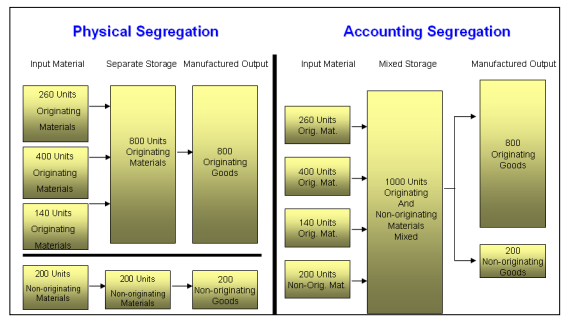

If manufacturers use originating and non-originating materials – even if

these are identical and interchangeable – under normal circumstances,

they are required to stock those materials separately to allow tracing back of

the different origins of materials used in the production of goods.

This ensures that only originating input is used for the manufacturing of

originating goods intended for export under preferences.

The requirement to stock originating and non-originating input material separately

may represent a huge financial burden for the manufactures.

Therefore, provisions on accounting segregation/fungible goods and materials offer

the possibility to use accounting methods to determine the different origins of input

materials or goods which are identical and interchangeable, without any obligation to

physically segregate stocks of non-originating and originating materials or goods.

Retrieved from:WCO ORIGIN COMPENDIUM

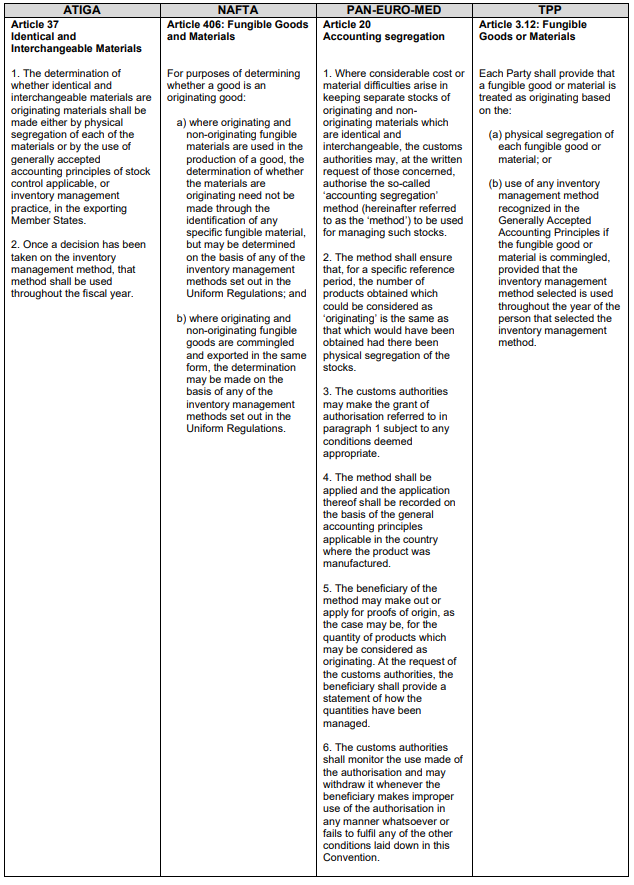

The method is called “Identical and Interchangeable Materials” in the ATIGA context,

“Accounting Segregation” in the PAN-EURO-MED origin system and “Fungible Goods

and Materials” in the NAFTA and TPP context.

In all four origin legislations the physical mix of non-originating and originating input

materials are limited to ‘fungible’ commodities,

i.e. commodities which are identical and interchangeable.

In the European and the ASEAN origin legislations the application of this method is

limited to materials and not allowed for finished products whereas in the NAFTA and

TPP contexts there are no such distinctions.

According to the NAFTA legislation the use of accounting methods to distinguish

originating and non-originating commodities in the manufacture of originating goods

is permitted. The same applies to the TPP Agreement and it states that the inventory

management selected should be applied throughout the year, however in the

PAN-EURO-MED origin system there is the requirement for a specific authorization by

the customs authorities for the use of such a method and the use of the method is

limited to such cases where keeping separate stocks of originating and non-originating

materials would result in considerable costs or material difficulties.

Such preconditions are not required in the ATIGA, the NAFTA and the TPP contexts.

Comparison of “Accounting Segregation/Fungible Goods and Materials”

Retrieved from:Comparative Study on Preferential Rules of Origin

Related Study Module on “Accounting Segregation/Fungible Goods”

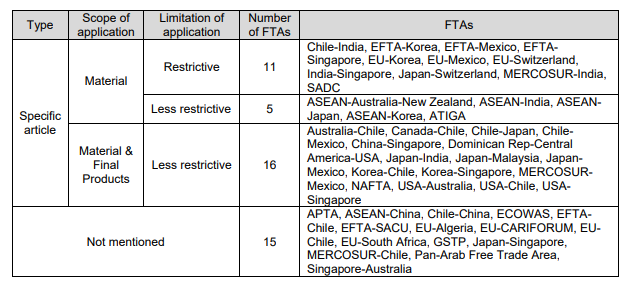

This study module aims to compare and analyse the features of Rules of Origin (ROO)

provisions of the selected 47 Free Trade Agreements (FTA). This module intends to sort out

the types of various topics of ROO provisions.

The following table is the comparison of accounting segregation / fungible goods in the

selected FTAs.

Retrieved from:Comparative Study on Preferential Rules of Origin