Are you struggling with HSclassification?

here is the technical solution for it.

You can determine HScode with ImageSearch on the world Customs ruling database.

The database consists of

29 countries Customs HSclassification decisions containing more than 300,000 records.

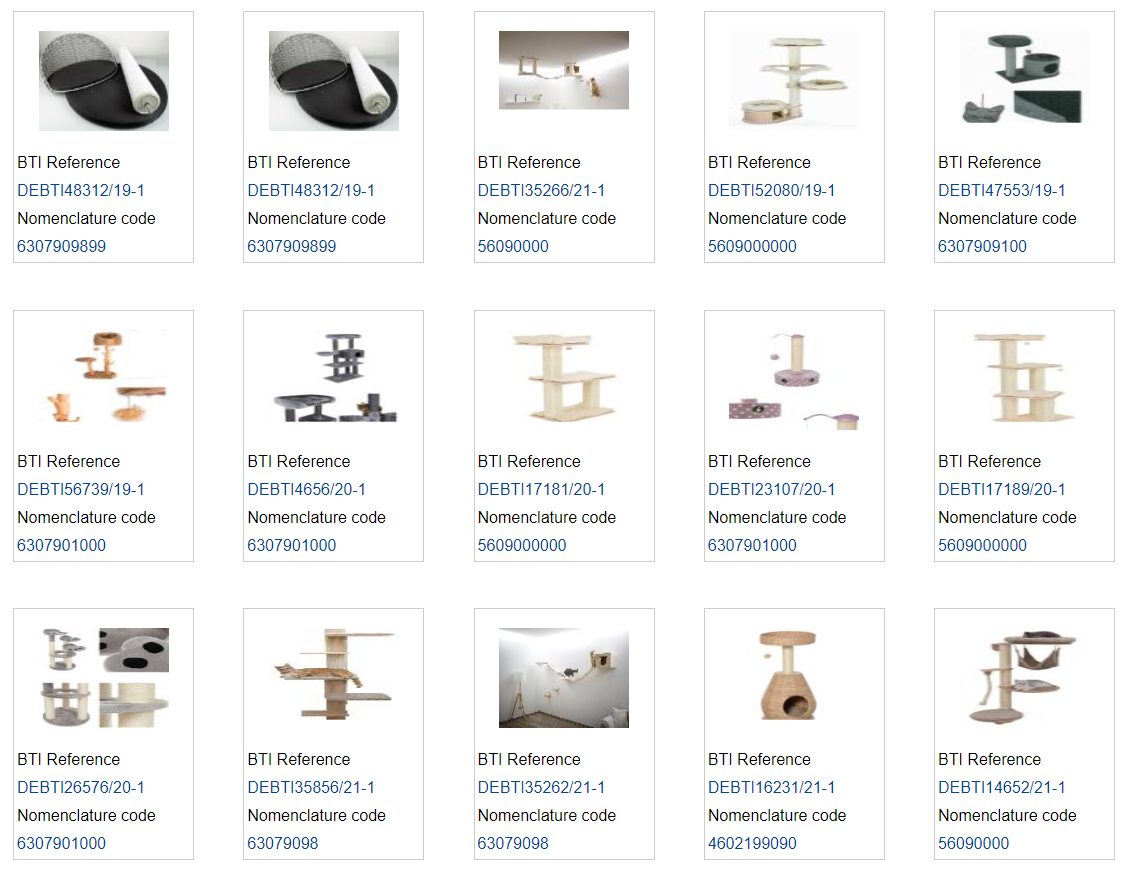

Let’s see, here is the list of the search results for “Cat tree”

You can see 3 patterns of HS code 6307.90, 5609.00, or 4602.19.

Just compare your item with them to determine which HS code is the appropriate one.

