When it comes to classifying Wireless headsets, there is a problem because it’s classifiable into two headings 8517 and 8518.

And each headings and subheadings are below.

8517

Telephone sets, including smartphones and other telephones for cellular networks or for other wireless networks; other apparatus for the transmission or reception of voice, images or other data, including apparatus for communication in a wired or wireless network (such as a local or wide area network).

851762

— Machines for the reception, conversion and transmission or regeneration of voice, images or other data, including switching and routing apparatus

———————————————————————–

8518

Microphones and stands

851830

– Headphones and earphones, whether or not combined with a microphone, and sets consisting of a microphone and one or more loudspeakers

I had searched many customs rulings and found there are two patterns of classification records 8517 & 8518 for Wireless headsets.

Table of Contents

Classified in 851762

| Item image |  |

|---|---|

| Issued Country | Danish Customs |

| Reference | DKBTI19-0447854 |

| Issuing date | Sept. 12, 2019 |

| Item name | wireless headphones |

| Classified HS code | 851762 |

| Details & Customs Opinion | The item is a set of headphones that are wireless. The headphones have on and off buttons, turn up and down, turn on and off microphone, and a Noise Reduction (ANC) button. The microphone switch can also be turned on or off by pressing it twice in succession. The item comes in a box where, in addition to space for the headphones, there is also room for a cord. The cord is for charging. The box is shaped to hold the headphones and protect them from bumps and the like. The box is covered with plastic and has a zipper running almost all the way around the edge. A USB dongle comes with the item. This dongle can be inserted into a computer and then automatically establishes contact between the computer and the headphones. Dongle cannot be viewed on the computer and cannot be used by other devices. Along with the item is a charging station for Jabra headphones. The stand is a USB cable where one end is mounted in a holder. The holder has fitted an indicator light which indicates that the headphones are charging. The holder is designed so that the headphones can stand in it when charging. The cable has a USB-A connector on one end and a USB mini B connector on the other end, which is mounted in the holder. The item is reported to be for wireless telephony and music playback. The product can be combined with computer, telephone and tablet. It has been stated that the stand is for holding handsets when charging. The item is a set of headphones in a box with a cord lying next to it. The stand is a USB cable where one end is mounted in a headphone holder. |

See How to search world customs ruling with an image.

| Item image | None |

|---|---|

| Issued Country | U.S Customs |

| Reference | N186376 |

| Issuing date | October 28, 2011 |

| Item name | Bose® Bluetooth® Headset |

| Classified HS code | 851762 |

| Details & Customs Opinion | The merchandise subject to this ruling is a Bose® Bluetooth® Headset. The Bose® Bluetooth® Headset is a 2-way communication device for the transmission and reception of voice communication when paired with a Bluetooth enabled mobile communication device. It consists of a headset, a USB cable, a power supply, additional ear tips, a carrying case, and an owner’s guide. It features a Version 2.1 EDR (Enhance Data Rate) and a Secure Simple Pairing (SSP). The various buttons on the headset enables the user to make and receive calls, end a call, adjust the volume, mute a call, transfer the audio to the user’s mobile phone, put an active call on hold and answer another phone or switch between two calls. The Bose® Bluetooth® Headset also allows the user to maintain an active connection with two mobile phones. The rechargeable battery within the headset provides 4.5 hours of talk time or 150 hours in standby mode. The battery can be recharged using the USB cable with a direct connection to either the USB port of a computer or the power supply, or through connection to a wall outlet via the power supply. A sample of the Bose® Bluetooth® Headset, which identified it as S/N Q54282Z11270097AE, was submitted and is being returned as per your request. The applicable subheading for the Bose® Bluetooth® Headset (S/N Q54282Z11270097AE) will be 8517.62.0050, Harmonized Tariff Schedule of the United States (HTSUS), which provides for “Machines for the reception, conversion and transmission or regeneration of voice, images or other data, including switching and routing apparatus: Other.” The rate of duty will be free. |

Classified in 851830

| Item image |  |

|---|---|

| Issued Country | German customs |

| Reference | DEBTI8534-18-1 |

| Issuing date | June 22, 2018 |

| Item name | Bluetooth headset |

| Classified HS code | 851830 |

| Details & Customs Opinion | Bluetooth headset; Model: AIRY NG – consisting of two upholstered handsets, right with Bluetooth transceiver module, 3.5 mm audio input, microphone, control element (music control, call acceptance and termination), accumulator and USB charging port (see attachment), – for converting electrical sound frequency pulses into sound waves and for converting sound waves into electrical sound frequency signals – characteristic main activity – as well as for sending and receiving audio signals in the Bluetooth standard for hands-free wireless communication with mobile phones without dialing capability, – together with accessory pack (USB cable, audio cable , Manual, fabric bag) in a common sales enclosure. The headphone determines the character of the whole. “”Headphone with microphone combined, not for wired telephone equipment, no handset for the hearing-impaired (combination of headphone / microphone – main character feature – and bluetooth module, in assortment with non character-defining accessory pack, in presentation for retail sale)”” |

