Here is a case study of “CTC” & “VA” method combined pattern.

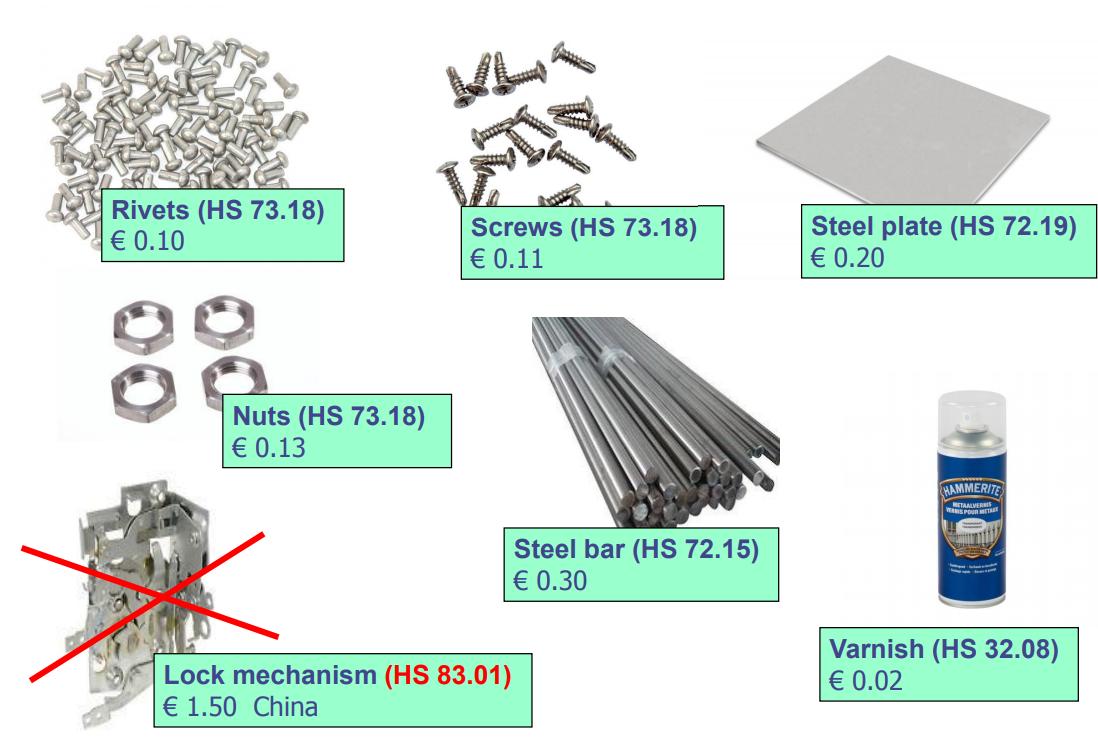

Company A manufactures Letter boxes of copper plate (HS Heading 74.19)

Letter boxes of heading 74.19 are manufactured from the

following non-originating materials:

| Final product | non-originating materials |

HS code | Value |

|

Letterboxes

|

Copperplate | 74.09 | € 1.80.- |

| Rivets | 74.15 | € 0.12.- | |

| Soldering material | 83.11 | € 0.12.- | |

| Insert of plastics | 39.26 | € 0.60.- | |

| Box of paperboard | 48.19 | € 0.15.- |

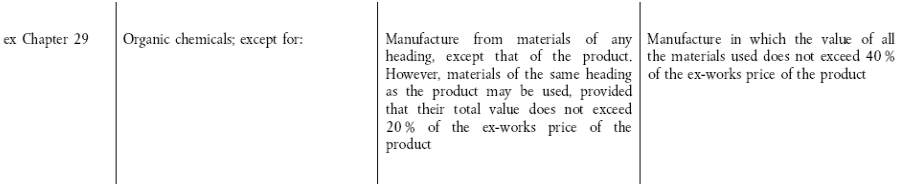

The origin rule for letter boxes of heading 74.19 is covered by “ex Chapter

74 – copper and articles thereof; except for: …”. Since heading 74.19 does

not appear in the list of exceptions, it is the specific rule for Chapter 74

which must be fulfilled:

Example PSR for goods of heading 74.19(Letterboxes ) is:

“Manufacture:

• from materials of any heading, except that of the product, and

• in which the value of all the materials used does not exceed 50 % of

the ex-works price of the product”.

*This rule (PSR) varies depending on the agreement

*This rule (PSR) varies depending on the agreement

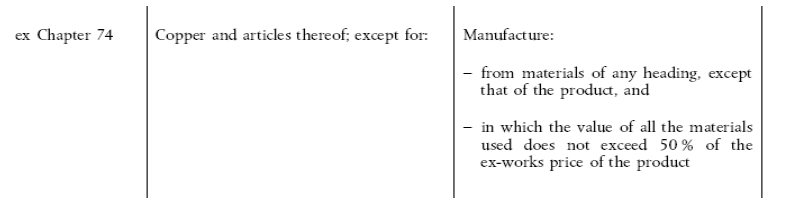

The rule contains two conditions. Both of them must be fulfilled. If not, the

product does not acquire originating status.

The first condition (CTC)

As the letterboxes are classified in heading 74.19 and none of the

materials used are classified in that heading, the first condition is satisfied.

The second condition (VA)

Since the total value of the non-originating material used (€ 2.79) is less

than 50 % of the ex-works price (€ 6.-), the second condition is also satisfied

and the boxes can be regarded as originating products.