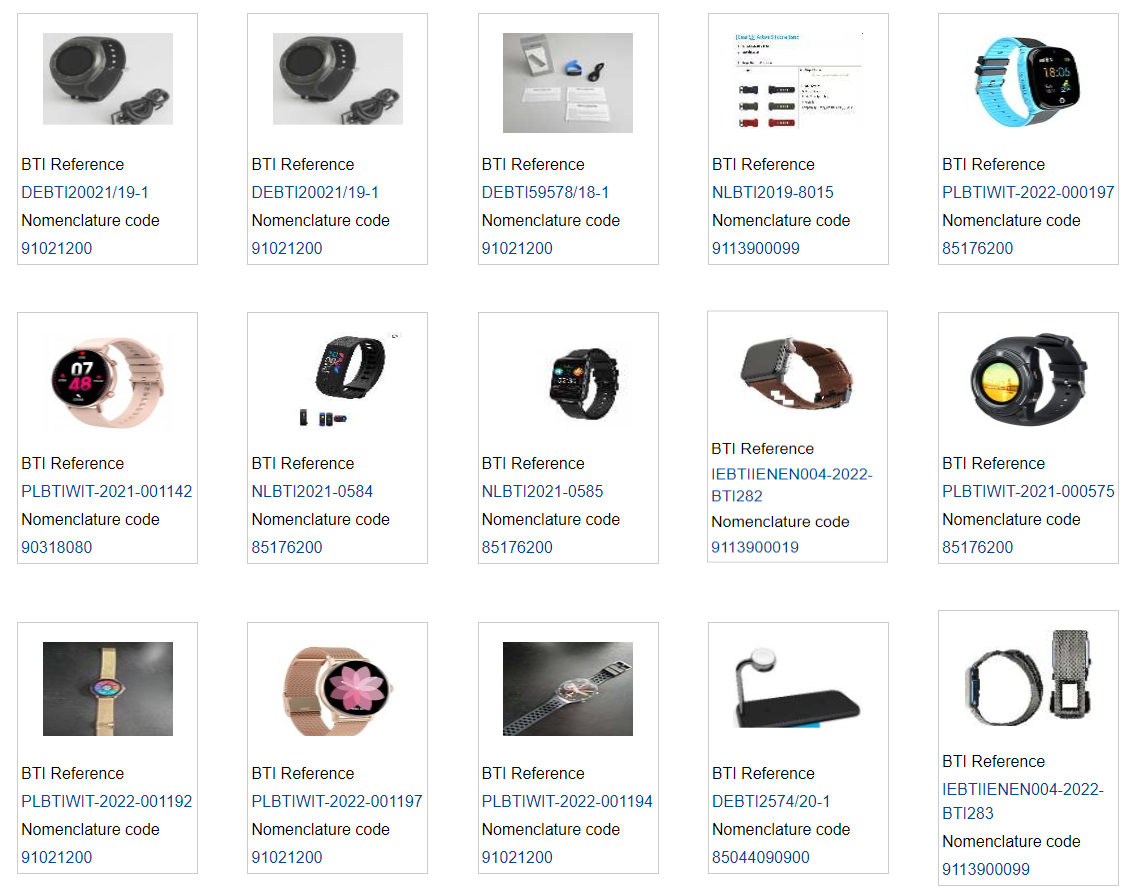

Search results for “Smartwatch”

