Here is a case study of Value Added method.

A company in TPP Party A manufactures engine wiring harness (subheading 8544.30)

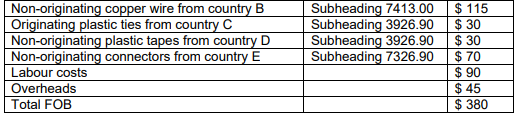

from the following materials:

- Non-originating copper wire (subheading 7413.00) imported from country B;

- Originating plastic ties (subheading 3926.90) imported from country C;

- Non-originating plastic tape (subheading 3926.90) imported from country D;

- Non-originating connectors (subheading 7326.90) imported from country E.

The unit price of a single harness is priced as:

Using the provision in Article 3.5 of the TPP Agreement on how to calculate the

regional value content (RVC), different methods can be used to determine if the

harness is originating.

The PSR for goods of subheading 8544.30 is:

A change to a good of subheading 8544.30 from any other subheading except

from heading 74.08, 74.13, 76.05, 76.14 or subheading 8544.11 through

8544.20 or 8544.42 through 8544.60; or

regional value content of not less than:

a. 35% under the build-up method

b. 45% under the build-down method

c. 60% under the focused value method taking into account only the

nonoriginating materials of heading 74.08, 74.13, 76.05, 76.14 and

subheading 8544.11 through 8544.60.

Table of Contents

Calculate RVC:

a. Focused value method

Focused value method is based on the value of specified non-originating materials.

Since subheading 7413.00 is subject to the exception in PSR 8544.30, “Non-originating

copper wire (subheading 7413.00) imported from country B;” is the material that

does not satisfy CTC rule.

Therefore subject to “Focused value method” is only this “copper wire”

RVC = Value of the Good – FVNM / Value of the Good x 100

In this case, RVC= (380-115) / 380 x100 = 69.73%

The threshold for FVNM is 60% so the harness will be considered to be originating.

It is important to note that all the other non-originating materials of subheadings not

mentioned in the specific PSR are disregarded when using the FVNM for

calculating the RVC.

b. Build-down method

Build-down method is based on the value of non-originating materials.

RVC = Value of the Good – VNM / Value of the Good x 100

In this case, RVC= (380-215) / 380 x100 = 43.42%

Here the goods will be considered non-originating since the RVC is less than 45%.

c. Build-up method: based on the value of originating materials

Build-up method is based on the value of originating materials

RVC = VOM / Value of the Good x 100

In this case, RVC = 30 / 380 x 100 = 7.89%

The goods are non-originating using the build-up method since the RVC is less than

the required 35%.

The three methods explained above are alternatives. A good is originating if it meets

one of the methods to calculate the regional value content.