The worst scenario of inadequate HS classification from a judicial example.

With this real example, you can see how HS misclassification is horrible and could lead to MULTI-MILLION DOLLAR LOSS.

The fact is that Thailand Supreme Court ordered the Japanese top car maker “Toyota” to pay $272.11 million due to the inadequate HS classification.

Source: Reuters

In the beginning, TOYOTA intended to export Automobiles to Thailand.

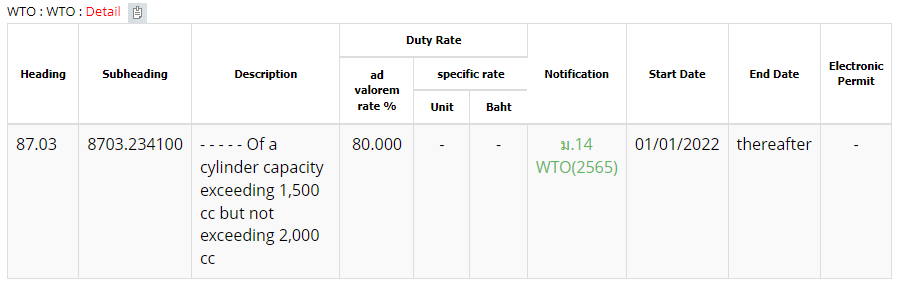

In this case, the tariff rate for Automobiles(HS:8703.23) is 80%(see the image)

The duty rate of 80% is very high and there is no FTA preferential treatment between Thailand and Japan for Automobiles(HS:8703.23).

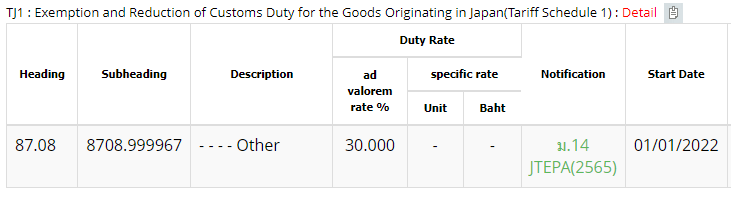

On the other hand, FTA between Thailand and Japan, there is preferential treatment for “Automobile parts” (HS:8708) 60% to 30%.

Toyota came up with an idea that they disassemble the Automobiles, ship them to Thailand and declare them as “Automobile parts”, and after clearance, they reassemble them to complete the car in Thailand.

If Toyota had exported Automobiles to Thailand, the duty rate would be 80% but if they disassemble them into Automobile parts, the duty rate would be 30%, literally, they succeeded to reduce 50% of customs duty.

It seemed it works, so they continued this Tariff Engineering from 2010 to 2012 for more than 20,000 vehicles assembled at Toyota’s Gateway factory.

But this is a double-edged strategy.

After that, Thailand customs pointed out that they are not Automobile parts because after importing those items to Thailand, they can be reassembled to be a complete automobile.

It’s nothing other than “Completely Knocked Down”, Thailand customs thought.

To understand why Automobile parts are regarded as complete automobiles by customs, we need to refer to the “General Rules of Interpretation (GRIs)”

GRI 2(a) states below

2. (a) Any reference in a heading to an article shall be taken to include a reference to that article incomplete or unfinished, provided that, as presented, the incomplete or unfinished article has the essential character of the complete or finished article.

It shall also be taken to include a reference to that article complete or finished (or falling to be classified as complete or finished by virtue of this Rule), presented unassembled or disassembled.

It means an unassembled or disassembled product is regarded as a completed product.

That’s the reason why Automobile parts are regarded as complete automobiles by Thailand customs.

The argument between Thailand customs and Toyota had taken a long time and it was brought to Court.

Sept 15, 2022 – Thailand Supreme Court on Thursday upheld a lower court ruling that the local unit of Toyota Motor Corp owed the government 10 billion baht ($272.11 million) in extra taxes for importing components not subject to a reduced tariff.

Here is The link to Thailand Supreme Court judgment

Below is translated judgment.

(Sorry it’s hard to read due to machine translation.)

