“HEARTLAND BY-PRODUCTS, INC.,” imported Sugar syrup from Canada to the U.S.

Heartland disguises the syrup material to adopt a lower tariff rate.

In order to disguise it, Heartland had “Molasses” added to raw sugar to adjust the purity of the product to adopt a lower tariff rate before importation.

Upon receiving the syrup in the United States, Heartland first removed the molasses and then refined the remaining syrup.

The removed molasses was returned to Canada but were again used the same way by adding them to other sugar syrup. As far as appears, this chain continued indefinitely.

How the court classifies the HS code for a disguised item?

This article is regarding the court case of 264 F.3d 1126 (Fed. Cir. 2001)

HEARTLAND v. the UNITED STATES, and UNITED STATES BEET SUGAR ASSOCIATION.

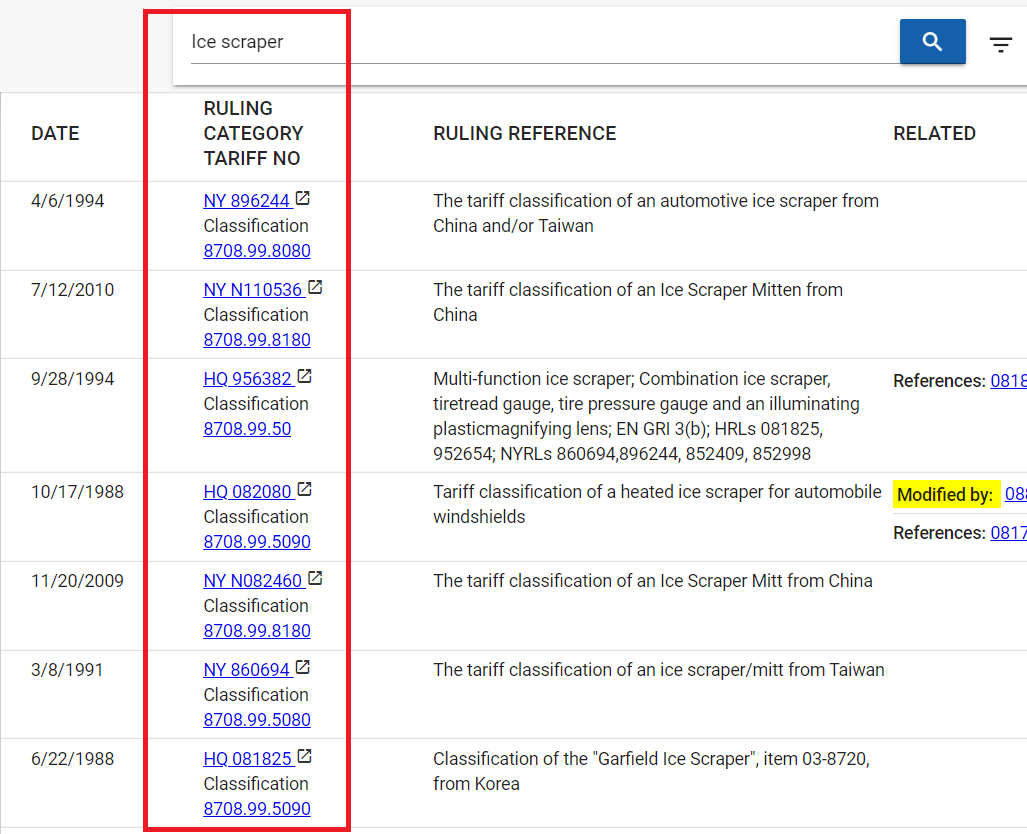

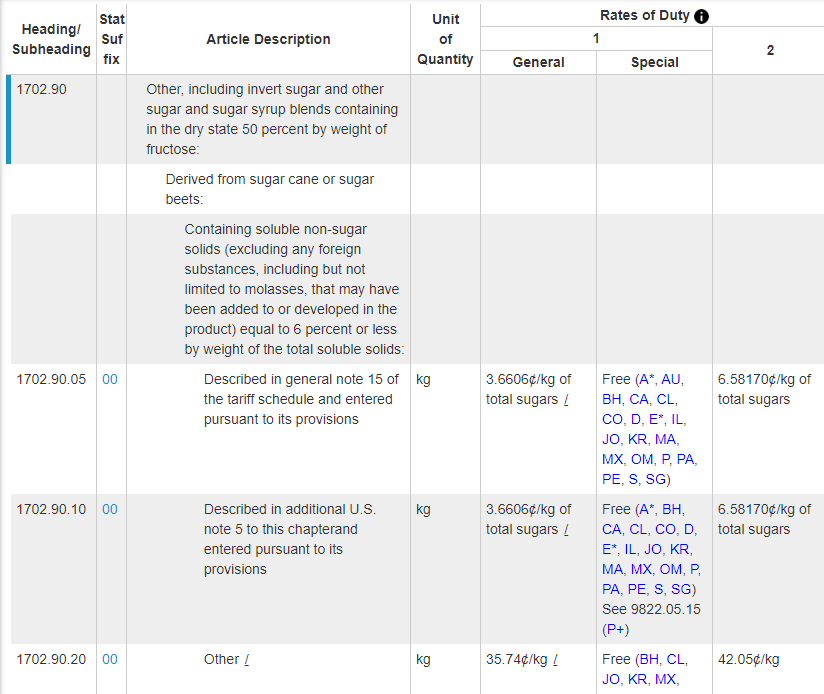

US Customs classified it HS:1702.90.10/20 of “HTSUS”

