Most of the cases bolts/nuts/screws are usually classified as 7318 or depending on the materials(ex.plastic screws HS3926.90) even though they are used as auto parts.

But the US tends to classify them as auto parts 8708 if they have a specific purpose rather than screwed into something.

There lies a thin line between HS7318 and HS 8708 it’s like a coin-toss game.

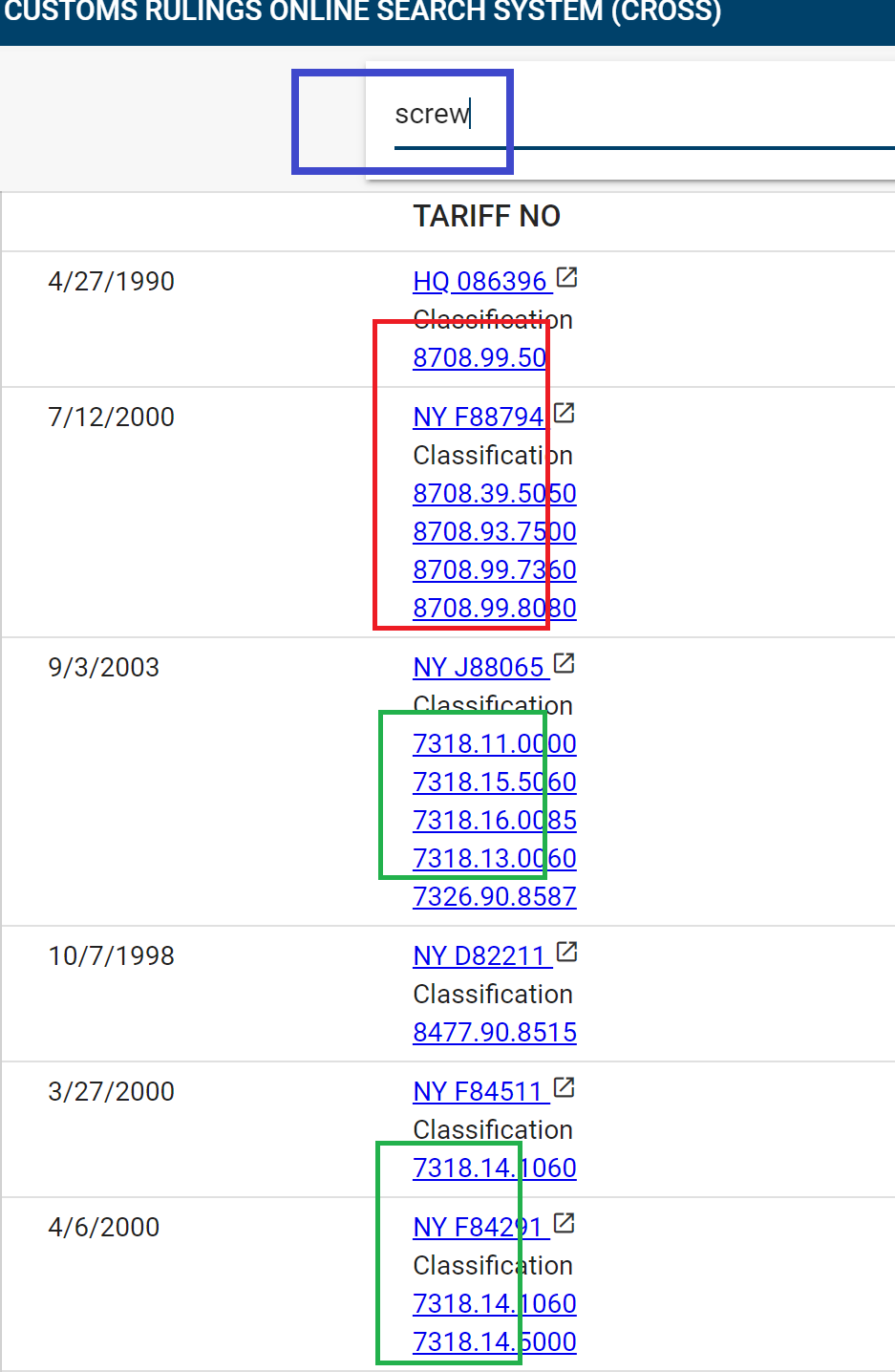

Here are US customs advanced ruling decision database called CROSS‘s result for the keyword of “screw”

You can see two separate decisions.

