What if we claim preferential tariff treatment the wrong way in order to reduce customs duties under the FTA?

Customs conduct a verification exercise on the good at random or when they have doubts about the authenticity of the certificate.

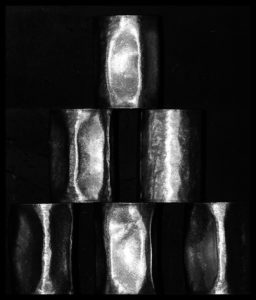

Here is an actual case of OriginVerification of a company imported Tin-Plate Can, claiming preferential tariff treatment under one of Japan’s EPAs.

An importer imported Tin Plate Cans from country L and provided a certificate of origin to

Customs when claiming preferential treatment.

A Customs official in the clearance section compared the certificate of origin with the list of

seals registered with Japan Customs, but could not find the same seal in the list. The official, therefore, had doubts about the authenticity of the certificate of origin. Hence, Customs

requested the exporting country to conduct verification with regard to the authenticity of the

certificate of origin.

As a result of the verification, it was discovered that the certificate of origin which the

importer had provided was forged.

Customs determined that the requirements for preferential tariff treatment had not been satisfied. Therefore, preferential tariff treatment was denied.