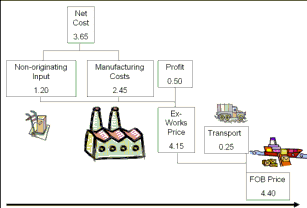

“Net cost” represents all of the costs incurred by the producer minus expenses for

sales promotion (including marketing and after-sales service), royalties, shipping

and packing costs and non-allowable interest costs.

Example

An electric hair curling iron (subheading 8516.32)

| Parts & Costs | Cost | Origin | Value |

| Non-originating materials(8516.90) | Net-cost | Non-Originating | 1.2 |

| Cost of production | Net-cost | 2.45 | |

| Profit | Cost | 0.5 | |

| Transport | Cost | 0.25 | |

| FOB Price | 4.4 |

Retrieved from:WCO ORIGIN COMPENDIUM

An electric hair curling iron (subheading 8516.32) is made in Mexico from

Japanese hair curler parts (8516.90). Selling price value 4.40; the value of

the non-originating hair curler parts is 1.20.

Example of Product-specific rule for headings 8516.32 is

(a). 60 percent where the transaction value method is used, or

(b). 50 percent where the net cost method is used.

There are two requirements to satisfy the rule of origin.

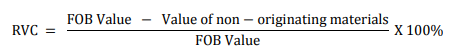

(a) calculation, adopting for “Transaction value method”

(b) calculation, adopting for “Net cost method”

If Transaction value method is used in this example,

The formula for calculating the qualifying value content is:

![]()

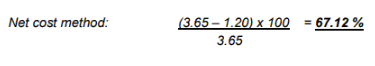

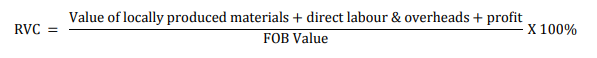

On the other hand, if the Net cost method is used,

The sum of “Non-originating materials” and “Cost of production” are

considered as a Net cost.