“3D drawing Pen” was classified as “heating apparatus, other electrothermic appliances of a kind used for domestic purposes”(HS:8516.79) by U.S. Customs ruling N248177.

However, this U.S. decision contradicts the decision of the other customs.

*example image of the targeting item

Before Revocation

The targeting item is called “3D drawing Pen”.

The product to be imported is the 3Doodler, a 3D drawing pen. This pen comes with a power adapter, 2 packs of ABS (acrylonitrile butadiene styrene) plastic monofilaments and 2 packs of PLA (polylactic acid) plastic monofilaments. For purposes of this reply, it is assumed that the styrene predominates by weight over each single monomer in the ABS copolymer.

Imported in various colors, these monofilaments measure approximately 3 mm in diameter and 25 cm in length. Once the 3Doodler is heated and the monofilament is loaded into the pen, the user presses and holds down the button for the desired speed and plastic is extruded through the pen’s tip.

At the first decision, U.S. Customs classified it in 8516.79.

And here is the Swedish Customs classification record, they classified it in 847780.

| Item image |  |

|---|---|

| Issued Country | Swedish Customs |

| Reference | SETIL 2014-10177 |

| Issuing date | Dec. 1, 2014 |

| Item name | 3D-pen |

| Classified HS code | 847780 |

| Details & Customs Opinion | 3D-pen pen in the form of an electrical apparatus (length of 180 mm and a maximum diameter of 40 mm) working with quick-setting plastic. The pen is charged with a single colored plastic straw that is heated and discharged quickly or slowly through the key selection. The pen connects to a power outlet using an AC adapter and an LED indicator shows when the right temperature is reached. The pen is a button to select the ABS or PLA plastic. The pen is sold in retail packaging with an AC adapter, 25 straws of ABS plastic and 25 straws of PLA plastic.

Classification is determined by general rules 1, 3b and 6 for the interpretation of the Combined Nomenclature, Note 2 e) to Chapter 84 and the wording of CN codes 8477, 8477 80 and 8477 80 99th |

See How to search world customs ruling with an image.

And here is the French customs classification record, they classified it in 847780.

| Item image | No image |

|---|---|

| Issued Country | French customs |

| Reference | FR-RTC-2016-000065 |

| Issuing date | March 1, 2016 |

| Item name | 3D-pen |

| Classified HS code | 847780 |

| Details & Customs Opinion | The apparatus of embodiments and 3D objects themselves as 3D pen plastic. This article instantly transforms the liquid photo-polymer gel that contains (as swap removable cartridge) solid plastic, through bulbs located around the mouthpiece. It allows you to draw directly in the air or on any surface. This item comes with 2 cartridges and 1 instruction manual (different color cartridges exist). It works with a LR06 battery included. It has an on / off button. This article is intended for users 14 and older and comes in a box.

General Rules 1 and 6: Classification is determined by the section and chapter notes, as well as by the wording of position, sub-position and CN code 8477, 847780 and 84778099. R 3b items mixed, composite, or sets are classified according to the material or component giving them the essential character, in this case the machine. Note 2) of Chapter 84. Note 3 to Section XVI: the main function is the transformation of plastics. HSEN the 8477 position XVI-8477-1 page. |

Issue:

U.S. customs decision is contradicted with Swedish and French customs decisions.

Is the 3Doodler Create Pen Set, as described above, properly classified under heading 8477, HTSUS, which provides for “Machinery for working rubber or plastics or for the manufacture of products from these materials, not specified or included elsewhere in this chapter; parts thereof”,

or under heading 8516, HTSUS, which provides for “Electric instantaneous or storage water heaters and immersion heaters; electric space heating apparatus and soil heating apparatus; electrothermic hairdressing apparatus (for example, hair dryers, hair curlers, curling tong heaters) and hand dryers; electric flatirons; other electrothermic appliances of a kind used for domestic purposes; electric heating resistors, other than those of heading 8545; parts thereof”?

After Review

The issue is whether the “3D drawing Pen” is classifiable as a “heating apparatus, other electrothermic appliances of a kind used for domestic purposes”(HS:8516.79), or Machinery for working rubber or plastics or for the manufacture

of products from these materials (HS:8477.80)

U.S. Customs has reviewed N248177 and has determined the ruling letters to be in error.

Below is what CBP says.

The Create Pen does not meet the description of any of the articles of heading 8516.

Though it is not stated in NY N248177, we surmise from that ruling’s conclusion that CBP concluded that the Create Pen fit the description of an electrothermic appliance of a kind used for domestic purposes. While it is an electrothermic device, the Create Pen cannot be said to be a domestic device.

We recognize that the Create Pen may be used in a domestic environment, but it is may also be used in a commercial environment, and indeed is marketed as being suitable for domestic, commercial, and educational use. Thus, the Create Pen is not an electrothermic appliance for domestic use. Based on the foregoing, it is not classifiable as an article of heading 8516.

Conclusion

By application of GRI 1, the 3Doodler Create Pen Set is properly classified under heading 8477, HTSUS. Specifically, it is classified under subheading 8477.80.00, HTSUS, which provides for “Machinery for working rubber or plastics or for the manufacture of products from these materials, not specified or included elsewhere in this chapter; parts thereof: Other machinery…”

Hence, N248177 is revoked and 3Doodler Create Pen is reclassified in 8477.

Source:Customs Bulletin

My opinion

The reason why U.S.Customs reclassified 3d pen is that “Create Pen may be used in a domestic environment, but it is may also be used in a commercial environment”

I feel uncomfortable with the reason above because when the item is both used in a domestic environment and in a commercial environment, they should consider GIR 3(c).

Rather than saying that they should say “Adopting GIR1. it’s classified in 8477” is far clear and simple.

Swedish and French customs opinion

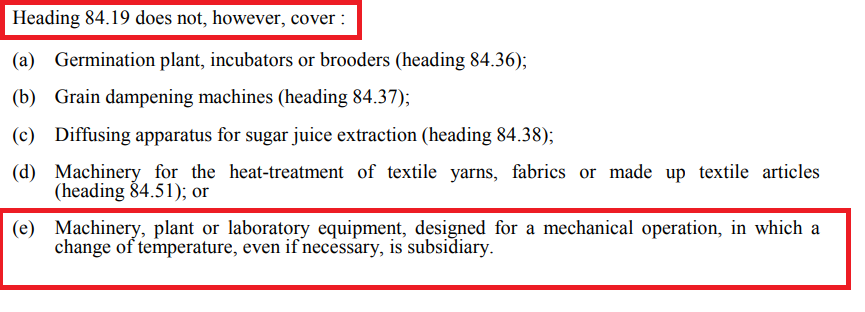

Swedish and French customs were considered classifying 8419.89 as well.

8419.89:

Machinery, plant or laboratory equipment, whether or not electrically heated (excluding furnaces, ovens and other equipment of heading 85.14), for the treatment of materials by a process involving a change of temperature such as heating, cooking, roasting, distilling, rectifying, sterilising, pasteurising, steaming, drying, evaporating, vaporising, condensing or cooling, other than machinery or plant of a kind used for domestic purposes; instantaneous or storage water heaters, non-electric.

But Note2 to Chapter 84 states that.

Therefore, Swedish and French customs classified 3d pen in 8477.80.