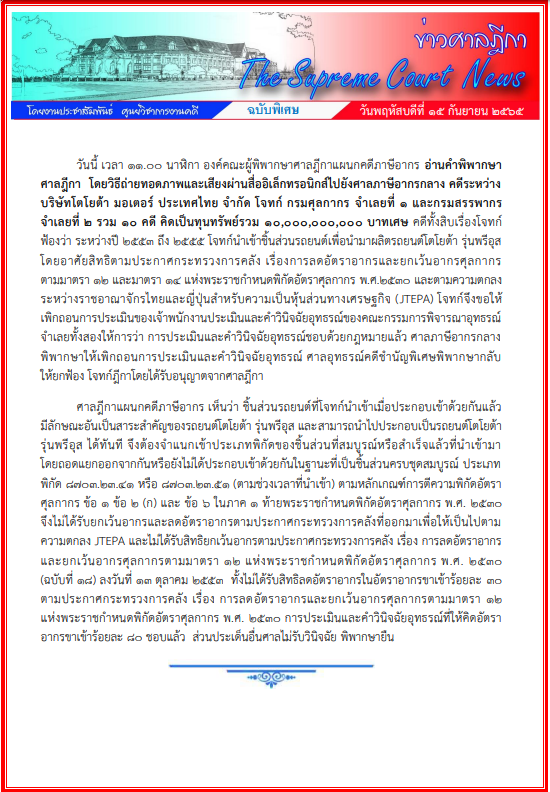

Today at 11:00 a.m., the Supreme Court of Justice Department of Tax Cases read the verdict.

The Supreme Court means transmitting images and sounds via electronic media to the Central Tax Court.Cases between Toyota Motor Thailand Company Limited, the plaintiff, the Customs Department, the 1st defendant, and the Revenue Department

The 2nd defendant, a total of 10 cases, accounted for total assets of 10 million baht, In all ten cases, plaintiffs sued that between 2010 and 2012, the plaintiff imported the friend’s car parts used to produce Toyota Prius models by the notification of the Ministry of Finance Regarding the reduction of duty rates and the exemption of customs duties under Section 12 and Section 14 of the Royal Decree on Customs Tariffs B.E. between the Kingdom of Thailand and Japan For the Economic Partnership (JTEPA), the plaintiff asked.revoke the assessment of the assessment and make an appeal decision of the Appeal Committee.

Both defendants testified that the assessment and The appeal ruling are lawful.

Central Tax Court adjudged to revoke the assessment and Appeal Court of Appeal The special judges returned.

to dismiss the plaintiff’s petition with permission from the Supreme Court

The Supreme Court’s Tax Litigation Division found that the plaintiff’s car parts are to be imported when assembled having a material nature It is important for the Toyota Prius model and can be assembled into Toyota cars.Prius immediately, so it must be classified into the coordinate type of the complete part or for the successfully imported either disassembled or not assembled as a complete set of parts.

Tariff 8703.23.41 or 8703.23.51(according to the time of import) according to the tariff interpretation rules

Customs Clause 1, *Article 2 (a) and Article 6 in Part 1 annexed to the Royal Decree on Customs Tariffs, B.E. 2530 (1987)*Guess it means GRI 2(a)

Therefore, it is not exempt from duty and reduces the duty rate according to the notification of the Ministry of Finance issued to comply with

the JTEPA agreement and is not entitled to exemption from duty according to the Ministry of Finance’s notification regarding the reduction of duty rates and exemption of customs duties under Section 12 of the Royal Decree on Customs Tariffs, B.E. 2530

(No. 18) dated October 13, 2010, neither has the right to reduce the duty rate at the import duty rate of 30 percent.under the Notification of the Ministry of Finance Re: Reduction of Duty Rates and Exemption of Customs Duty under Section 12

of the Royal Decree on Customs Tariffs, B.E. in the appellate decision to charge the rate 80% of the import duty was approved, while other issues were not accepted by the court, and the verdict was confirmed.

Sometimes I hear that “to reduce duty rate, disassemble the commodity into parts to import and reassemble them in the targeting country, Wow this is a smart way of Tariff Engineering”

But this is the inadequate solution for reducing the duty rate that most people easily come up with.

In short term, it might work I admit, but customs officers are not foolish in overlooking this behavior. Therefore it turned out to be a nightmare one day.

It does not mean disassembling the commodity into parts to import is not a bad way. Sometimes depending on the commodity, disassembling is required.

But please keep in mind that customs seek the possibility to adopt GRI 2(a) to disassembled commodity to reclassify to another HS code.

Don’t underestimate GRI 2(a), it is very important.

If there is a need for disassembling commodities, I recommend consulting customs that the HS code is appropriate in a wide range of views.

As a Japanese, I am personally proud of Toyota’s international business.

Hoping Toyota overcomes this incident and develops more.

This incident must be a great guideline for many traders worldwide.

This post is written based on translated judgment. If I misunderstand the content, please let me know.