Products such as machinery, equipment, vehicles or other products are often

sold with accessories, spare parts, tools or illustration materials, e.g. manuals

(illustration materials are generally subsumed under the term “accessories”,

but they are listed separately in certain origin provisions) which are needed

for their operation or maintenance.

Retrieved from:Comparative Study on Preferential Rules of Origin

Most origin provisions contain guidelines on how to deal, for origin determination

purposes, with such accessories, spare parts or tools which are dispatched with the

machinery, equipment, vehicles etc..

The specific origin rule for accessories, spare parts and tools has to be viewed in

conjunction with the definition of the unit of reference for which origin provisions

are deemed to be applied

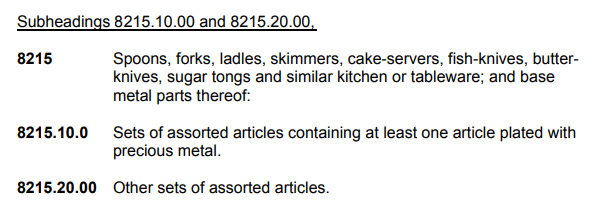

Tariff classification is the basis for the application of origin rules in all origin

legislation systems.

The identification of a product through tariff classification allows the product-specific

origin rule to be specified for a given product. Thus, tariff classification is a core

requirement for the correct application of origin rules.

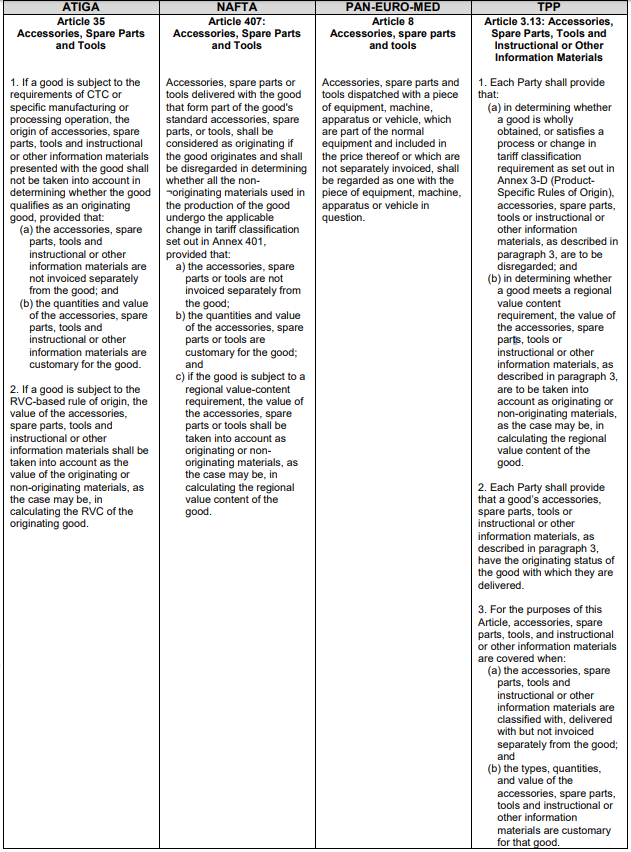

In the USMCA context, accessories, spare parts, and tools (Article 4.14) are explicitly

disregarded for the change of tariff classification requirements.

In the ATIGA origin system, accessories,spare parts and tools (Article 35) shall not be

taken into account in the requirements of CTC or specific manufacturing operations.

The TPP agreement as well disregards the origin of accessories, spare parts, tools and

instructional or information materials (Article 3.13) when determining the requirements

of wholly obtained, change in tariff heading or specific manufacturing processes.

Such exclusions are not applied in the PAN-EURO-MED origin legislation (Article 8).

Nevertheless, with the tolerance rules, its practical impact might be insignificant.

With regard to origin determination based on ad valorem rules, all four origin systems

take the value of accessories, spare parts or tools into account in the origin conferring calculation.

This means that accessories, spare parts and tools which are dispatched with an apparatus,

a machine or a vehicle are considered as part of the consignment, and origin determination

is made on the basis of the whole consignment for the ad valorem calculation. Accessories,

spare parts and tools are :

(a)disregarded in the examination of a change of tariff classification requirement in the

NAFTA, ASEAN and the TPP contexts.

(b)disregarded in the examination of a specific manufacturing or processing operation

requirement in the ASEAN and the TPP contexts.

(c)disregarded in determining whether a product is wholly obtained in the TPP context.

Example:

The remote control of a TV receiver with a third-country origin, which is invoiced and

packed with the TV receiver is considered to be originating where the TV receiver originates,

and the fulfillment of a change in tariff classification requirement for the remote control shall be

disregarded. The value of the remote control must, however, be counted as non-originating for

any calculation of a regional value content requirement.

