The “absorption” or “roll-up principle” allows intermediate products to maintain

their originating status when they are used for subsequent manufacturing operations.

The part of all non-originating inputs contained in the intermediate product is

disregarded when assessing the origin of the final good.

This means that if a material which contains non-originating input(s) satisfies the

applicable origin criterion and has acquired originating status, the entire material is

treated as originating when assessing the origin of the subsequently produced good:

The feature of Roll-Up principle

1.the value of the non-originating inputs contained in intermediate materials which have

acquired originating status is counted as originating content in the calculation of value

added criteria;

2.the non-originating parts or materials contained in intermediate materials are not

considered when assessing whether a product-specific rule based on a change of tariff

classification is fulfilled; or

3.the manufacturing processes of non-originating inputs contained in the intermediate

materials are not taken into account when assessing the specific manufacturing or

processing criteria.

The absorption or roll-up principle makes origin rules less restrictive, allowing the use of more

non-originating inputs than are permitted in product-specific rules.

Whereas the absorption or roll-up principle attenuates the restrictiveness of rules of origin for

manufacturing processes within one contracting party of a free trade area, cumulation offers the

same principles to manufacturing processes across contracting parties.

Exsample of Roll-Up principle

Retrieved from:Comparative Study on Preferential Rules of Origin

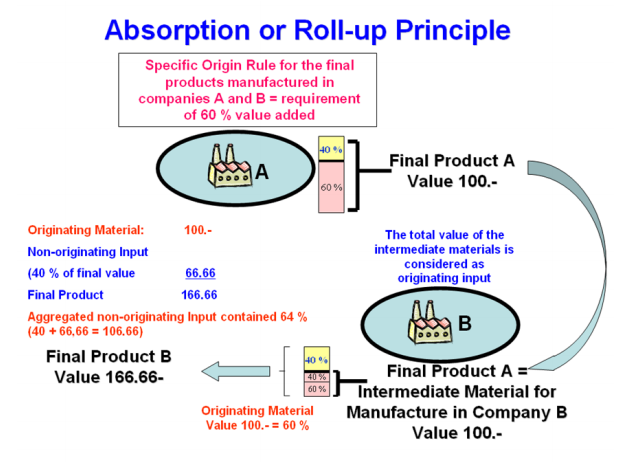

The example illustrates how the absorption or roll-up principle works:

A product produced in company A fulfills the origin criterion which requires that 60 % of the

value of the good be added in the free trade area (40 % of the value of the final product maybe

non-originating).

The product is further used as an intermediate material for the subsequent manufacturing of

another good in company B. The absorption or roll-up principle allows the entire good

(from company A) is considered originating when assessing the originating status of the final

product.

Let us assume that the product-specific rule for the product manufactured in company B also

requires that 60 % of the value of the product be added in the free trade area. The intermediate

material is considered to be 100 % originating and it is, therefore, possible to use 40 % of

non-originating materials in the manufacturing of the final product. In this way, the final

product may in practice contain non-originating input of 64 % of the value of the final product,

despite the fact that the origin rule limits non-originating input to 40 % of the value of the

final product.

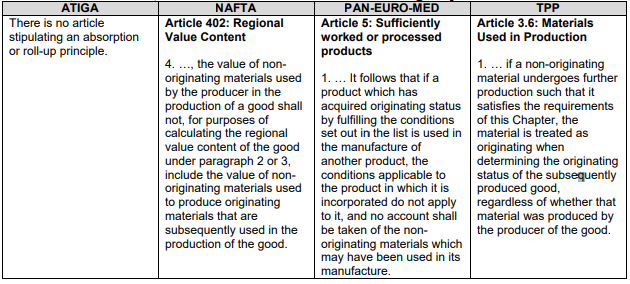

The absorption or roll-up principle is extensively used in the PAN-EURO-MED context. The

NAFTA legislation also uses the absorption principle, but applies it in a more restrictive manner,

limiting it to the purposes of calculating the regional value content and furthermore excluding its

application in the automotive sector. The TPP Agreement allows for the use of the absorption

or roll-up principle in its general regime-wide origin context. There is no absorption or roll-up

principle in the ATIGA origin system.

Comparision of Roll-Up principle

Here is comparison of “Absorption or Roll-Up Principle/Intermediate Material” in

the ATIGA, the NAFTA, the PAN-EURO-MED and the TPP origin systems

Retrieved from:Comparative Study on Preferential Rules of Origin

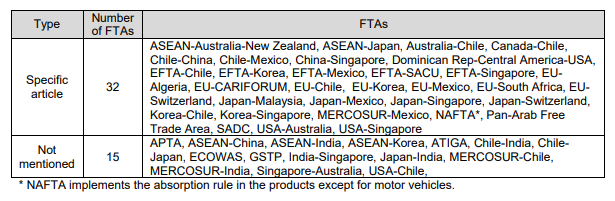

This study module aims to compare and analyze the features of Rules of Origin (ROO)

provisions of the selected 47 Free Trade Agreements (FTA). This module intends to sort out

the types of various topics of ROO provisions.

The following table is the comparison of the absorption or roll-up principle/intermediate

the material in the selected FTAs.