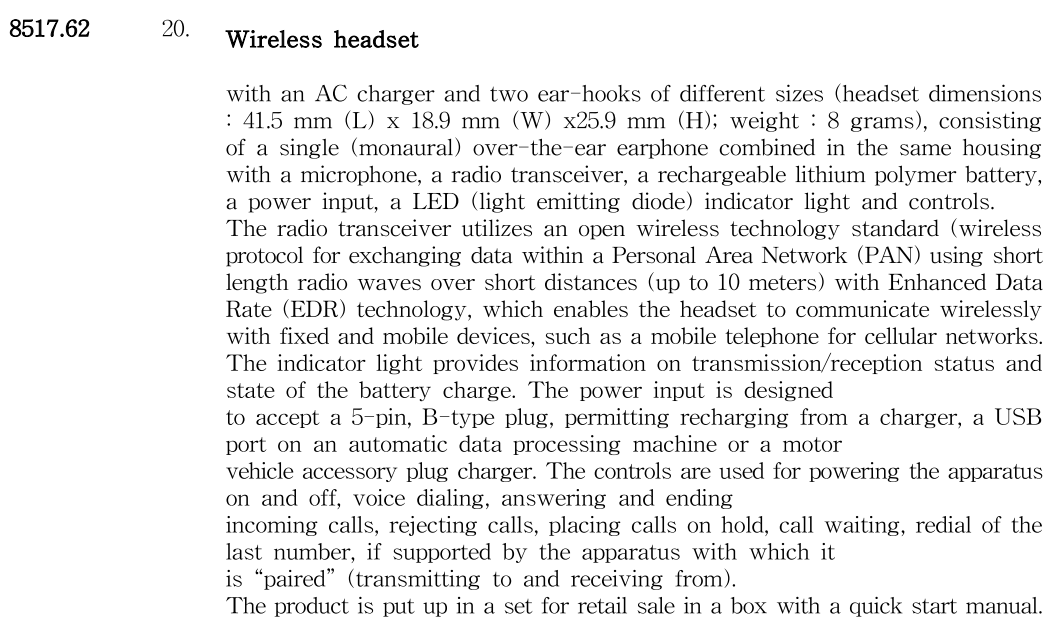

Compendium of Classification Opinion

8517.62 to “Harmonized Commodity Description and Coding System Compendium of Classification Opinion” states below.

Source: WCO “Harmonized Commodity Description and Coding System Compendium of Classification Opinion”

It seems that the Compendium of Classification Opinion supports Wireless headsets to be classified in 8517.62.

India customs rulling

India customs ruling state that

“Headphones combined with a microphone of heading 8518 carry only audio signals and are not an active part of a network, whereas a Bluetooth headset with mobile telephony function is an active part of a wireless network, includes a software part for the wireless network and simultaneously receives/transmits voice and data in a wireless network. Thus, “Bluetooth Wireless headsets for mobile phones / cell phones” equipped with communication device fully comply with the subheading 8517.62.”

Source:Taxguru.in

Counter opinion for HS:8517

There are documents that support wireless headset to be classified in 8517, but there is also a counter-opinion that insist wireless headset should be classified in 8518.

Below is Danish Customs rulings. a remarkable part of it is that there is a statement that an applicant requested classification at 851762 but Danis Customs rejected it.

See red-colored text in the description.

| Item image |  |

|---|---|

| Issued Country | Danish Customs |

| Reference | DK16-1898692 |

| Issuing date | April 7, 2017 |

| Item name | wireless headphones |

| Classified HS code | 851830 |

| Details & Customs Opinion | The product is a set of stereo headphones on an adjustable headband with ear plugs that can be folded in when the headphones are not in use. Ear peaks are upholstered and insulate against outside noise when the headphones are placed over the ears. The headphones are equipped with electronic noise reduction (Noise Canceling) that actively reduces audible noise from the surroundings. This function can be switched on and off. Establishing a wireless connection between the headphones and an audio source can be done using the built-in Near Field Communication (NFC) technology, if the audio source also has NFC. When the devices come into close contact with each other, a network is established that allows the necessary transfer of data that can identify the two devices opposite each other prior to the creation of a wireless connection. The audio signal can be transmitted wirelessly from the audio source via Bluetooth (local network transmitting data over short distances up to 10 meters). It allows the headphone to communicate with fixed and mobile devices wirelessly, such as a cellular phone (cellular phone), a computer / tablet / television, or similar devices that can broadcast audio. The product can be connected to multiple audio sources at the same time, allowing them to be easily switched (for example, a music player and a smartphone). The headphones can also be connected to an external audio source with a cable (audio or USB cable). There are physical buttons on the ear cups for controlling sound level and source, etc. There are also built-in earphones microphones for use in eg. telephone calls. With the help of buttons it is possible to answer, end calls, and redial last used numbers. The item itself can not be used to make arbitrary telephone calls. The headphone is powered by a built-in rechargeable battery, which is charged with USB cable when connected to the headphone’s micro USB input.

