How do you classify “Soap Dispenser” under the HS code?

It sounds easy but it is actually quite a lot of work to think deeply because

Five Customs classifies different HS for “Soap Dispenser”.

| German and Switzerland case | HS:8479.89 |

| US case | HS:8424.89 |

| Japan case | HS:3924.90 (GRI3(b)) |

| Taiwan case | HS:8413.20 |

| India case | HS:3924.90 (GRI1) |

“Soap Dispenser”, an empty bottle, made of plastic and no electrical function.

Soap is pop out when you push the top of the dispenser by hand.

It’s just an ordinary item, but I guess it’s a kind of unclassifiable item without consult importing country’s customs.

Let’s see each country’s Customs ruling recode of “Soap Dispenser”

Table of Contents

German case HS:8479.89

In most cases, Customs in the EU classify Soap dispensers in 8479.89.

“Machine, apparatus and apparatus having individual functions”

this is from the case of a German custom.

Other EU country’s customs classify the same way.

Ref: DEBTI21927/19-1

Issue date: 2019-07-22

HS code: 84798997900

English description:

Soap dispenser, Art.-No. 18791, – of a cuboid housing made of plastic with a removable, mounted on a container opening, manually operated piston pump with spring-loaded suction pipe and soap dispensing spout (Figure see Appendix), – for the metered dispensing of liquids by pressing the piston pump. “Machine, apparatus and apparatus having individual functions, not specified or included elsewhere in Chapter 84, other than code number 8479 1000 00 0 to 8479 8997 85 0 – So-called soap dispensers”

Original description:

US case HS:8424.89

Previously US customs classify Soap Dispenser in 8424.20: Spray guns and similar appliances,

but revoked to 8424.89.“Mechanical appliances (whether or not hand-operated) for projecting, dispersing or spraying liquids . . . : Other appliances: Other.”

Ref: HQ H305296

Issue date: July 6, 2004

HS code: 8424.89.7090

English description: The article in question is a hand-operated soap and lotion dispenser, identified as a hand-painted liquid glass pump. The unit consists of a glass bottle reservoir, plastic pump assembly and dispenser head. By pressing the pump assembly up and down, soap or lotion is moved from the reservoir through the pump, and ejected out through the dispenser head.

The applicable subheading for the soap and lotion dispenser will be 8424.89.7090, Harmonized Tariff Schedule of the United States (HTS), which provides for other mechanical appliances for projecting, dispersing or spraying liquids.

The reason why US customs changed their mind to classify 8424.20 to 8424.89 is here

The compact Oxford English Dictionary defines spray gun as “a device resembling a gun which is used to spray a liquid such as paint under pressure.” As described in the ENs, spray guns are usually designed for attaching to compressed air or steam lines, are connected with a reservoir with the material to be projected, and are fitted with a trigger or valve to control the flow through the nozzle. x, and do not fall within the description of subheading 8424.20, HTSUS.

Subheading 8424.89.90, HTSUS, provides for other mechanical appliances for projecting or dispersing liquids. We have previously determined that hand-operated pump dispensers that operate in a manner similar to the instant items are classified in subheading 8424.89, HTSUS. See HQ H070635 (July 13, 2010); HQ H012731 (March 27, 2008); HQ 956522 (August 29, 1994); HQ 956530 (August 29, 1994). Accordingly, we conclude that the subject pump dispensers hand pump are classified in subheading 8424.89, HTSUS.

furthermore, according to “Harmonized Commodity Description and Coding System Compendium of Classification Opinions” Pump is classified in 8424.89

8424.89 «Pump»

comprising a press-button, a nozzle; a piston-spring, a sealing-piston, a stem,

a container-gasket, a screw cap, housing, a spring, a sealing-ball and a diptube.