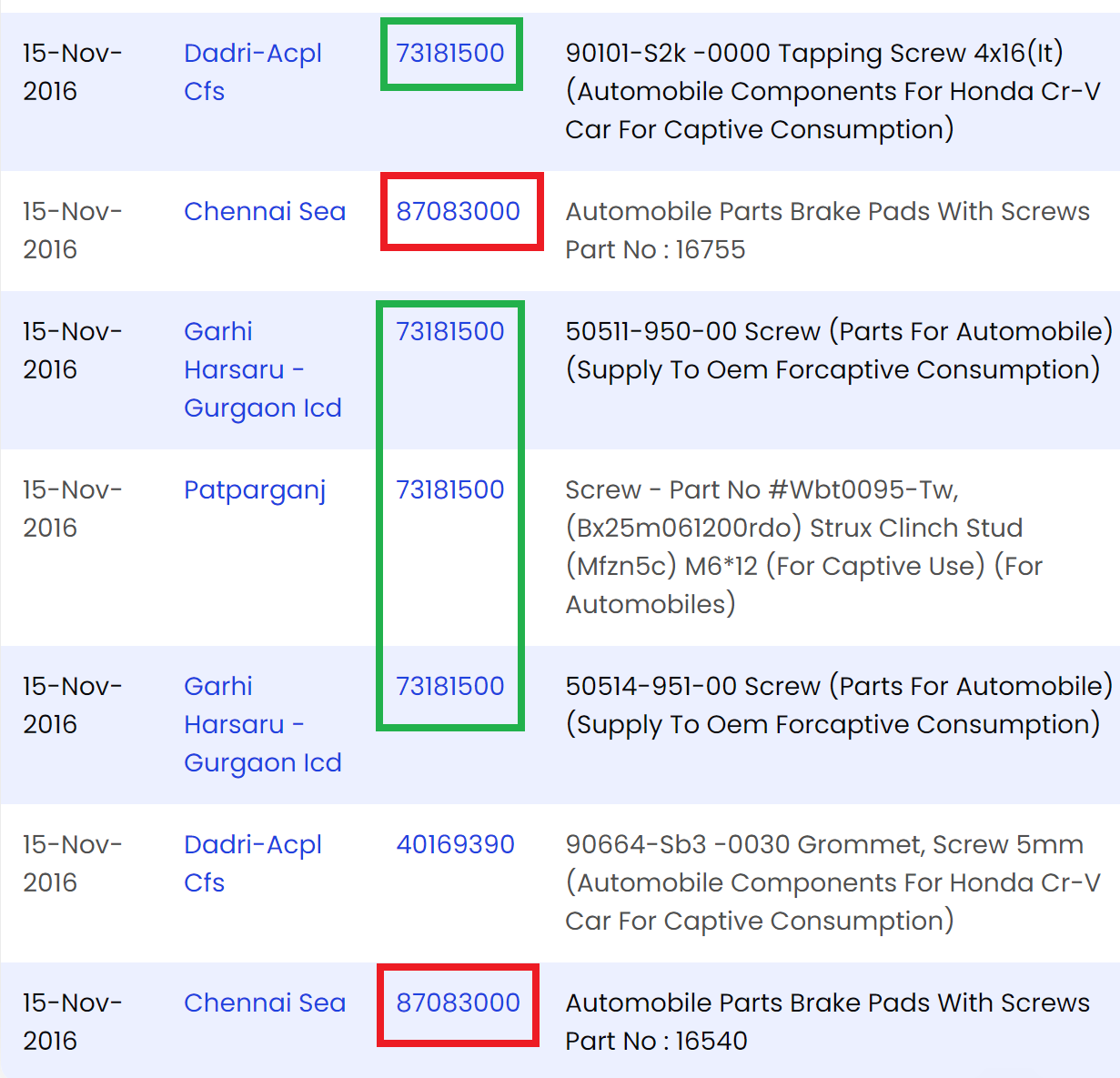

Here are Indian import statistics database with HScode, the result for the keyword of “screw automobile”

You can also see two separate decisions.

Of course, the best way to avoid misclassification is to apply the advance ruling to importing customs but the procedure is really complexed and time-consuming.

When it comes to importing “bolts/nuts/screws” for automobiles.

further consideration is needed.

1.Cleary define what that “bolts/nuts/screws” are used for.

If they are used something rather than screwed into something, You need to understand what they are used for. This is the most important thing.

