This issue is whether the Name Plates, Labels, Emblems made from plastic for use on Motor Vehicles are classifiable under HScoce:8708 as parts of automotive or under sub-heading 3926.90 as other articles of plastics.

Those goods can be affixed only on the vehicle for which these have been specifically and principally manufactured; that without these goods the vehicle cannot be identified as a particular vehicle and as such these are parts specially designed for vehicles.

Therefore it seems that they are classifiable under HScode:8708 but it has not been held by the Court M/S. Pragati Silicones P. Ltd. vs Cce Delhi on 17 April, 2001

The court judged that a motor vehicle is complete and function as Motor Vehicle without the impugned goods; that as these goods have been made of plastics, these are classifiable as articles of plastics under HScode of heading 3926.

When it comes to deciding whether plastic automotive parts can be classified HScode:8708,

we need to consider if an automotive mechanism works without it or not.

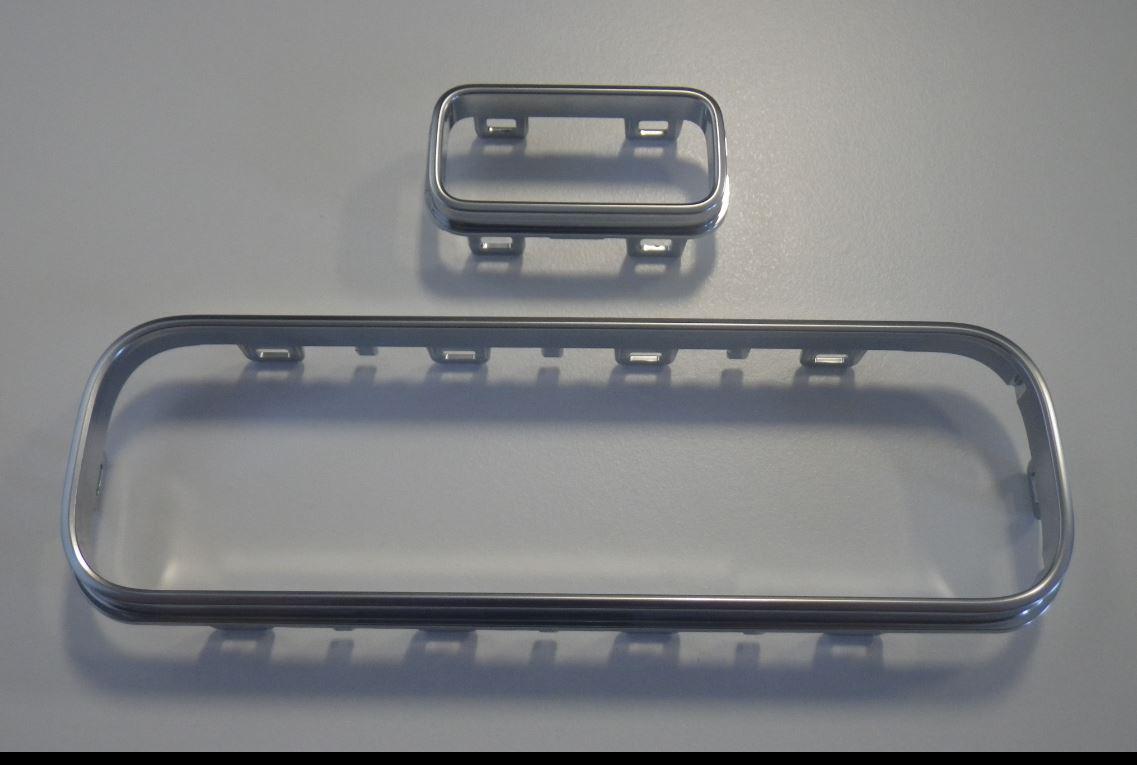

The below example is the plastic automotive part which was classified as automotive parts HScode:8708

| Item image |  |

|---|---|

| Issued Country | German customs |

| Reference | DE892/17-1 |

| Issuing date | 2017-06-12 |

| Item name | Steering column part |

| Classified HS code | 8708.99 |

| Details & Customs Opinion | in the form of a specifically manufactured, elongated, foldable product, made of plastic, provided with fastening devices, – is permanently locked to the steering column of small buses or vans, according to the application – is not attached directly to the body of the vehicle, which means that it is not fitted with any hardware or fittings similar to that of plastic, or of a bodywork accessory of subheading 8708 2990, On the basis of the objective characteristics (inter alia, specific shape), mainly for motor vehicles of Chapter 87. ‘Parts for motor vehicles of heading 8701 to 8705 (cable holders), other than those specified in subheadings 8708 10 to 8708 95, for the industrial assembly of motor vehicles of heading 8703 or of motor vehicles of heading 8704, with reciprocating internal combustion piston engines (diesel or semi-diesel engines ) And a cylinder capacity of 2 500 cm 3 or less or with reciprocating internal combustion piston engine of 2,800 cm 3 or less The application of the non-preferential rate of customs duty on the basis of end-use and classification in the tariff heading indicated above is subject to reservation The submission of the required certificate |

The reason why the above item was classified as automotive parts HScode:8708 is that the automotive mechanism does not work without it.

Materials are almost the same but classified differently due to usage.