The article is designed to be mounted on the neck of a container for projecting

liquids, powders or foams through the nozzle by means of a piston-pump

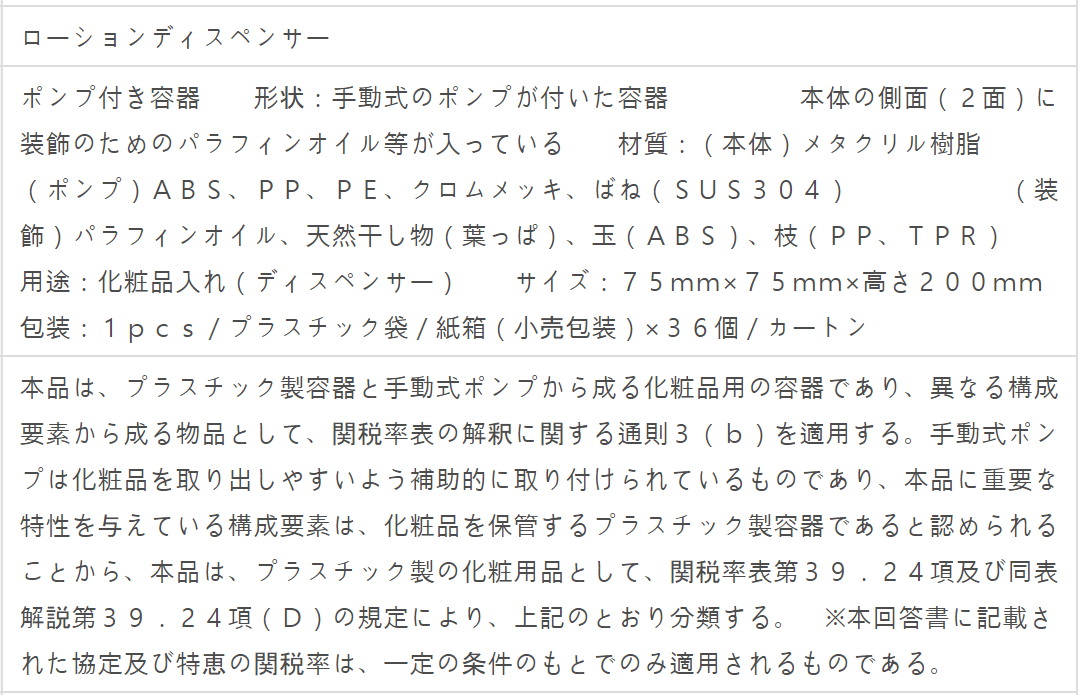

Japan case HS:3924.90

Japan case is a bit complicated, “Soap Dispenser” has a “Double-layered soap tank”.

Soap is stored inside of the tank, and paraffin oil, leaves, and ABS balls are stored outside of the tank to decorate its looks.

Japanese customs adopted GRI3(b) to classify and impart essential character on the decorated plastic container itself. They take the pump function as a secondary.

Personally, I don’t agree with that idea, even though the container has unique features, and looks good, this item is nothing other than a pump.

*Example Image1(it’s not confirmed that the below item image is ruling item.)

*Example Image2(it’s not confirmed that the below item image is ruling item.)

Source: Yahoo Shopping

Source: Yahoo Shopping

Ref: 115003375

Issue date: 2015-07-17

HS code: 392490010

English description: Lotion dispenser, Pump with container shape: manual material paraffin oil, etc. are entered for the decoration to the pump is marked with the container body side (two-sided) of ( body) methacrylic resin (pump) ABS, PP, PE, chrome-plated, spring (SUS304) (decoration) paraffin oil, naturally dried washing (leaves), Ball (ABS), branch (PP, TPR) Applications: cosmetics purse (dispenser) Size: 75mm × 75mm × height 200mm

This product is a container for cosmetics made from a plastic container and a manual pump, as an article consisting of different components, to apply the general rule 3 (b) on the interpretation of the tariff. Manual pumps are those that are supplementary mounted so easy access cosmetics, construction elements that gives an important feature for this product, because it is recognized as a plastic container store cosmetics, the goods as plastic cosmetic supplies, pursuant to the provisions of Article 39.24 Section tariff and the same table commentary Section 39.24 (D), are classified as described above.

Original description:

