Goods put up in sets, consisting of two or more separate constituents,

that are classified in one single heading in accordance with

Rule 3 of the General Rules for the Interpretation (GIRs) of the Harmonized System,

often pose problems to customs insofar as such sets are to be classified according to

the component which gives the set its essential character.

Where the constituents of a set have various origins, this may also pose problems for the

determination of the origin of the set.

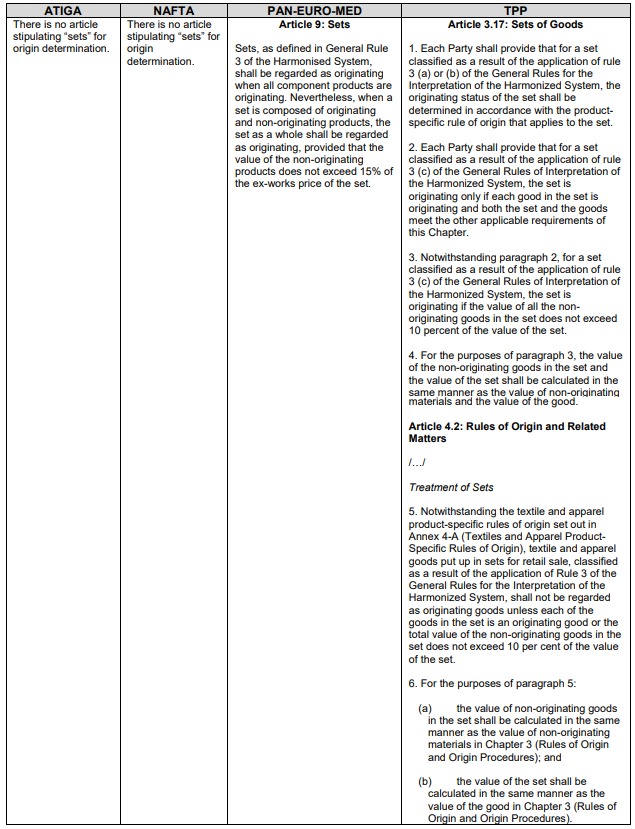

Some origin legislations (e.g. NAFTA and ATIGA origin systems) do not mention “sets” at all,

subsuming the origin determination implicitly under the issue of classification according

with the Harmonized System GIRs, whereas other origin legislations deal with this topic in a

separate article (e.g. PAN-EURO-MED and TPP origin systems).

In the PAN-EURO-MED origin system, sets shall be regarded as originating when all

components are originating. Sets comprising originating and non-originating constituents may

also be considered originating provided that the value of the non-originating constituents does

not exceed 15% of the ex-works price of the whole set

(Article 9 of the PAN-EURO-MED origin legislation).

In the TPP Agreement, where a set is classified by application of GIR 3(a) or (b), the originating

status of the set is determined in accordance with the product specific rule of origin that applies

to the set, while where the set is classified by application of GIR 3(c), the set is originating if

each constituent in the set is originating and both the set and the constituents meet other

applicable requirements of Chapter 3 (Article 3.17).

Sets comprising originating and nonoriginating materials may be regarded as originating

as long as the value of the non-originating goods in the set does not exceed 10% of the

value of the set.

Table of Contents

Comparison of “Sets”

Here is comparison of “Sets” in the ATIGA, the NAFTA, the PAN-EURO-MED and

the TPP origin systems

Retrieved from:Comparative Study on Preferential Rules of Origin

GRIs for “Sets”

GRI 1

Classification of merchandise under the HS is in accordance with the

General Rules of Interpretation (GRI’s).

GRI 1 provides that classification is determined according to the terms of the

headings and any relative section or chapter notes.

In certain areas of the HS, sets are specifically mentioned by name.

The only requirements which are to be followed when dealing with a GRI 1 set

are those mentioned in the particular HS provisions describing the set,

relevant chapter and section notes, and the relevant Explanatory Notes (ENs)1.

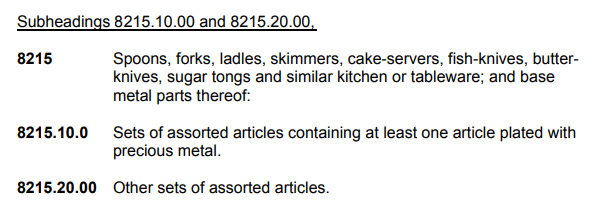

Sets may appear in the heading text, such as electric generating sets of

heading 8502, HS, or in a subheading text, such as sets of kitchenware of

subheadings 8215.10 and 8215.20, HS.