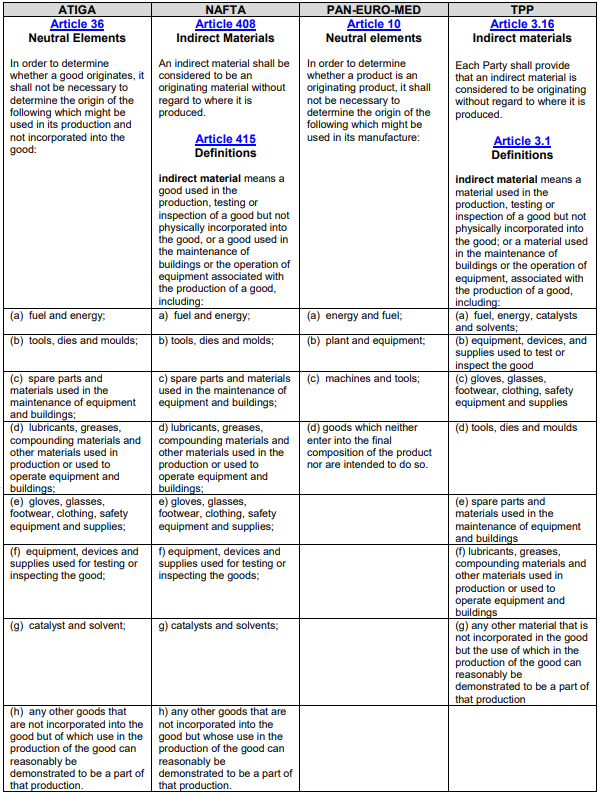

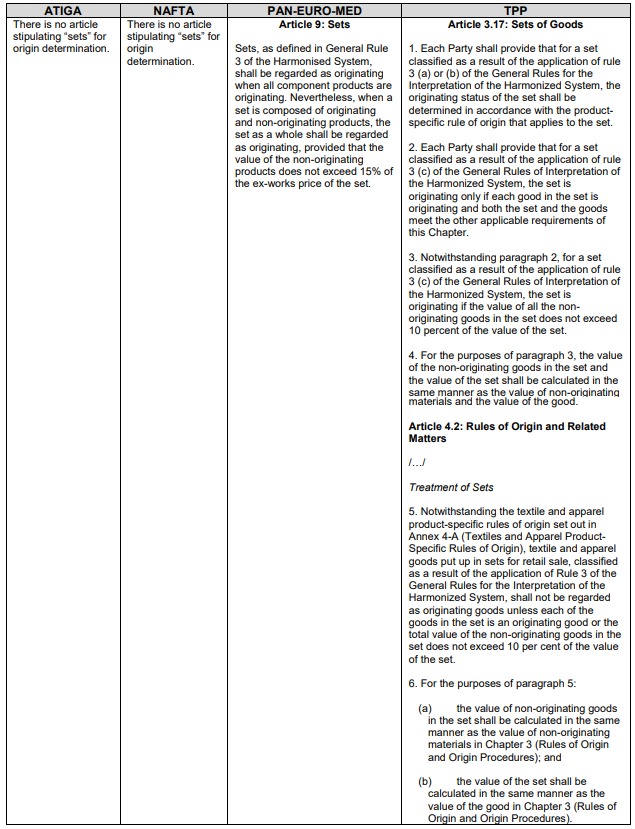

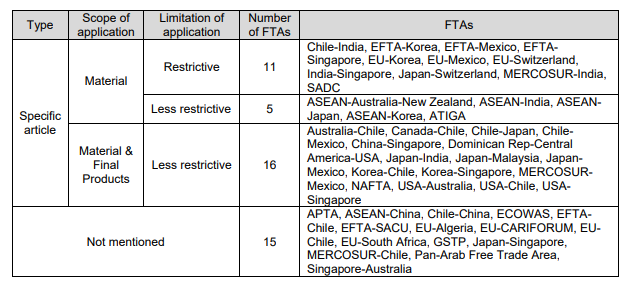

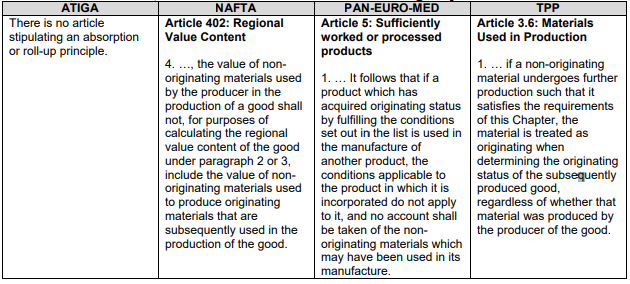

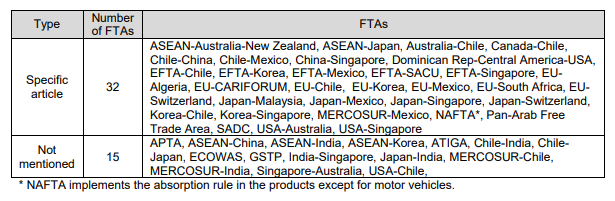

Comparison of “Spare Parts” rules for FTAs