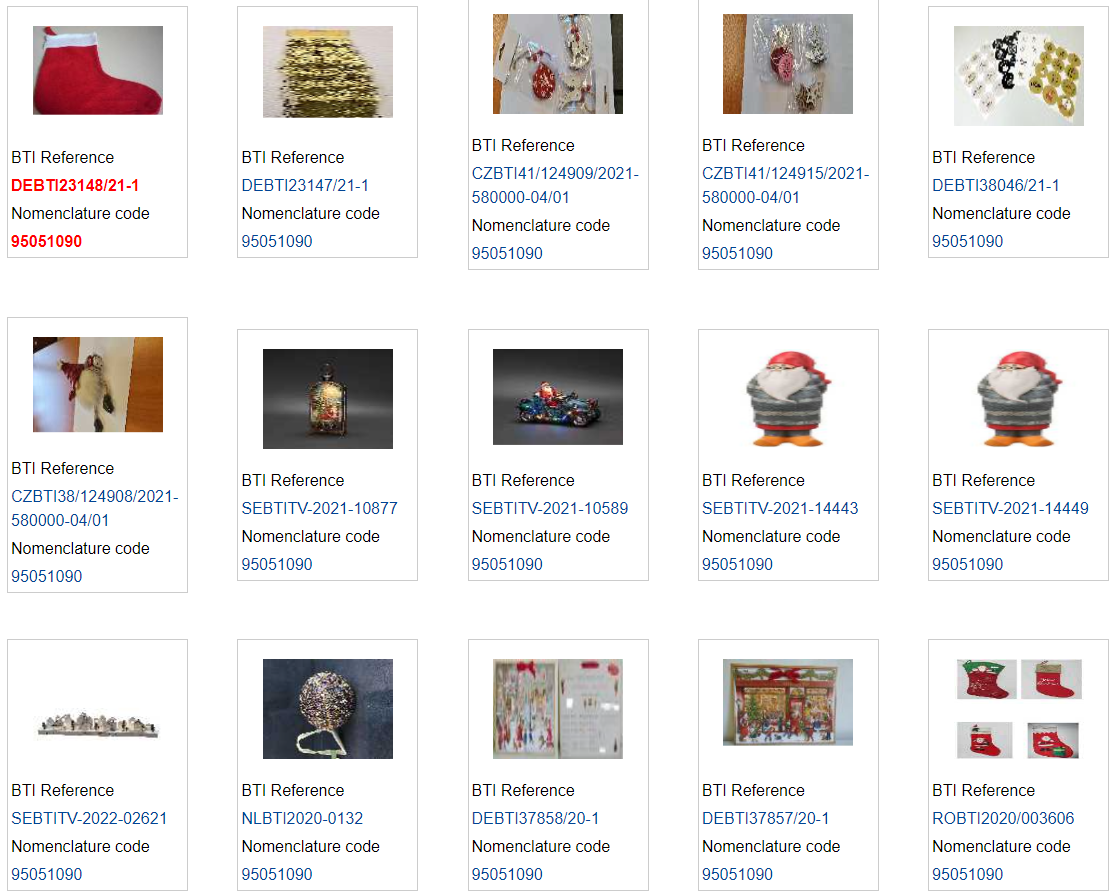

Search results for “Christmas goods”