This HS code adopts a higher tariff rate

1702.90.10…3.6606¢/kg of total sugars

1702.90.20…35.74¢/kg

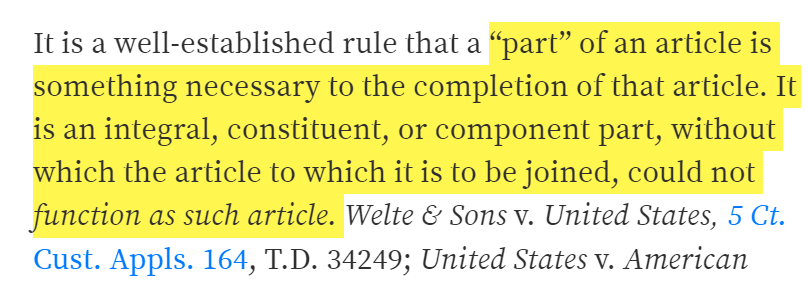

The key point of the classification is the rule below.

Containing soluble non-sugar solids (excluding any foreign substances, including but not limited to molasses, that may have been added to or developed in the product) equal to 6 percent or less by weight of the total soluble solids:

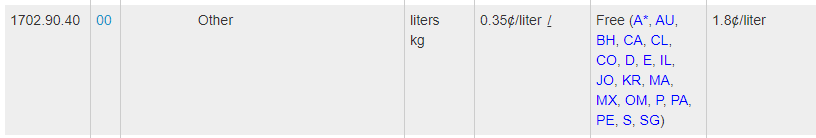

Heartland contends that it’s classifiable HS:1702.90.40 of “HTSUS”

This HS code adopts a lower tariff rate

0.35¢/liter

1.Customs’s opinion

- there are no commercial identities or commercial uses for the syrups as imported other than the extraction of the molasses after importation

- the added molasses is a “foreign substance” relative to the sugar to which it is added and, therefore, should not be included when determining the soluble solids content of the sugar syrup under 1702.90.10 HTSUS and 1702.90.20 HTSUS.

- the addition of molasses to raw sugar is not a “genuine step” in the manufacturing process, but instead amounts to a “‘disguise or artifice’ intended to escape a higher rate of duty such as a quota or tariff rate.”

2.HEARTLAND’s opinion

- syrup falls under 1702.90.40 HTSUS because it contains more than 6% by weight of soluble, non-sugar solids with no foreign substances, and is not molasses.

- Customs once agreed with Heartland’s proposed classification, and issued a ruling letter classifying the syrup under 1702.90.40 HTSUS. N.Y. Ruling Letter 810329 (May 15, 1995) (“New York Ruling Letter”).

- neither the preimportation manufacturing process nor the processing that Heartland performs in the United States involves any artifice or disguise.

3.CIT’s (Court of International Trade) Opinion

The court rejected Customs’ reasoning that the molasses is a foreign substance that should be excluded from the solids content calculation, finding that the record demonstrated that the molasses is made from cane or beet sugar and that the sugar, molasses, and syrup “all have the same chemical ingredients, including impurities that naturally occur in sugar.” .

The court reasoned that because raw sugar itself contains molasses, combining raw sugar with additional molasses does not amount to an addition of a foreign substance. Id. at 1134.

The court stated that Customs’ conclusion to the contrary “was simply wrong.” Id.

The court also stated that “Customs’ interpretation of ‘foreign substances’ to include anything that is itself ‘derived from sugar cane or sugar beets’ is unreasonable and an abuse of discretion.”

The court also rejected Customs’ determination that the addition of molasses amounted to an artifice or disguise.

The court noted that Heartland never falsified or concealed the identity of its sugar syrup, its method of manufacture, or its use. Id. at 1337.

The court determined that evidence of record demonstrated a clear commercial purpose for the addition of molasses, citing testimony to the effect that molasses may be added to adjust the purity of the product during crystallization or to produce a final product of a particular polarity. Id. at 1335.

The court also determined that the evidence of record indicated that Heartland’s sugar syrup results from an intermediate stage of the refining process, citing testimony to the effect that “the process of combining granular raw sugar with molasses, adding water, and heating is common in sugar refining operations.” Id. at 1338.