2.Prepare authority of classification from Explanatory notes with item’s documents and submit it to the customs before the import examination started by an officer.

It’s important to submit them before being questioned by a customs officer.

the officer is like a child with pride.

Even if your claim is valid.once they doubt the classification they hardly withdraw what they said due to their pride. In order to avoid this situation, you should submit all the detailed and valid authority of classification before the import examination started.

3.Search as many customs rulings decision as possible to make a conviction of classification.

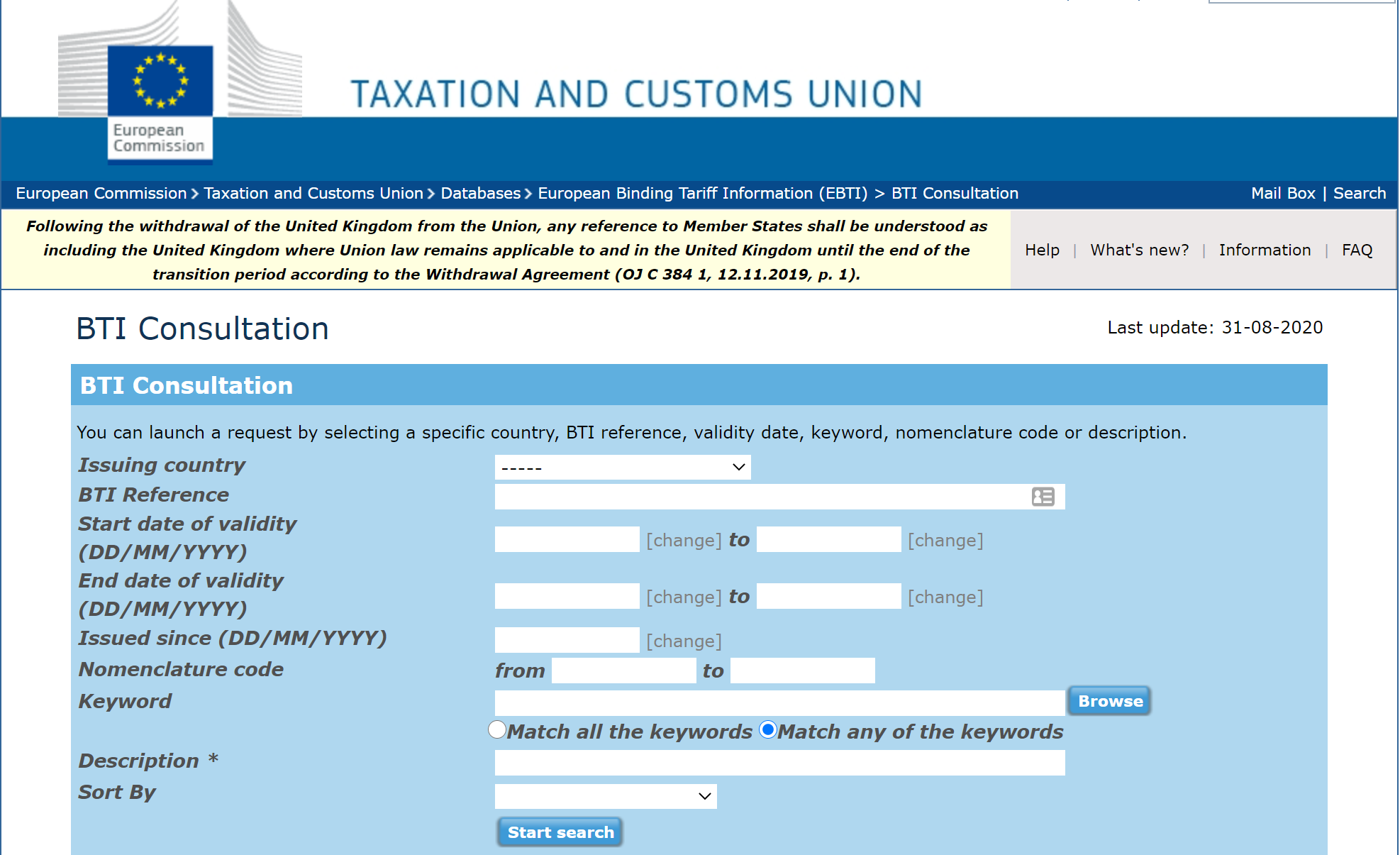

Here are the customs rulings decision database.

US customs “CROSS”

EU taxation and customs union “BTI Consultation”