When it comes to adopting FTA to reduce customs duty, there are so many complicated laws or regulations Traders need to learn.

That knowledge is needed both Importer and Exporter.

One understand but if the other one does not understand the FTA rule, it would be a nightmare when Customs audit carried out.

Let’s say if an Importer had required a self-certificate of origin to an Exporter but the Exporter does not understand the rule of FTA, this self-certificate was issued without evidence that the Customs requires.

In this situation the Importer likely to be denied preferential customs duty rate and to be fined penalty.

In order to avoid this situation, FTA manual should be referred to.

In this article,I’m going to introduce well written FTA manuals.

Table of Contents

■OUTLINE OF RULES OF ORIGIN

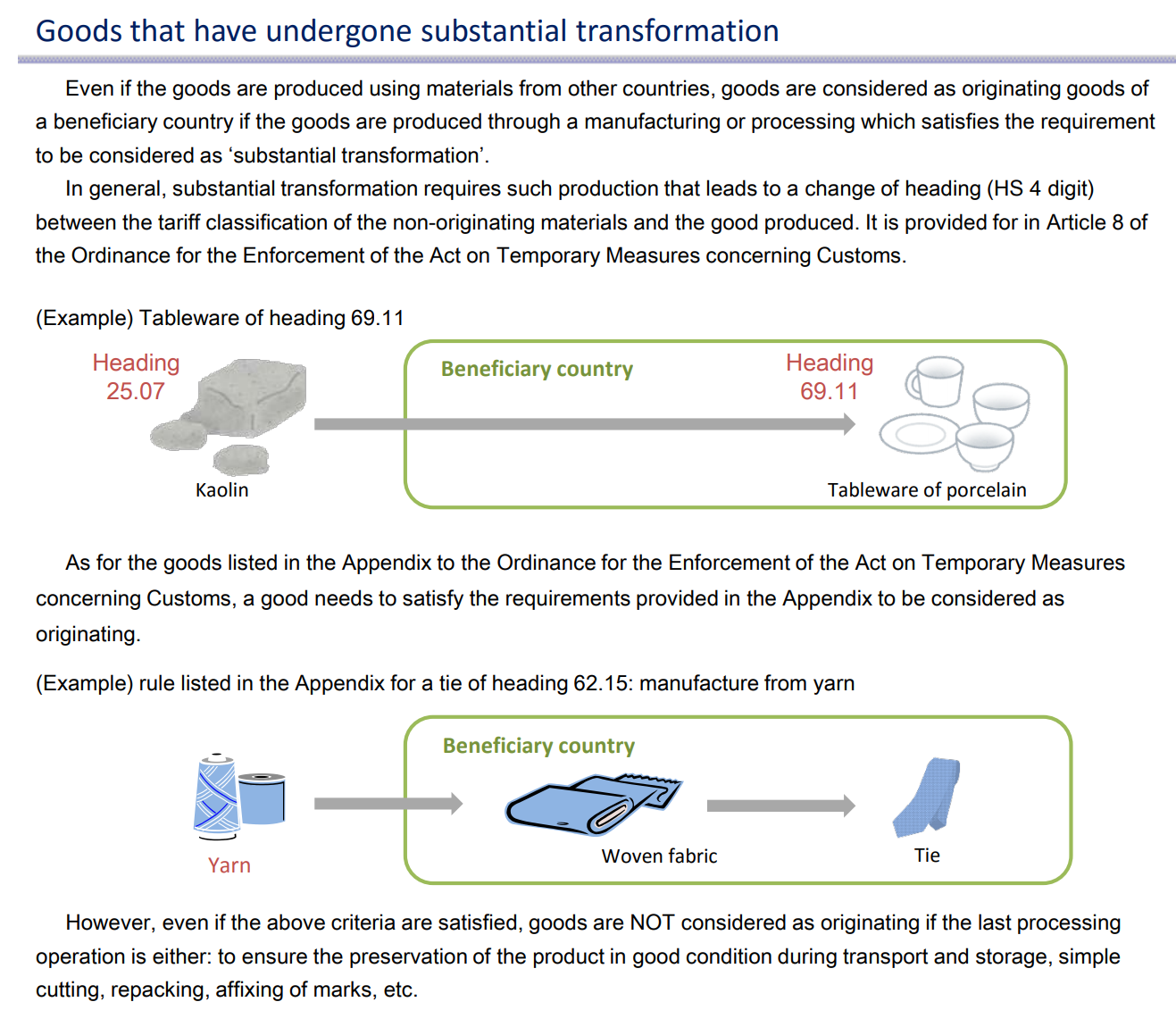

This manual is written by Japan customs.it has many images to make it clear.

