HS classification is an important component to determining both import duty rates and if

products qualify for preferential tariff treatment under the many free trade agreements.

And also it’s important to classify HS code correctly but since HS classification system is a

black box, sometimes classification dichotomy occurs between Customs and Trader.

What happens if HS classification dichotomy or misclassification occurs?

Here are some consequences of misclassification

- Overpayment of duties

- Missed opportunity to benefits from free trade agreement

- Import may be subject to anti-dumping or countervailing duties

- Alert to customs agents about deeper problems, which could lead to an audit

- Unexpected customs clearance delays.

Based on my 10 years of experience as a Customs broker qualified by Japan Yokohama Customs. I can tell the method of HS classification.

In this article, you will learn

- How does HS classification dichotomy or misclassification occur?

- The best way to search for the appropriate HS code online.

- How to search the World Customs HS decision database to find reliable information.

- How to use item description, image, and basis of classification from Customs HS decision database

How HS Misclassification occurs?

Identifying the right HS code is sometimes easy but often difficult.

These examples demonstrate how difficult HS classification can be comparing simple examples and complex examples.

Example1. Wooden chair

Simple example

Source::European Union Website

This item is quite easy to classify. Nothing other than Upholstered wooden frame seats(HS:9401.61)

Complex example1

This item is hard to classify because this item can be classified both ways.

Choices are as follows:

1.Chair (HS:9401.80 -Other seats)

2.Hammocks (HS:6306.90 -Other camping goods)

Complex example2

Source::European Union Website

This item (set of table and chairs) is hard to classify because this item can be classified both ways.

Choices are as follows:

1.Wooden chair (HS:9401.69 -Seats)

2.Wooden table (HS:9603.60 -wooden furniture)

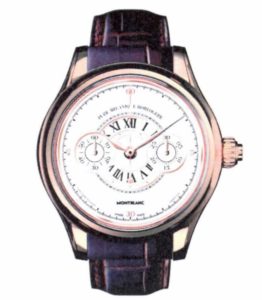

Example2. Watch

Simple example

Source::European Union Website

This item is quite easy to classify. Nothing other than Wristwatches(HS:9102)

Complex example1

Source: China customs

This item (Apple Watch) is hard to classify because it’s not just a watch, it has multiple functions.

Choices are as follows:

- Telephone sets (HS:8517)

- Sound recording or reproducing apparatus(HS:8519)

- Video recording or reproducing apparatus(HS:8521)

- Revolution counters,production counters,taximeters, odometers(HS:9029)

- Measuring or checking instruments(HS:9031)

- Wristwatches, pocketwatches and other watches(HS:9102)

Complex example2

Source::European Union Website

This item (set of Watch and Knive) is hard to classify because both are packed as a set product.

Choices are as follows:

1.wrist watches with mechanical display only(HS:9102.11)

2.Knives having other than fixed blades(HS:8211.93)

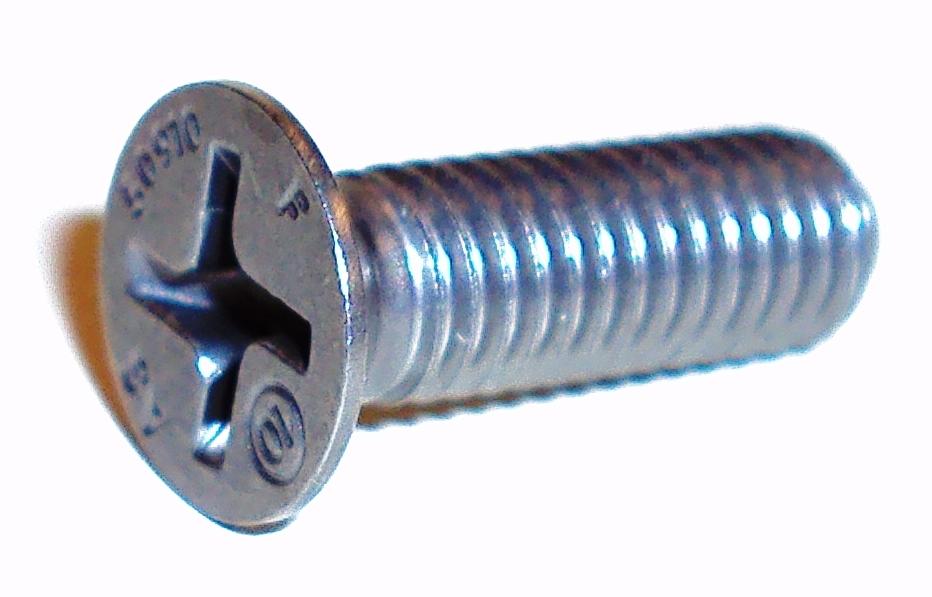

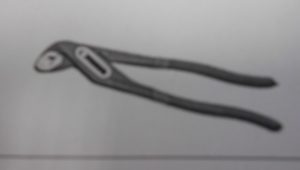

Example3. hand tool

Simple example1

Source::European Union Website

This item is quite easy to classify. Nothing other than Plier (HS:8203)

