GRI Rule 1 Terms of the Headings, Section/Chapter Notes

THE TABLE OF CONTENTS, ALPHABETICAL INDEX, AND

TITLES OF SECTIONS, CHAPTERS AND SUB-CHAPTERS ARE

PROVIDED FOR EASE OF REFERENCE ONLY; FOR LEGAL

PURPOSES, CLASSIFICATION SHALL BE DETERMINED

ACCORDING TO THE TERMS OF THE HEADINGS AND ANY

RELATIVE SECTION OR CHAPTER NOTES AND, PROVIDED SUCH

HEADINGS OR NOTES DO NOT OTHERWISE REQUIRE, ACCORDING

TO THE FOLLOWING PROVISIONS: [that is, GRIs 2 to 6].

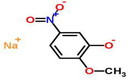

EXAMPLE 1: Under GRI 1, if a provision specifically and completely

describes a product, then the product would be classified in that provision

(e.g., fresh grapes are classified under heading 0806 which provides for

“grapes, fresh or dried”). In this situation, the product is classified by the

terms of a heading.

Example: Live poultry (heading 01.05)

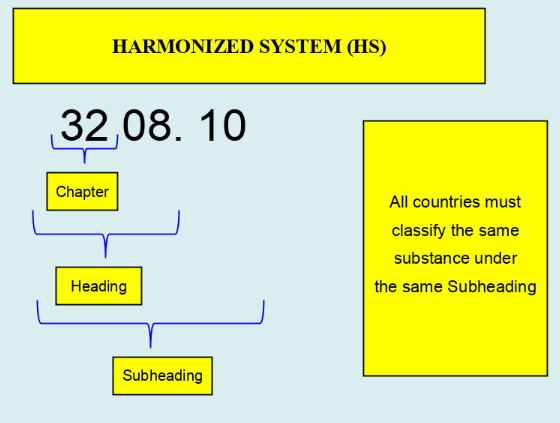

Retrieved from: HARMONIZED COMMODITY DESCRIPTION and CODING SYSTEM or HARMONIZED SYSTEM(HS)

EXAMPLE 2: Note 3 to Section XVI to the Harmonized System directs

classification of composite machines described therein on the basis of the

“principal function” of the machines. Under GRI 1, such machines are to

be classified as so directed in that note. In this situation, the products are

classified by the terms of a section note.

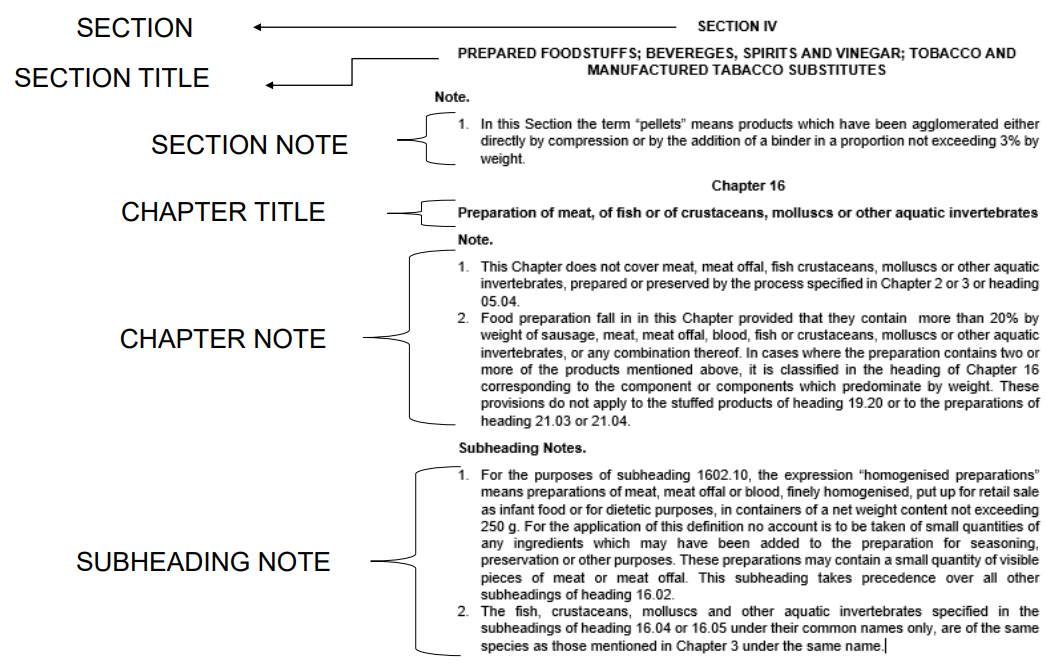

Example of Terms of the Headings, Section/Chapter Notes

EXAMPLE 3: Section XV is entitled “Base metals and articles of base metal”

but jewelry of base metal is classified in Section XIV.

EXAMPLE 4: Chapter 61 is entitled “Articles of apparel and clothing accessories,

knitted or crocheted”, although the chapter also covers certain articles which are

not wholly knitted or crocheted, such as those in heading 62.12.

EXAMPLE 5: Live horses are classified in Heading 01.01.

GRI 1 further states that if the texts of the headings and of the notes cannot, by

themselves, determine the appropriate heading for classification of merchandise, then

classification is to be determined by the appropriate GRIs that follow GRI 1 (i.e., GRIs 2

to 6).

EXPLANATORY NOTE

(I) The Nomenclature sets out in systematic form the goods handled in international trade. It

groups these goods in Sections, Chapters, and sub-chapters which have been given titles indicating as concisely as possible the categories or types of goods they cover. In many cases, however, the variety and number of goods classified in a Section or Chapter are

such that it is impossible to cover them all or to cite them specifically in the titles.

(II) Rule 1 begins therefore by establishing that the titles are provided “for ease of reference

only”. They accordingly have no legal bearing on classification.

(III) The second part of this Rule provides that classification shall be determined :

(a) according to the terms of the headings and any relative Section or

Chapter Notes, and

(b) where appropriate, provided the headings or Notes do not otherwise

require, according to the provisions of Rules 2,3,4, and 5.

(IV) Provision (III) (a) is self-evident, and many goods are classified in the Nomenclature

without recourse to any further consideration of the Interpretative Rules (e.g., live horses

01.01), pharmaceutical goods specified in Note 4 to Chapter30 (heading 30.06).

(V) In provision (III) (b) :

(a) The expression “provided such headings or Notes do not otherwise require” is

intended to make it quite clear that the tern of the headings and any relative

Section or Chapter Notes are paramount, i.e., they are the first consideration in

determining classification. For example, in Chapter 31, the Notes provide that

certain headings relate only to particular goods. Consequently those headings

cannot be extended to include goods which otherwise might fall there by reason of

the operation of Rule 2 (b).

(b) The reference to Rule 2 in the expression “according to the provisions of Rules 2,3, 4 and 5” means that :

(1) goods presented incomplete or unfinished (e.g., a bicycle without saddle and

tyres), and

(2) goods presented unassembled or disassembled e.g., a bicycle, unassembled or

disassembled, all components bein presented together) whose components could individually be classified in their, own right (c.g., tyres, inner tubes) or as “parts” of those goods,

are to be classified as if they were those goods in a complete or finished state,

provided the terms of Rule 2 (a) are satisfied and the headings or Notes do not

otherwise require.