Here is a case study of Accumulation method.

Company A manufactures color TVs (HS8528.12) in Japan and plans to export

them to Chile under the Agreement between Japan and Chile.

Tuners (HS8529.90) which are used in the manufacturing process of the color

TV are imported from Chile.

The product specific rules for colour TV (HS8528.12) under the Agreement are:

A change to heading 85.25 through 85.28 from any other heading; or

No required change in tariff classification to heading 85.25 through 85.28,

provided there is a qualifying value content of not less than 45 percent

when the Build-down method is used, or of not less than 30 percent

when the Build-up method is used.

To prove that the color TV qualifies as an originating good of Japan, Company A

has to prove that the color TV satisfies either the CTC rule or qualifying value

content of not less than 45 percent when the Build-down method is used, or of not

less than 30 percent when the Build-up method is used.

Company A decided to choose the method based on the value of originating

materials (Build-up method) in this case.

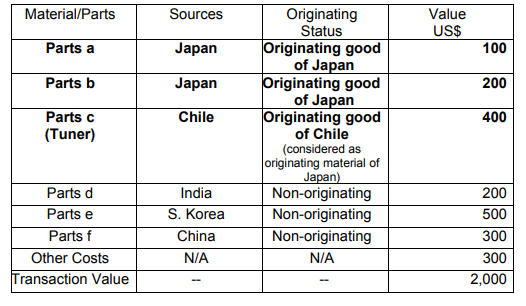

Company A’s manufacturing costs of color TV

If Parts c (tuner) is an originating good of Chile, the color TV will qualify as an

originating good of Japan by considering Parts c as an originating material of

Japan in accordance with of Article 33.

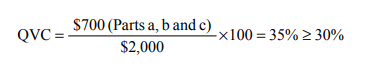

The calculation of QVC of the color TV is:

This calculation shows that the TV qualifies as an originating good of Japan.