Source: Japan customs

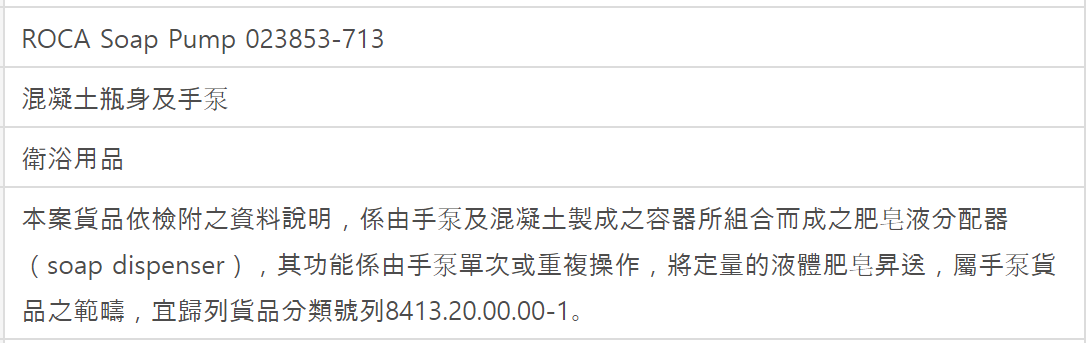

Taiwan case HS:8413.20

Ref: 104AA0113

Issue date: 2015-03-05

HS code: 841320

English description: Soap Pump According to the information attached to the case, the product is a soap dispenser which is a combination of a hand pump and a container made of concrete. Its function is a single or repeated operation of the hand pump, which will quantify the liquid soap. Upgrade, which belongs to the category of hand pump goods, should be listed in catalog number 8413.20.00.00-1.

Original description:

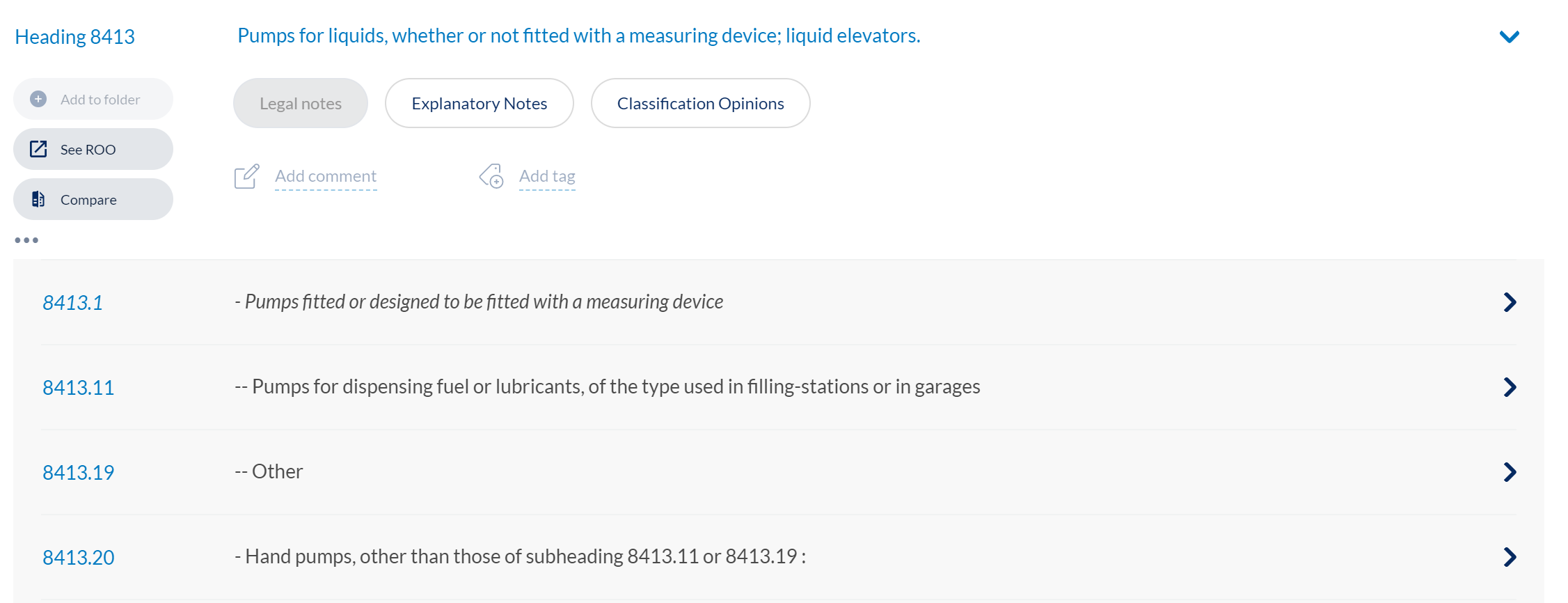

Below is TARIFF from the WCO web page, you can see subheading 8413.20 “Hand pumps”.

