When it comes to classifying Autoparts made of Plastic, there are many HS options.

Especially those two HS definitions are vague

HS:3926.30 “Fittings for coachwork or the like:” and

HS:8708.99 “Parts and accessories of the motor vehicles ”

When you need to classify plastic auto parts you would be confusing which HS code the item belongs to.

In order to make a clear line between them, you need to understand two methods.

1.What is excluded from heading 8708

2.Definitions of “general use parts”

Table of Contents

What is excluded from heading 8708

According to CBP “Vehicles, Parts and Accessories Under the HTSUS”.

In order for motor vehicle parts or accessories to be classifiable under heading 8708, they must satisfy all three of the following conditions:

otherwise, they are excluded from heading 8708.

1.They must be identifiable as being suitable for use solely or principally with

motor vehicles of headings 8701-8705.

2.They must not be excluded by Section XVII, Note 2.

3.They must not be more specifically provided for elsewhere in the HTSUS.

Above definitions 1 and 3 are understandable but 2, we need to refer Section XVII note2

Section XVII note2

The expressions “parts” and “parts and accessories” do not apply to the following articles、whether or not they are identifiable as for the goods of this Section:

(a) Joints、washers or the like of any material(classified according to their constituent material or in heading 84.84)or other articles of vulcanised rubber other than hard rubber(heading 40.16);

(b) Parts of general use、as defined in Note 2 to Section XV、of base metal(Section XV)、or similar goods of plastics(Chapter 39);

In this note, parts of general use are excluded from HS:8708 so what’s the definition of parts of general use?

Definitions of “parts of general use”

Note 2 to Section XV state.

2.Throughout the Nomenclature, the expression “parts of general use” means:

(a) Articles of heading 73.07,73.12,73.15,73.17 or 73.18 and similar articles of other base metals;

(b) Springs and leaves for springs、of base metal、other than clock or watch springs(heading 91.14); and

(c) Articles of headings 83.01、83.02、83.08、83.10 and frames and mirrors、of base metal、of heading 83.06。

similar goods of (a),(b),(c) made of plastics are also considered as “parts of general use”

With the above definitions we may make a clear line between HS:3926.30 or HS:8708.99.

The Case of 3926.30

Even if the item is auto parts, fitting parts could be excluded from 8708.

below are examples of classified as 3926.30 by Europian Customs.

Fittings(panel for window frames)

DE4899-16-1

Fittings(panel for window frames)

DEBTI3658/19-1

Fittings

DEBTI27153/18-1

Logo

ESBTIESBTI2017SOL836

Logo

ESBTI2017SOL0000000000749-1

Some items are kind of Joints, and some are “parts of general use”

The Case of 8708.99

Even though the items below are made of plastic, they are essential parts for automobiles and not excluded from HS:8708.

The plastic blower for cars

SK12536/16/02

Parts of a steering column

DE892/17-1

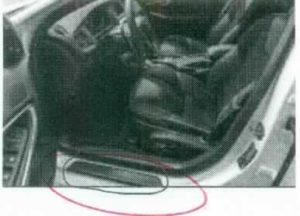

CONSOLE

GB501958157

Glove box

DE4894-16-1

cable guide

DEBTI5248-18-1

Retrieved from:European Union Website