine them by items picture obtaining from the customs ruling database.

Please refer to the above pictures to see the difference between auto parts made of plastic 3926 and 8708.

GOOD INVOICING IS ESSENTIAL

Even if a person knows the GRIs as well as they know their own social security number

and is aware of all the relevant legal and explanatory notes, classification is just guesswork if invoices do not give complete and accurate descriptions of what is being

imported.

This is especially true when there is a lack of uniformity between Customs and trade definitions. Fasteners are a good case in point. Many shippers of automotive parts

consider just about any threaded fastener that can be used with a nut to be a “bolt.”

To Customs and the fastener industry, however, a threaded fastener which is used with a nut may be a “screw” that has a duty rate which is more than twelve times higher! According to the Explanatory Notes for heading 7318, a bolt is designed to engage in a nut, whereas screws for metal are more usually screwed into a hole tapped in the material to be fastened.

Screws are, therefore, generally threaded throughout their length, whereas bolts

usually have a part of the shank unthreaded. These are, however, just a few of the

characteristics that need to be examined.

Both U.S. Customs and the fastener industry rely on a whole series of primary and supplemental criteria to distinguish a bolt from a screw.

Some other terms for auto parts that can be a problem because they are so vague are

“actuator,” “bearing,” “gasket,” “seal,” “solenoid,” “valve,” and “washer.” Such descriptions by themselves are too broad to classify the goods properly and there is more than one classification and duty rate which could apply.

Without more specific information, Customs officers may assume the classification with the highest duty rate is the right one–to the detriment of the party paying the duties. Needless to say, it is to the shipper and importer’s advantage to make sure such articles are described fully enough to avoid further inquiries or unwarranted additional duty assessments from Customs.