The court noted that the only evidence indicating that adding molasses to sugar is not a legitimate commercial process relates to the addition of molasses to refined sugar, not the addition of molasses to raw sugar, as is done by Heartland. Id.

The court therefore concluded that Customs’ determination that Heartland had engaged in artifice and disguise and its subsequent consideration of the post importation use of the syrup was “an abuse of discretion and otherwise not in accordance with law.” Id. at 1338-39.

The court, therefore, granted Heartland’s motion, declared the revocation ruling unlawful, and ordered that the sugar syrup be classified under 1702.90.40 HTSUS

The United States and the United States Beet Sugar Association appeal the decision of the United States Court of International Trade in favor of Heartland By-Products, Inc.

4.US Court of Appeals for the Federal Circuit’s opinion

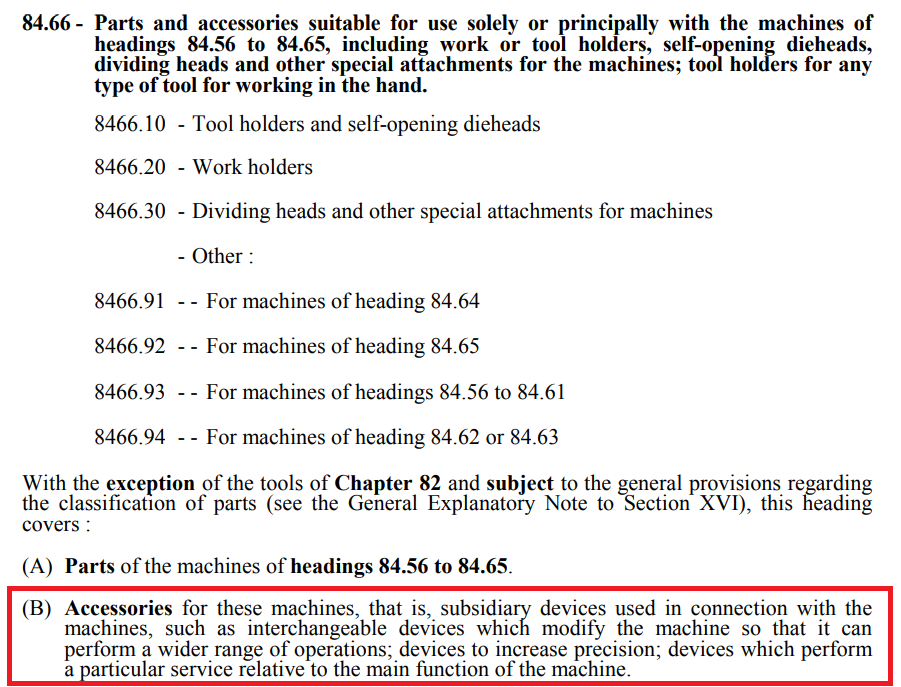

The court cited Explanatory Note 17.02(B)(2), which states that ” [j]uices and syrups obtained during the extraction of sugars from sugar beet, sugar cane, etc.,” fall under 1702 HTSUS, and that these syrups “may contain pectin, albuminoidal substances, mineral salts, etc., as impurities.” Id. at 1335.

The court determined that because this note permits products with the same impurities as molasses to be classified under 1702 HTSUS, it undermines Customs’ determination that molasses

is a foreign substance.

This note, however, does not indicate whether the molasses added to raw sugar to make Heartland’s sugar syrup is a “foreign substance” under 1702.90.10/20 HTSUS because it does not set forth under which subdivision of 1702 HTSUS the described sugar syrups are classified.

Moreover, the impurities described in the note are naturally present in the juices and sugar syrups, not added to raw sugar like the molasses at issue in this case.

Heartland does not argue that its sugar syrup contains less than 6% by weight of soluble non-sugar solids when the weight of the molasses solids is excluded.

Therefore, in view of our determination that Customs’ interpretation of the term “foreign substances” should not be disturbed, The court upheld the revocation ruling classifying Heartland’s sugar syrup under 1702.90.10/20 HTSUS

CONCLUSION

For the foregoing reasons, the decision of the Court of International Trade declaring the revocation ruling unlawful and ordering that Heartland’s sugar syrup be classified under 1702.90.40 HTSUS is REVERSED.

Author’s Opinion

The remarkable point of this case is that when Heartland had applied Ruling, Heartland never falsified or concealed the identity of its sugar syrup, its method of manufacture.

And Customs agreed with Heartland’s proposed classification and issued a ruling letter classifying the syrup under 1702.90.40 (lower tariff rate).

In this circumstance, Customs did not see the entire process of the Trading, from the manufacturing process to suppling consumer, therefore Customs issued wrong Rulings.

This example indicates that HS classification is not determined at the point of importation but the entire process of the Trading.

Source:United States Court of Appeals for the Federal Circuit