Here is a case study of Value Added (VA) method.

Company A manufactures Nitrobenzoyl chloride (HS Heading 2916)

Nitrobenzoyl chloride of Heading 2916 are manufactured from the

following non-originating materials:

| Final product | non-originating materials |

HS code | Value |

|

Nitrobenzoyl chloride |

Benzoic acid | 29.16 | € 17.- |

| Hydrochloric acid | 28.06 | € 23.- | |

| Nitric acid | 28.08 | € 2.- |

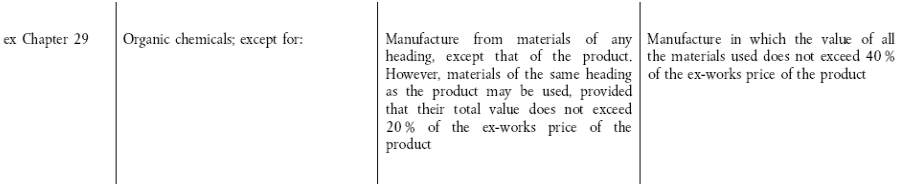

The final product of heading 29.16 is covered by the list rule of “ex Chapter 29

– organic chemicals, except for:…”

the following Example PSR rules in columns 3 and 4 will be applied for goods

of heading 29.16(Nitrobenzoyl chloride)

*This rule (PSR) varies depending on the agreement

*This rule (PSR) varies depending on the agreement

The rules in column 4

The rules in column 4 stipulate that the working or processing that needs to be

carried out on non-originating material is the following: “Manufacture in which

the value of all the materials used does not exceed 40 % of the ex-works price of

the product”.

The condition in this rule is not fulfilled as the total value of the non-originating

The materials used are 42 %.

The rules in column 3

The rule in column 3 consists of 2 requirements:

(i) “Manufacture from materials of any heading, except that of the product”.

The hydrochloric acid and the nitric acid are classified in headings 28.06 and 28.08

(other than the nitrobenzoyl chloride of heading 29.16) and therefore fulfill the

change of heading requirement. The benzoic acid, on the contrary, is classified as nitrobenzoyl chloride of heading 29.16 and does not comply with the tariff shift rule.

(ii) The second requirement, however, stipulates that : “However, materials of the

same heading as the product may be used, provided that their total value does not

exceed 20 % of the ex-works price of the product”.

As the value of the benzoic acid (17€) is only 17 % of the ex-works price of the

nitrobenzoyl chloride (100 €) the requirement of column 3 is fulfilled.

As it is sufficient that the requirement of either column 3 or column 4 is fulfilled,

the nitrobenzoyl chloride can be regarded as an originating product.