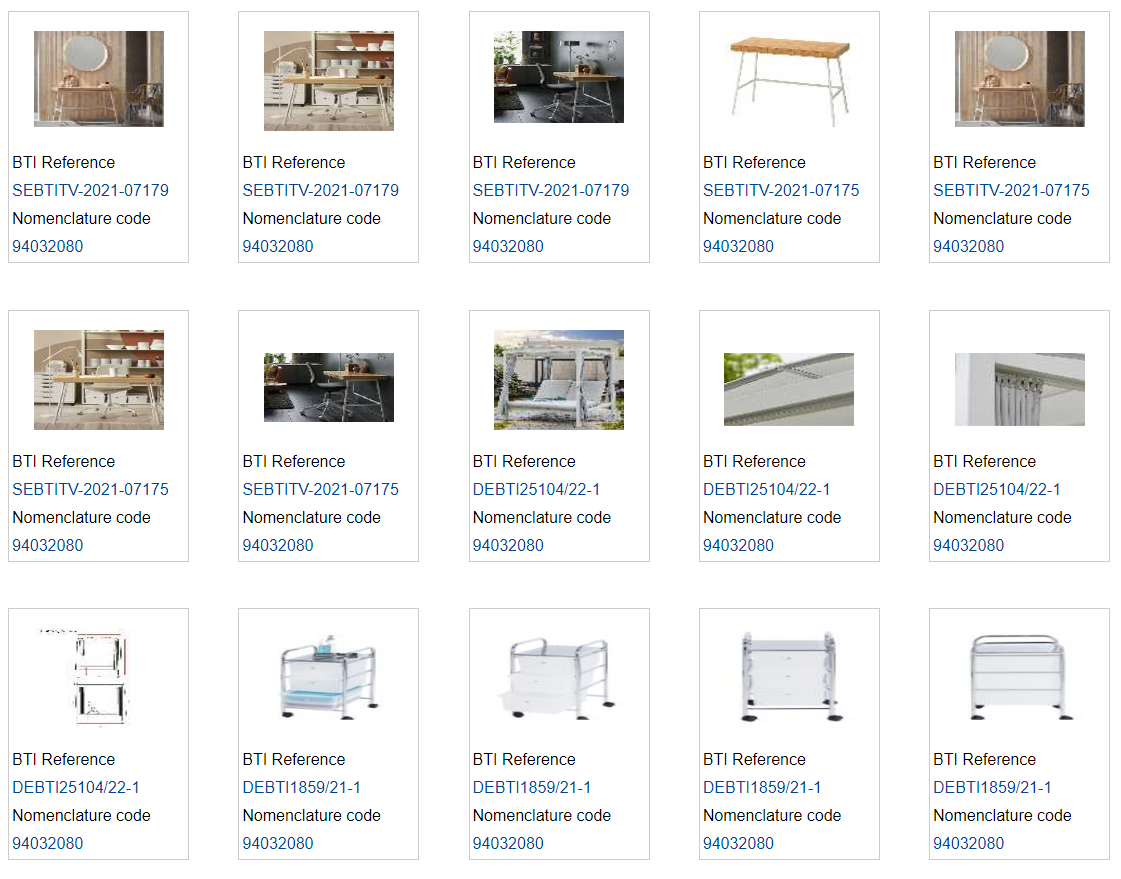

Search results for “Metal furniture”

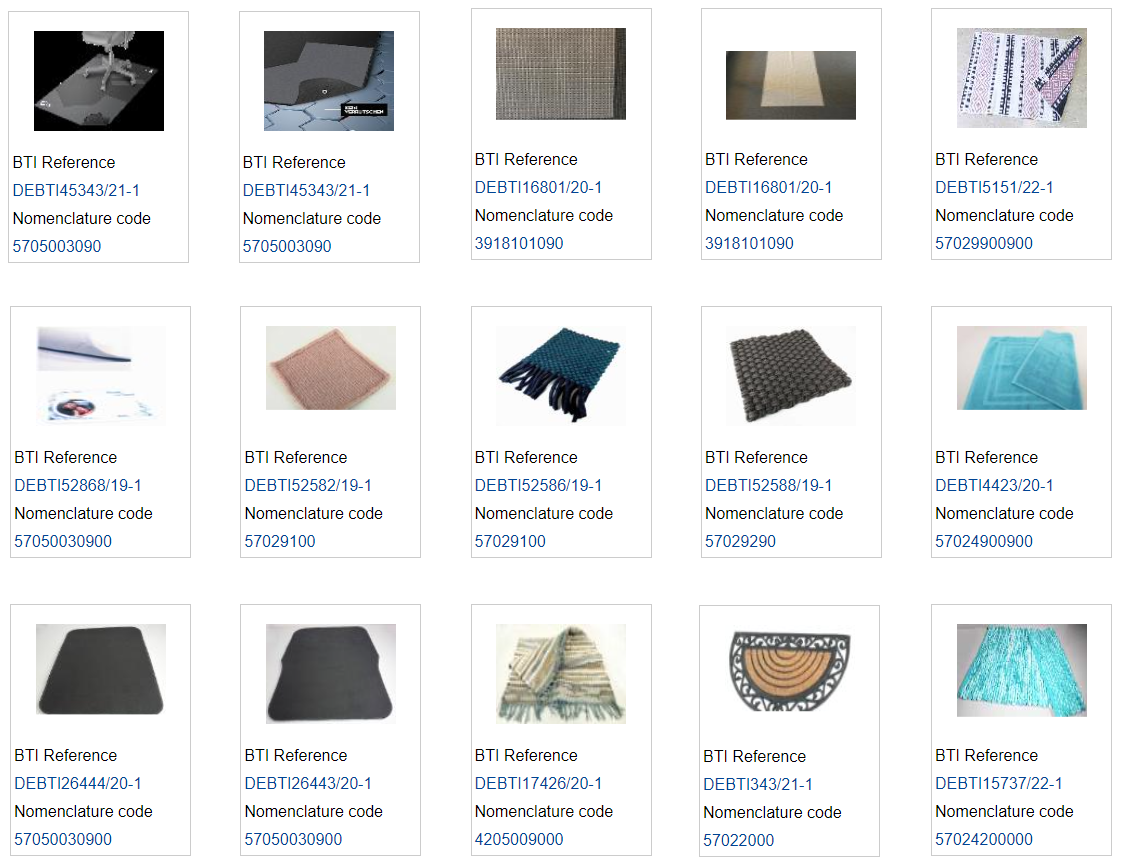

Search results for “Carpet”

This video shows how to find HScode by image search.

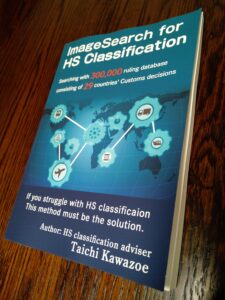

ImageSearch for HSclassification is detailed in this book.

