In cases where a product-specific rule(PSR) provides a choice of rules based

on a value added criterion(VA), change in tariff classification criterion(CTC),

specific manufacturing or processing operation criterion, or a combination of

any of these, the exporter can decide which rule to use.

Where product-specific rules require a change in tariff classification criterion or

specific manufacturing or processing operation criterion, it is required that each

of the non-originating materials used in the production fulfills the applicable rules

set out in Annex 3.

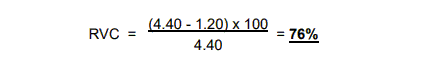

If a value-added criterion(VA) is applied, the regional value content (RVC) of

a good is calculated using the formula set out in Article 29.

Example: Hair curling iron of subheading 8516.32

An electric hair curling iron (subheading 8516.32) is made in Malaysia

from Mexican parts (8516.90).

FOB price US$ 4.40; the value of the non-originating parts is US$ 1.20.

The breakdown of the value of the good is shown in the table below:

Retrieved from:WCO ORIGIN COMPENDIUM

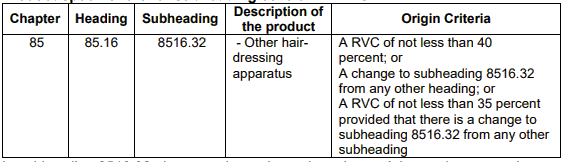

Here is a product-specific rules for “Hair curling iron”(HS8516.32)

Retrieved from:Comparative Study on Preferential Rules of Origin

In subheading 8516.32, there are three alternative rules and the producer can choose

a rule. The first rule requires a RVC of not less than 40 percent. This rule is fulfilled

since the RVC is 76 %. For the calculation of the RVC (Regional Value Content),

see Article 29 or Regional Value Content / Value Added Rules.

Therefore, the good at issue is considered originating under the ATIGA.