The product is classified under Commodity Code 8518 30 95 90 in accordance with General Rules 1, 3 (b) and 6 for the Combined Nomenclature and the wording of product codes 8518, 8518 30, 8518 30 95 and 8518 30 95 90 as well as Section 3 of Title 16 of the Customs Tariff. The product is a composite product consisting of headphones and Bluetooth connectivity (wireless network). Items combined to perform two or more functions are classified according to the main function according to Section 3 of the Customs Tariff Section 16. The headphones design with padded ear plugs, the active noise reduction and high quality audio features, and the headphones are particularly useful with several different features. Audio sources are qualities that are primarily related to headphones. The Bluetooth function (wireless network) is optional because the audio transfer can also take place using cable. The primary function is therefore the headphone, and the product is then classified. Position 8518 has the text “”Microphones and racks therefor; Speakers, also mounted in the cabinet; Headphones and earphones, also combined with microphone (…) “”. In the Explanatory Notes to this heading, the product range described under C is as follows: “”Headphones and earphones, also combined with a microphone, and set of microphones and one or more speakers.”” (…) “”The position includes headphones and earphones also combined with A microphone for use in telephony and telegraphy; (…); Headphones and earphones for use with radio and television receivers, reproducers or automatic data-processing machines. “”The product is covered by the text of heading 8518 and corresponds to the description in the Explanatory Notes to this heading. The product is finally classified as “”Other”” under product code 8518 30 95 90. The company has requested classification at 8517 62 00. The text of the item code is: “”Receiving, converting and transferring devices, or restoration of voice, images or other data, including Devices for coupling and routing. “”Position 8517 62 00 includes cf. Explanatory notes, inter alia, So-called wireless headset, designed for use solely or mainly with mobile phones, and placed on the ear for hands-free operation, and where the communication between the devices takes place wirelessly. The text of this position does not cover the item, as the headphones are considered as primary function. The characteristics and characteristics mentioned above do not cover the product, cf. above on the primary function of the product, and the request for classification at position 8517 62 00 can therefore not be met. |

| Item image |  |

|---|---|

| Issued Country | Danish Customs |

| Reference | DK16-1898697 |

| Issuing date | April 7, 2017 |

| Item name | wireless headphones |

| Classified HS code | 851830 |

| Details & Customs Opinion | The product is a set of stereo headphones on an adjustable headband with ear plugs that can be turned and folded when the headphones are not in use. Ear peaks are upholstered and insulate against outside noise when the headphones are placed over the ears. The headphones are equipped with electronic noise reduction (Noise Canceling) that actively reduces audible noise from the surroundings. This functionality can be turned on and off. Establishing a wireless connection between the headphones and an audio source can be done using the built-in Near Field Communication (NFC) technology, if the audio source also has NFC. When the devices come into close contact with each other, a network is established that allows the necessary transfer of data that can identify the two devices opposite each other prior to the creation of a wireless connection. The audio signal can be transmitted wirelessly from the audio source via Bluetooth (local network transmitting data over short distances up to 10 meters). It allows the headphone to communicate with fixed and mobile devices wirelessly, such as a cellular phone (cellular phone), a computer / tablet / television, or similar devices that can broadcast audio. The product can be connected to multiple audio sources at the same time, allowing them to be easily switched (for example, a music player and a smartphone). The headphones can also be connected to an external audio source with a cable (audio or USB cable). There are on the ear cups a touch panel and physical buttons for controlling the sound level and source, etc. There are also built-in earphones microphones for use in eg. telephone calls. Using the panel and buttons, it is possible to answer, end call, and redial last used numbers. The item itself can not be used to make arbitrary telephone calls. The headphone is powered by a built-in rechargeable battery, which is charged with USB cable when connected to the headphone’s micro USB input.