![ImageSearch for HS classification by [Taichi Kawazoe]](https://m.media-amazon.com/images/I/51bvQb2eDZL.jpg)

By countryUS|UK|DE|FR|ES|IT|JP|CA|AU|NL

|

Author: Taichi Kawazoe HS classification adviser.Experienced as a qualified customs broker for Japan Yokohama Customs for 10 years.Supporting trading companies all over the world how to determine HS code thorough web site of “ImageSearch for HS Classification” |

Here is the list of countries you can search for each customs HS classification decision:

United States, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Rep., Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, United Kingdom.

Many of them have images and detailed information with the authority of the decisions.

Just type the keyword of the targeting items and choose a similar item’s record to determine HS code.

With this method, you can find the appropriate HS code effectively.

Without this method, how do you determine HS code? turning thick Tariff and Explanatory note all day?

Feedback from professional HS classifiers.

Feedback 1I usually do not promote other people’s items for sale but I feel I want to make an exception for this book, written by an esteemed colleague and aficionado of the art of tariff classification (yes, I describe it as an “art”), 河副太智 (Taichi Kawazoe)

It had no yet occurred to me to include an image search in my methodology and that to me at least is an eye opener. I always regarded that feature of that database as a bit of a gimmick but it turns out I was very wrong!

Anyway, whether you are just starting out on the HS classification career path or are a seasoned (and spoiled) classifier like myself, Warmly recommended.

Thank you !

Feedback 3Thanks for posting. This is great tool to incorporate into a classification process/methodology.

Feedback 4I can warmly reccommend the posts of 河副太智 (Taichi Kawazoe) showing so differend classification on the HS4 level worldwide.

I have bought his book too

Feedback 5Amazing! Great work 河副太智 (Taichi Kawazoe) I would love a demonstration the next time I have a client that requires something like this!

Feedback 6Also from my side, I can‘t thank 河副太智 (Taichi Kawazoe) enough for his œvre. Someone who loves to think and discuss about the art of customs classification also in his spare time! This is never self-evident, not to mention that there are only a few classification experts, also globally spoken. It is always fun to see your posts.

Feedback 7I would like to thank you for providing me such useful material.You have improved my knowledge and concept a lot.

Thanking you for every act of kindness and not only for me, you are helping our whole classification community without expecting anything and that is very noble work you are doing regardless someone notices or not.

Wishing you lots of health, happiness and success ahead.

The real book image is below.

![ImageSearch for HS classification by [Taichi Kawazoe]](https://m.media-amazon.com/images/I/51bvQb2eDZL.jpg)

By countryUS|UK|DE|FR|ES|IT|JP|CA|AU|NL

By countryUS|UK|DE|FR|ES|IT|JP|CA|AU|NL

There is a vast amount of HS codes that make it easy to misclassify.

According to the survey, around 30% of all declarations are said to be misclassified.

What happens if HS classification dichotomy or misclassification occurs?

Here are some consequences of misclassification:

1. Overpayment of duties

2. Missed opportunity to benefits from Free Trade Agreement

3. Import may be subject to anti-dumping or countervailing duties

4. Alert to customs deeper problems, which could lead to an audit

5. Unexpected customs clearance delays

This book is all about how to avoid those problems by specifying appropriate HS codes effectively to make

trading procedures smooth and make the most of the benefit of reducing customs duties by the HS classification method.

In this book, you will learn…

1. The method to search for the appropriate HS code online effectively to make customs clearances smooth,

avoiding clearance delays and unnecessary inspection from customs.

2. Make the most of the opportunity to benefit from free trade agreements to reduce tons of customs duties.

If trading transactions are continuous, the possibility of reducing customs duties is enormous and profit

becomes higher.

3. Avoid overpayment of duties due to classification dichotomy or misclassification.

This method is based on searching the World Customs HS decision database to find reliable information to define the target item’s HS code.

From this database, you can retrieve item descriptions, images, and defined HS code by item keywords.

This book is for Customs brokers, HS classifiers, Trading companies, manufacturers, suppliers, trading consultants, and all people involved in Trading.

Also, this book is for a complete beginner who has just started learning HS classification.

Through this book, I want to share my experience of searching Worldwide Customs decision databases.

