Here is a case study of Change in classification(CTC) and DMI method.

Company A manufactures Door locks (HS Heading 8301)

Retrieved from:CCI du Luxembourg belge

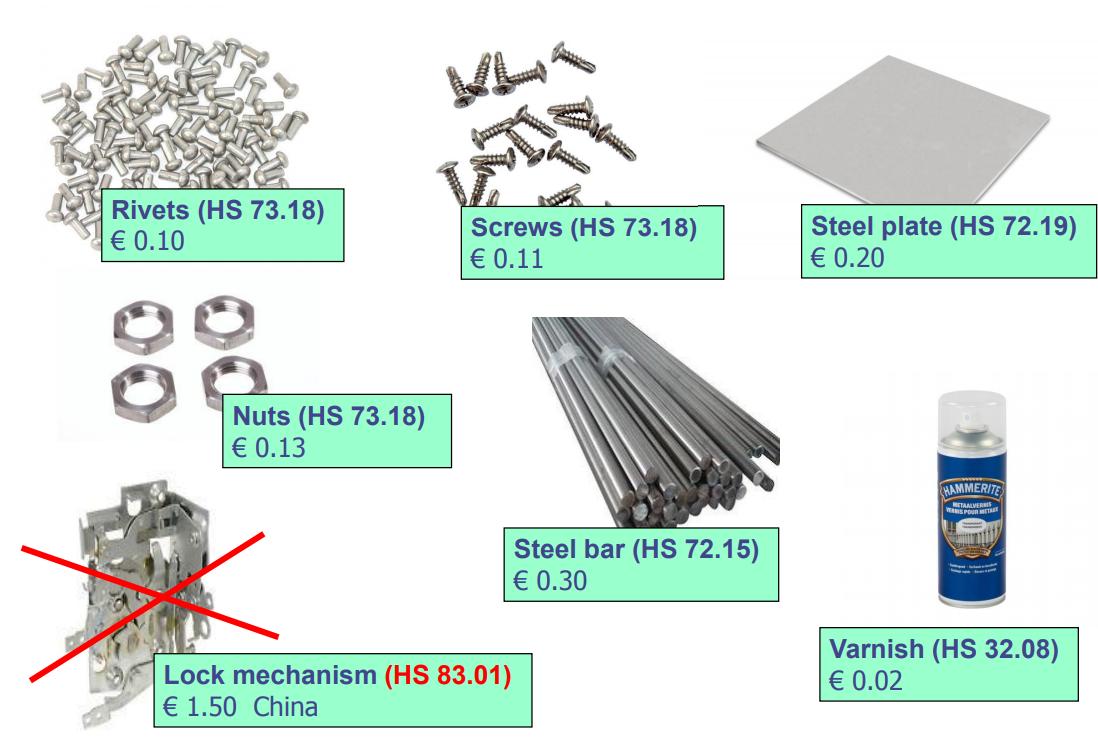

Door locks of Heading 8301 are manufactured from the following non-originating materials:

| Final product | non-originating materials |

HS code | Value |

|

Door locks |

Steel plate | 72.19 | € 0.20 |

| Rivets | 73.18 | € 0.10 | |

| Screws | 73.18 | € 0.11 | |

| Nuts | 73.18 | € 0.13 | |

| Steel bar | 72.15 | € 0.30 | |

| Varnish | 32.08 | € 0.02 | |

| Lock mechanism | 83.01 | € 1.50 |

The specific origin rule for door locks of heading 83.01 is found in

“ex Chapter 83 – miscellaneous articles of base metal; except for : ….”

Example PSR for goods of heading 8301(Door locks) is:

“Manufacture from materials of any heading, except that of the product”.

*This rule (PSR) varies depending on the agreement

Using steel plates, rivets, screws, nuts and varnish which are classified within

headings other than heading 83.01, the tariff shift rule would be fulfilled.

Another way of saying: “Change of Tariff Heading” (CTH)

A product is considered to be sufficiently worked or processed when it is classified in a

4-digit level of the Harmonized System, i.e. heading, which is different from those in

which all the non-originating materials used in its manufacture are classified.

However, lock mechanisms of heading 83.01 are also used in the manufacture

of the locks, so for that material the change of tariff heading is not fulfilled.

Retrieved from:CCI du Luxembourg belge

According to the “De Minimis/tolerance(DMI) rule” the use of non-originating

materials may however be allowed when the value of these does not exceed

10 % of the ex-works

*This rule (DMI) varies depending on the agreement

price of the product. The value of the lock mechanisms (€ 1.50) is only 7,5 % of

the exworks price of the lock (€ 20.-).

Thus, the use of the lock mechanisms does not prevent the final product from

acquiring originating status.

Consequently, the locks can be regarded as originating products.