Source:Japancustoms OUTLINE OF RULES OF ORIGIN

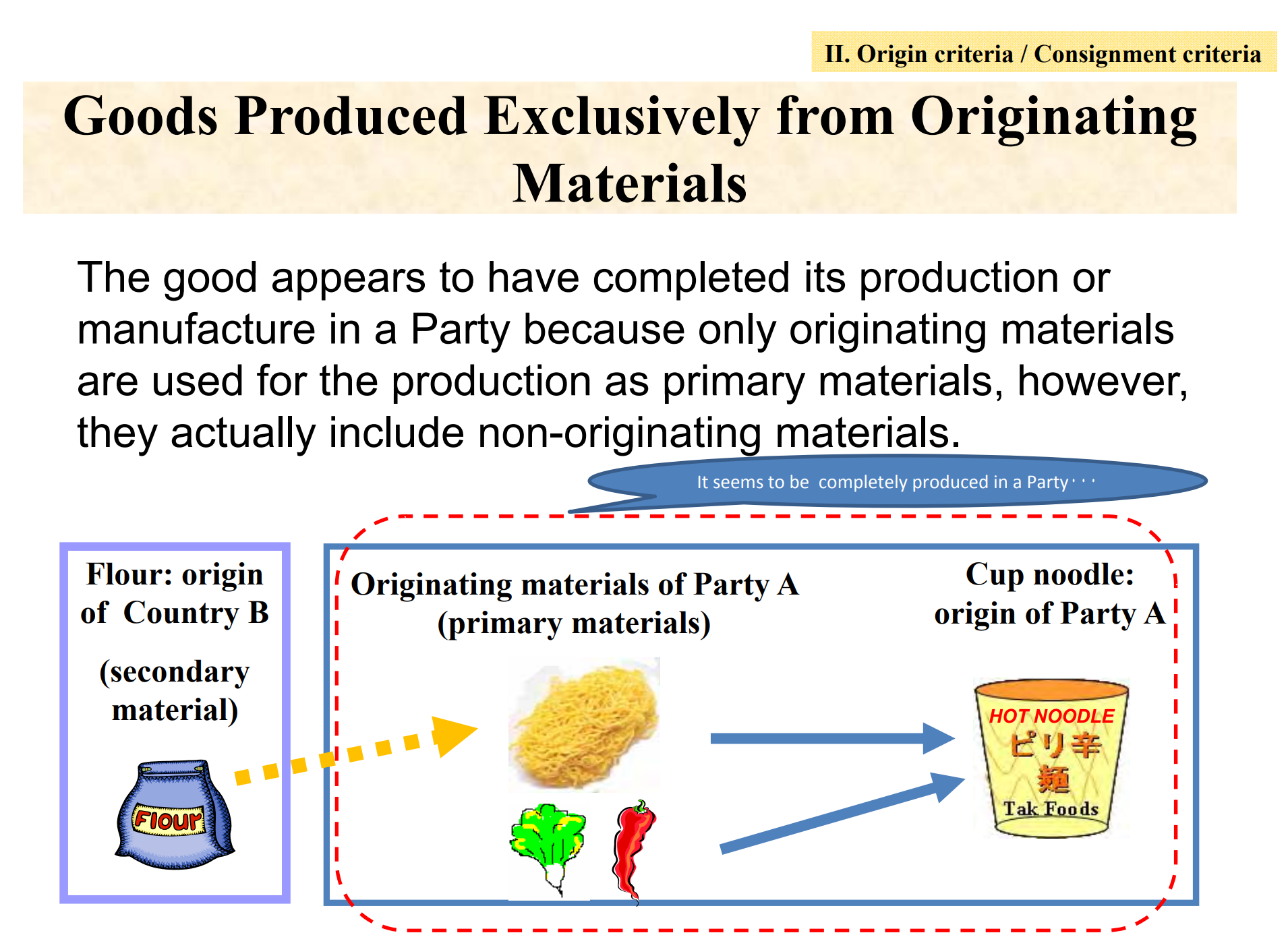

■Outline of Rules of Origin for EPA in Japan

This manual can be used as a seminar slide.