![ImageSearch for HS classification by [Taichi Kawazoe]](https://m.media-amazon.com/images/I/51bvQb2eDZL.jpg)

By countryUS|UK|DE|FR|ES|IT|JP|CA|AU|NL

By countryUS|UK|DE|FR|ES|IT|JP|CA|AU|NL

The worst scenario of inadequate HS classification

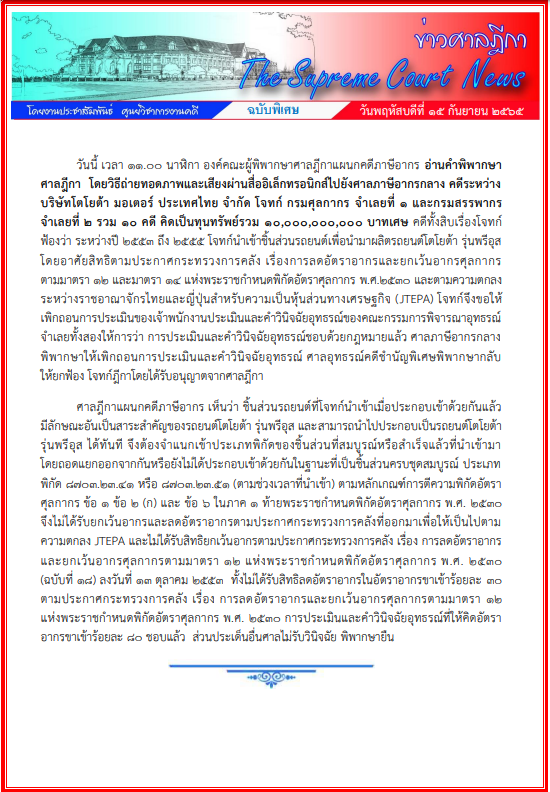

I’m going to introduce the worst scenario of inadequate HS classification from a judicial example.

With this real example, you can see how HS misclassification is horrible and could lead to MULTI-MILLION DOLLAR LOSS.

The fact is that Thailand Supreme Court ordered the Japanese top car maker “Toyota” to pay $272.11 million due to the inadequate HS classification.

Source: Reuters

In the beginning, TOYOTA intended to export Automobiles to Thailand.

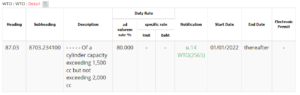

In this case, the tariff rate for Automobiles(HS:8703.23) is 80%(see the image)

The duty rate of 80% is very high and there is no FTA preferential treatment between Thailand and Japan for Automobiles(HS:8703.23).

On the other hand, FTA between Thailand and Japan, there is preferential treatment for “Automobile parts” (HS:8708) 60% to 30%.

Toyota came up with an idea that they disassemble the Automobiles, ship them to Thailand and declare them as “Automobile parts”, and after clearance, they reassemble them to complete the car in Thailand.

If Toyota had exported Automobiles to Thailand, the duty rate would be 80% but if they disassemble them into Automobile parts, the duty rate would be 30%, literally, they succeeded to reduce 50% of customs duty.

It seemed it works, so they continued this Tariff Engineering from 2010 to 2012 for more than 20,000 vehicles assembled at Toyota’s Gateway factory.

But this is a double-edged strategy.

After that, Thailand customs pointed out that they are not Automobile parts because after importing those items to Thailand, they can be reassembled to be a complete automobile.

It’s nothing other than “Completely Knocked Down”, Thailand customs thought.

To understand why Automobile parts are regarded as complete automobiles by customs, we need to refer to the “General Rules of Interpretation (GRIs)”

The argument between Thailand customs and Toyota had taken a long time and it was brought to Court.

Sept 15, 2022 – Thailand Supreme Court on Thursday upheld a lower court ruling that the local unit of Toyota Motor Corp owed the government 10 billion baht ($272.11 million) in extra taxes for importing components not subject to a reduced tariff.

Here is The link to Thailand Supreme Court judgment

*If you want to know a further detail of this incident, please visit here.

Sometimes I hear that “to reduce duty rate, disassemble the commodity into parts to import and reassemble them in the targeting country, Wow this is a smart way of Tariff Engineering”

But this is the inadequate solution for reducing the duty rate that most people easily come up with.

In short term, it might work I admit, but customs officers are not foolish in overlooking this behavior. Therefore it turned out to be a nightmare one day.

In order to avoid this nightmare, I strongly recommend reading this book.