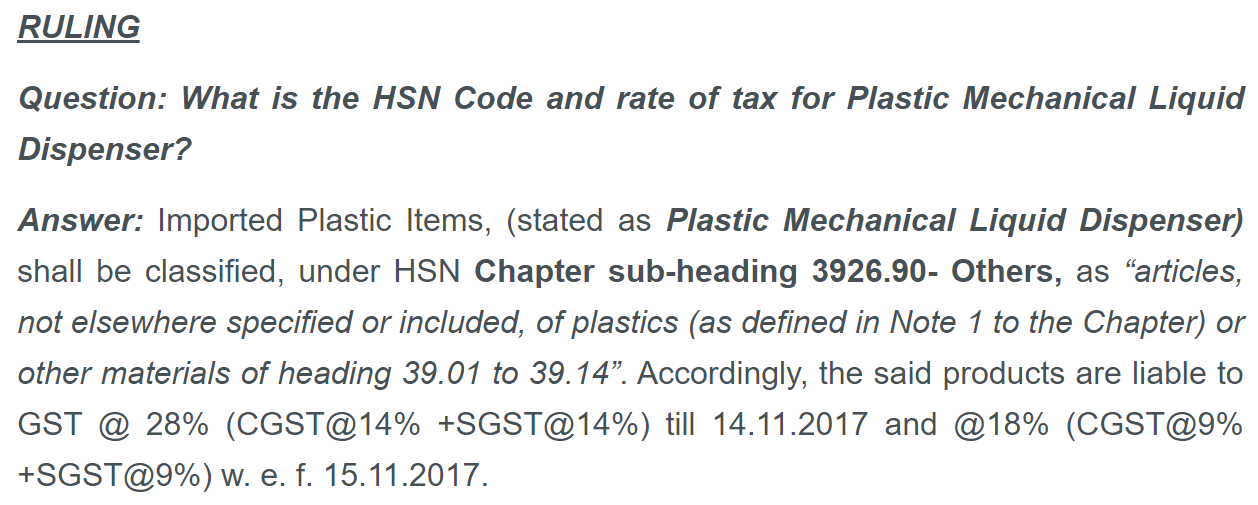

India case HS:3926.90

Ref: GUJ/GAAR/R/34/2020

Issue date: 03/07/2020

HS code: 3926.90

English description: The applicant has submitted that they are engaged in importing “Plastic Mechanical Liquid Dispensers” from China and sell them in local market since 2011. These dispensers are used as the caps of bottles. They are used for dispensing liquid either through direct discharge or spray type discharge or foam type of discharge.

The items in question are neither a mechanical appliance, Fire extinguisher, Spray guns and similar appliances, Steam or sand blasting machines and similar jet projecting machines nor it can be classified under CTH 8424.89 because CTH 8424.89 refers to other than agricultural or horticultural appliances, industrial bellows and similar other products having same type of functioning are covered.

Indian customs did not take Soap dispensers as a mechanical appliances.

France case HS:8479.89

Ref: FR-PRO-2011-006450

Issue date: Nov. 25, 2011

HS code: 8479.89

English description:DISPENSER MADE OF A HEAD PUMP POLYSTYRENE APPEARANCE AND BRUSH STEEL BODY WITH RUBBER COATING OF OIL. DIAMETER: 7.3 CM Height: 17 CM COLOR: PURPLE

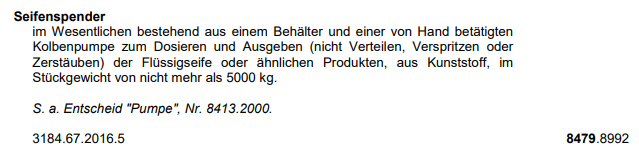

Switzerland case HS:8479.89

Ref: Customs ruling in Switzerland

Issue date: 01/04/2020

HS code: 8479.89

English description: Soap dispenser

essentially consisting of a container and a manually operated

piston pump for dosing and dispensing (not distributing, spraying or

spraying) of liquid soap or similar products, made of plastic, in the

Unit weight of not more than 5000 kg.

Original description:

Source: Customs ruling in Switzerland

Conclusion

As stated above Five countries Customs have different opinions to classify.

EU case HS:8479.89

US case HS:8424.89

Japan case HS:3924.90

Taiwan case HS:8413.20

India case HS:3924.90

Japan and India choose the same HS code, but the classification reason is different.

Personally, I like the Taiwan customs decision HS:8413.20. But in EN, there is no clear definition of “Hand pumps”. On the other hand, US opinion and “Harmonized Commodity Description and Coding System Compendium of Classification Opinions” decisions are considerable. (HS:8424.89), because Heading 8424 state that “Mechanical appliances for projecting, dispersing” .

So I think about how the word “Dispense” connects with “projecting” and “dispersing” could be a key point

From “Merriam-webster” each words are defined below.

Dispense: to divide and share out according to a plan: to deal out in portions

Projecting: to cause to jut out

Dispersing: to cause to become spread widely

What do you think?