Source:Japancustoms Outline of Rules of Origin for EPA in Japan

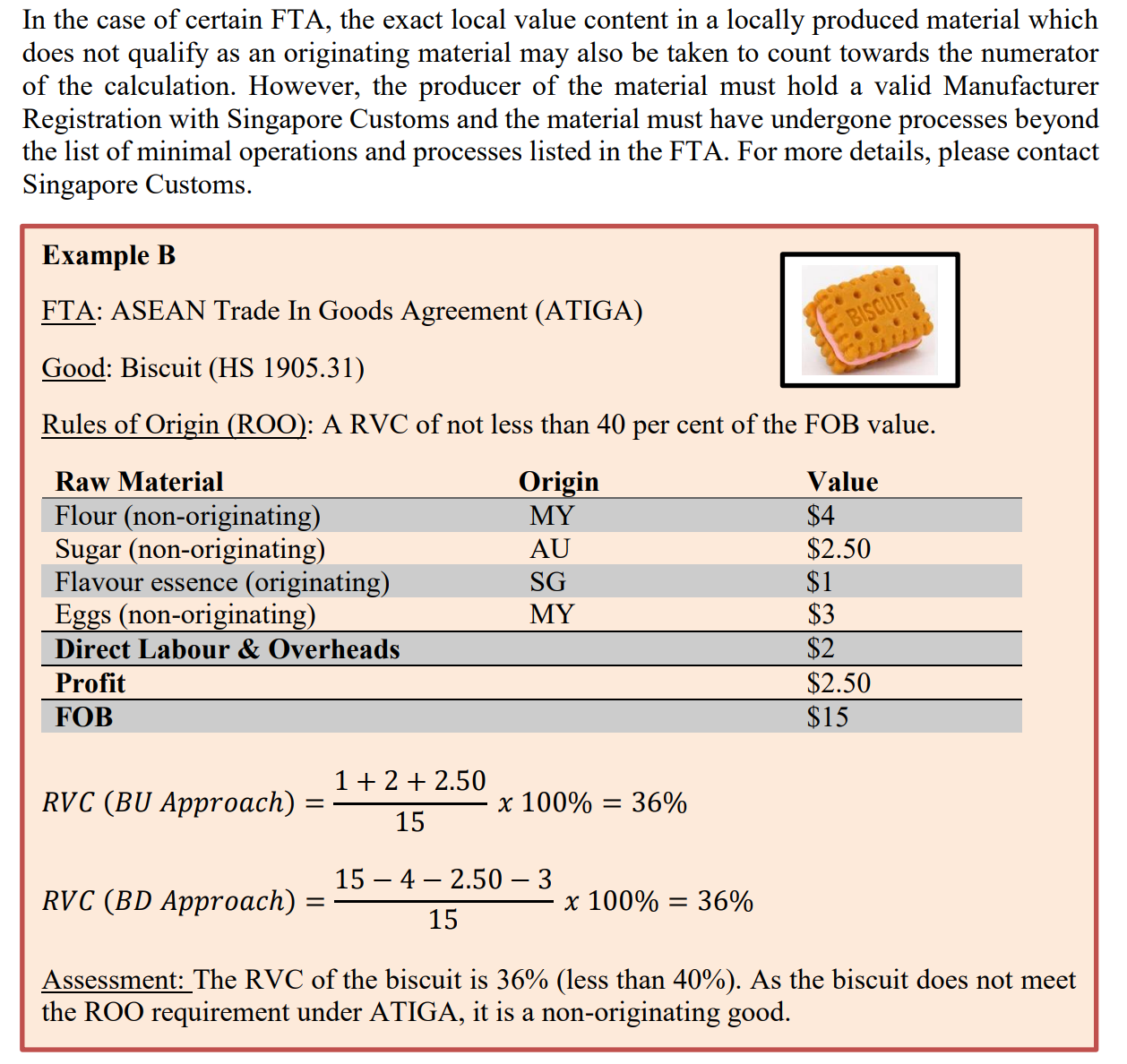

■Handbook on ROO for preferential Certificates of Origin

This manual is written by Singapore customs, it has many Charts and many examples.

