The change of tariff classification criterion(CTC) is found in virtually all

origin systems. This criterion may be applied together with other criteria

such as an ad-valorem.

Most systems make wide use of the criterion of change in tariff classification.

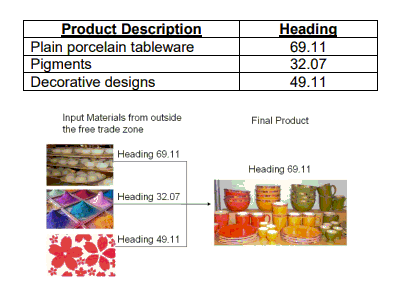

Example : Manufacture, in a contracting party of a free trade agreement,

of porcelain tableware decorated in several colors, of tariff heading 69.11,

using the following materials from countries outside the free trade area:

Retrieved from:WCO ORIGIN COMPENDIUM

Given the use of plain tableware which is classified in the same tariff heading as

the final decorated tableware, the working carried out in the contracting party to

the free trade area does not fulfil the product specific rules based on a

change of tariff classification, and the decorated tableware therefore cannot be

considered as originating in the free trade area.

The criterion based on tariff classification changes is considered to have the following

specific features:

Features of the Change in Tariff Classification Criterion:

- Synergy effects can be gained by using the Harmonized System for origin determination,

as most goods in international trade are classified in the

Harmonized System Nomenclature; - The Harmonized System is designed to be a multi-purpose nomenclature and has been

established as a common Customs language; traders and Customs officers are familiar

with the Harmonized System; - Product specific rules based on a change in tariff classification criterion are

unambiguous and simple to apply and control, with a correct classification

of the input materials and the final product; - They can normally be used across-the-board for all product categories,

with specific adaptations of the rules (change of tariff subheading or split-heading

or split-subheading) under certain circumstances; - Once created, product specific rules based on a change of tariff classification

are predictable; - Although the Harmonized System is a multi-purpose nomenclature,

it is not always structured in a suitable way for origin determination purposes; - In some Chapters extensive knowledge on the Harmonized System is needed;

- The Harmonized System is amended every five years which requires a transposition

of the rules of origin (as explained in Section 5); - The application of product specific rules based on a change in tariff classification

may require additional provisions, such as minimal operations/insufficient working

or processing operations.