For subheading sets, GRI 6 applies GRI 1 by requiring that only subheadings

at the same level are comparable. Sets may appear in legal notes, as in chapter 62,

note 3, HS, in which are described sets of garments known as suits and

ensembles, classified in headings 6203 and 6204, HS. Sets may be mentioned

only in the ENs to a particular heading. The rules with regard to GRI 3(b) sets,

discussed below, do not apply to GRI 1 sets.

Taking the kitchenware example mentioned above, subheadings 8215.10.00 and

8215.20.00, HS, provide for sets of assorted articles which are described by

heading 8215, HS. The relevant provisions are as follows:

Chapter 82, note 3, HS, and EN 82.15 describe the types of sets to be included in

heading 8215, HS. See HQ 959713, dated May 6, 1997, for an example of how

we classify goods in the provisions of the set of heading 8215, HS.

In that ruling, we held that barbecue utensils, consisting of a fork, spatula, tongs, and

brush, constitute a GRI 1 set under subheading 8215.20.00, HS, as other sets of

kitchen or tableware articles.

GRI 3(B)

The provisions involved in this discussion are as follows:

GRI 3(b)

Mixtures, composite goods consisting of different materials or made up of

different components, and goods put up in sets for retail sale, which cannot be

classified by reference to 3(a), shall be classified as if they consisted of the

material or component which gives them their essential character, insofar as this

criterion is applicable.

EN (VIII) to GRI 3(b)

The factor which determines essential character will vary as between different

kinds of goods. It may, for example, be determined by the nature of the material

or component, its bulk, quantity, weight or value, or by the role of a constituent

material in relation to the use of the goods.

EN (X) to GRI 3(b)

For the purposes of this Rule, the term “goods put up in sets for retail sale” shall

be taken to mean goods which:

(a) consist of at least two different articles which are, prima facie, classifiable in

different headings. Therefore, for example, six fondue forks cannot be regarded

as a set within the meaning of this Rule;

(b) consist of products or articles put up together to meet a particular need or

carry out a specific activity; and

(c) are put up in a manner suitable for sale directly to users without repacking

(e.g., in boxes or cases or on boards).

The term therefore covers sets consisting, for example, of different foodstuffs

intended to be used together in the preparation of a ready-to-eat dish or meal.

Examples of sets which can be classified by reference to Rule 3 (b) are:

(1)

(a) Sets consisting of a sandwich made of beef, with or without cheese, in

a bun (heading 16.02), packaged with potato chips (French fries)

(heading 20.04):

Classification in heading 16.02.

(b) Sets, the components of which are intended to be used together in the

preparation of a spaghetti meal, consisting of a packet of uncooked

spaghetti (heading 19.02), a sachet of grated cheese (heading 04.06)

and a small tin of tomato sauce (heading 21.03), put up in a carton:

Classification in heading 19.02.

The Rule does not, however, cover selections of products put up together and

consisting, for example, of:

– a can of shrimps (heading 16.05), a can of pâté de foie (heading 16.02), a

can of cheese (heading 04.06), a can of sliced bacon (heading 16.02), and a

can of cocktail sausages (heading 16.01); or

– a bottle of spirits of heading 22.08 and a bottle of wine of heading 22.04.

In the case of these two examples and similar selections of products, each item

is to be classified separately in its own appropriate heading.

(2) Hairdressing sets consisting of a pair of electric hair clippers (heading

85.10), a comb (heading 96.15), a pair of scissors (heading 82.13), a brush

(heading 96.03) and a towel of textile material (heading 63.02), put up in a

leather case (heading 42.02):

Classification in heading 85.10.

(3) Drawing kits comprising a ruler (heading 90.17), a disc calculator (heading

90.17), a drawing compass (heading 90.17), a pencil (heading 96.09) and a

pencil-sharpener (heading 82.14), put up in a case of plastic sheeting

(heading42.02):

Classification in heading 90.17.

For the sets mentioned above, the classification is made according to the

component, or components taken together, which can be regarded as

conferring on the set as a whole its essential character.

As EN (X) to GRI 3(b) states, for a group of articles to qualify as a set under GRI

3(b), it must meet three requirements:

(1) consist of at least two different articles which are, prima facie, classifiable

in different headings;

(2) consist of products or articles put up together to meet a particular need or

carry out a specific activity; and

(3) be put up in a manner suitable for sale directly to users without repacking.

If these requirements are met, all articles in the set are classified in the provision

for the article among them that gives the set its essential character.

Because of requirements (1) and (3) are more easily determined and success in

finding a valid set under GRI 3(b) hinges to a large extent on the application of

requirement (2), we will limit our discussion to issues involving the language

contained therein and not discuss requirements (1) and (3) in this publication.