The product is classified under Commodity Code 8518 30 95 90 in accordance with General Rules 1, 3 (b) and 6 for the Combined Nomenclature and the wording of product codes 8518, 8518 30, 8518 30 95 and 8518 30 95 90 as well as Section 3 of Title 16 of the Customs Tariff. The product is a composite product consisting of headphones and Bluetooth connectivity (wireless network). Items combined to perform two or more functions are classified according to the main function according to Section 3 of the Customs Tariff Section 16. The headphones design with padded ear plugs, the active noise reduction and high quality audio features, and the headphones are particularly useful with several different features. Audio sources are qualities that are primarily related to headphones. The Bluetooth function (wireless network) is optional because the audio transfer can also take place using cable. The primary function is therefore the headphone, and the product is then classified. Position 8518 has the text “”Microphones and racks therefor; Speakers, also mounted in the cabinet; Headphones and earphones, also combined with microphone (…) “”. In the Explanatory Notes to this heading, the product range described under C is as follows: “”Headphones and earphones, also combined with a microphone, and set of microphones and one or more speakers.”” (…) “”The position includes headphones and earphones also combined with A microphone for use in telephony and telegraphy; (…); Headphones and earphones for use with radio and television receivers, reproducers or automatic data-processing machines. “”The product is covered by the text of heading 8518 and corresponds to the description in the Explanatory Notes to this heading. The product is finally classified as “”Other”” under product code 8518 30 95 90. The company has requested classification at 8517 62 00. The text of the item code is: “”Receiving, converting and transferring devices, or restoration of voice, images or other data, including Devices for coupling and routing. “”Position 8517 62 00 includes cf. Explanatory notes, inter alia, So-called wireless headset, designed for use solely or mainly with mobile phones, and placed on the ear for hands-free operation, and where the communication between the devices takes place wirelessly. The text of this position does not cover the item, as the headphones are considered as primary function. The characteristics and characteristics mentioned above do not cover the product, cf. above on the primary function of the product, and the request for classification at position 8517 62 00 can therefore not be met. |

| Item image |  |

|---|---|

| Issued Country | Poland customs |

| Reference | PLPL-WIT-2017-00262 |

| Issuing date | Feb. 14, 2017 |

| Item name | wireless headphones |

| Classified HS code | 851830 |

| Details & Customs Opinion | Wireless earphones with microphone dedicated to gamers. Equipped with two speakers in the housing and a flexible, removable microphone. On the earmuffs, there are two knobs to regulate the sound, separately for the game and the talk mode, and the buttons for enabling and disabling the headphones and the microphone on the other. Headphones are compatible with PCs, laptops, consoles and smartphones. Other parameters: connectors: USB 2.0, Optical S / PDIF; Communication: 2.4 GHz wireless; Audio system: stereo; Headphone Frequency Response: 20.00 to 20,000.00 Hz; Impedance: 32.00 Ohm; Speaker dynamics: 107.00 dB; Microphone sensitivity: 60.00 dB; Reach: 10,00 m. |

My opinion

A long time ago, headsets are connected to audio devices with wires. in that era, there might be no problem classifying them as “Headphones“(HS:8518) but nowadays there are many headsets that do not have wires. Therefore HS classification system can not catch up to the development of the device, and that causes this kind of problem.

There are few documents stating that wireless headset is classified 8517 and indeed wireless function should belong to “apparatus for the transmission or reception of voice, images or other data, including apparatus for communication in a wired or wireless network(HS:8517)”.Hence If I was to classify wireless headset, I would classify it in 8517.

But the wireless headset is also nothing other than “Headphones“(HS:8518)

So wireless headset is apparently classified under two headings, therefore, I think it would be clearer if rulings apply GIR3(c) to classify it in 8518.

Conclusion

I posted this issue on Linked in to collect opinions from connections.

as a results, most of them supported it to classify 8517.62

— Machines for the reception, conversion and transmission or regeneration of voice, images or other data, including switching and routing apparatus.

after that, I searched the definition of wireless headset classification and found EU document that classify them clearly.

| 8517 62 | This subheading also includes so-called “wireless headsets” designed to be used solely or principally with telephones for cellular networks (mobile phones), intended to be hung on the ear to provide a hands-free option. They enable the user to control telephone functions, such as answering, ending and dialling (for example, redialling the last call), within approximately 10 m from the mobile phone and have means for adjusting the earphone sound volume. These headsets incorporate a radio transmitter/receiver to communicate with a mobile phone by means of wireless technology, for example, “Bluetooth”.’ | ||||

| 8518 |

‘This heading does not include:

|

Nowadays many wireless headsets have a function to answer a phone call and talk with a built-in microphone. That type of headset is classified in 8517.62.

But there is a fact that few customs classify wireless headsets in 8518 as “Headphones”.

Therefore importers who intends to bring Wireless headsets should be careful.