Source: Singapore customs Handbook on rules of origin for preferential Certificates of Origin

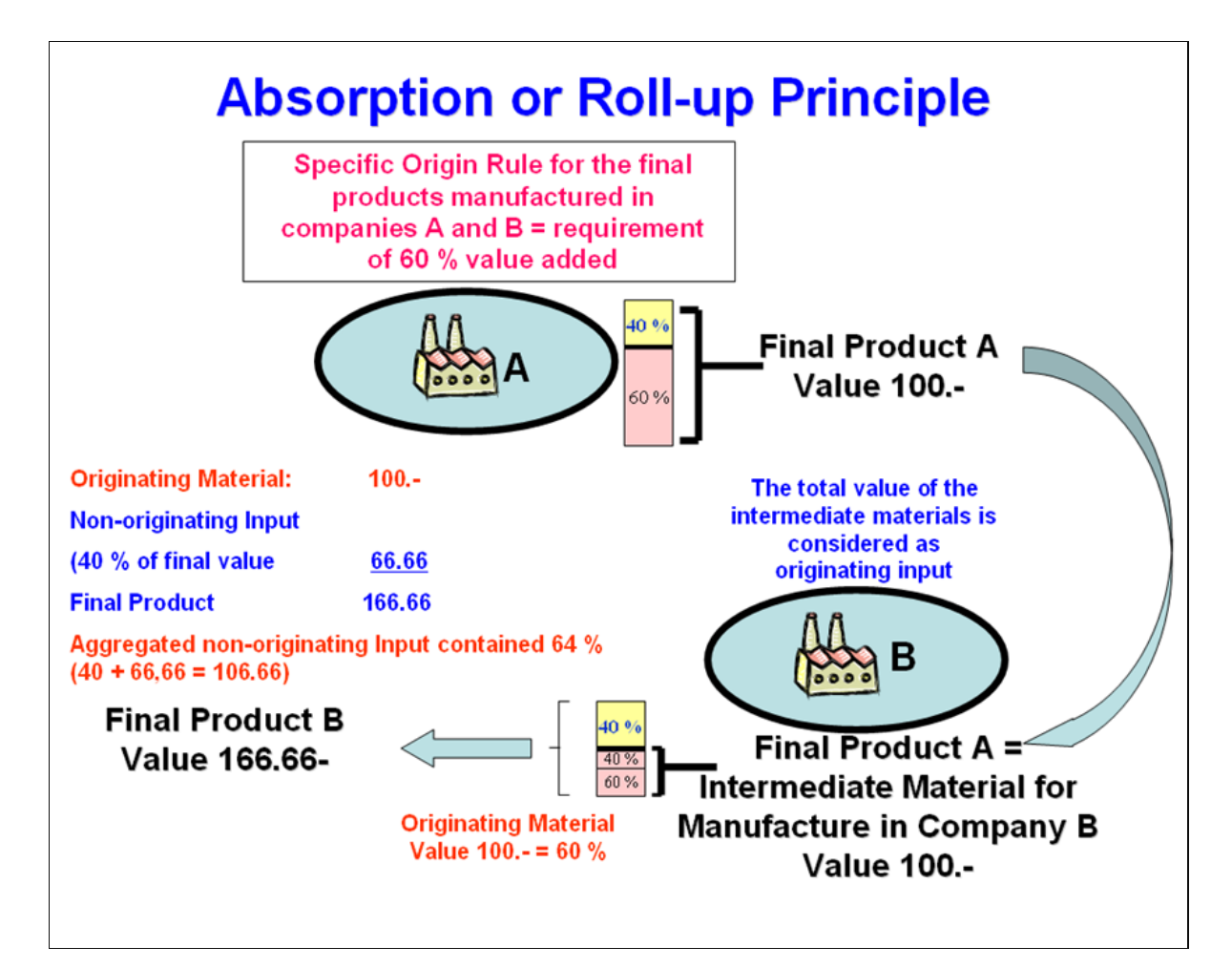

■Comparative Study on Preferential Rules of Origin

This manual is written by WCO. Contents are so many that beginner can hardly read.

It is only for professionals.

Source: WCO Comparative Study on Preferential Rules of Origin

When you notice that your trading partner does not have enough knowledge of FTA, then you should send those manuals to the partner to understand the rule.

Otherwise, you would declare customs with a self-certificate of origin without evidence.