Simple example2

Source::European Union Website

This item is quite easy to classify. Nothing other than Wrenches (HS:8204)

Complex example

Source :Customs Bulletin

So-called “Locking pliers”, it has two functions of Plier and Wrenches

Choices are as follows:

1.Plier(HS:8203)

2.Wrenches(HS:8204)

With those examples above you may understand why HS misclassification occurs.

Some items are easy to classify, but some are not.

Customs’s opinion and Trader’s opinions are not always same, because there are

so many choices.

So is there any way to avoid HS misclassification?

The best way to avoid HS misclassification is to apply the Customs *Advance rulings

but the process is complicated and time-consuming.

Customs asks you so many questions regarding your items and require documents or

sample items when you apply for advance rulings.

If you deal with many items, applying for advance rulings is not always a good option.

*Advance ruling

Importers and other relevant parties may make an inquiry to Customs regarding the

HS classification of the goods in advance of importation, which is called “Advance ruling.”

Advance ruling provides certainty on the Customs duty rate to be applied which is

issued in writing on the applicant’s written request.

Since applying for advance rulings is not always a good option, I recommend

Searching customs ruling database.

What is Customs Ruling Database

When Trader apply for advance ruling, Customs issues writing answer regarding

Trader’s item’s HS classification and opens it online.

There are more than one million classification records issued by customs all over the world which available on the internet.

They contain customs opinions based on a legal basis regarding how HS classification decision was made for each item individually and some items come with an image of the items.

If you usually struggle with HS classification, there is no way not using Customs Ruling

Database.

Here are some examples of Customs Ruling decision records available on the internet.

| Item image |  |

|---|---|

| Issued Country | Netherlands |

| Reference | NLRTD-2013-002426 |

| Issuing date | 2013-11-11 |

| Item name | Hammock chair |

| Classified HS code | 6306.90 |

| Details & Customs Opinion | A hammock chair with-as stated, include the following features and characteristics: – an up article in a rectangular shape – made from woven cotton – the two short sides of the fabric by means of braided cords attached to a wooden stick; – not shaped seat – a seating area with dimensions (L x W) 110 x 60-70 cm – a back section with dimensions (L x W) 110 x 70-80 cm – the hammock chair hanging on a wooden spreader with a length of 110 cm.De hammock chair is intended to be. attached to the ceiling, beam, or to a branch point The article takes the body shape of the person who sits in it. The hanging chair can be used both indoors and outdoors.

Classification is determined by General Rules 1 and 6 for the interpretation of the Combined Nomenclature, notes 7 to Section XI, Note 1 to Chapter 63, Regulation (EC) No 471/2002 of 15 March 2002 ( Official Journal L75) and the wording of CN codes 6306, 6306 90 and 6306 90 00. |

| Item image |  |

|---|---|

| Issued Country | Germany |

| Reference | DEBTI58717/18-1 |

| Issuing date | 2019-03-07 |

| Item name | ASSEMBLED FURNITURE |

| Classified HS code | 9401.69 |

| Details & Customs Opinion | The product called “ASTRO chair” is a composite product consisting of an unpadded chair without armrests and a loose seat cushion. The chair is made of acacia wood and has a size of 60 x 59 x 89 cm (L x W x H). The goods are equipped with a backrest. The chair determines the character of the goods in terms of volume and importance for use. Two chairs are packed together as a set in a cardboard box. The goods shall be classified as ‘other than seats specified in heading 9402, not covered by subheadings (HS) 9401 10 to 9401 59, with a frame of wood, not upholstered’. |

| Item image |  |

|---|---|

| Issued Country | China |

| Reference | J2015-0015 |

| Issuing date | None |

| Item name | Apple Watch |

| Classified HS code | 8517.62 |

| Details & Customs Opinion | Apple Watch product design worn on the user’s wrist device that can directly communicate with the user’s iPhone. As the iPhone expansion device. The user can directly operate the device by Apple Watch the hardware and access many iPhone applications, achieve the iPhone function expansion: 1, processor; 2, the touch screen; 3, digital crown: by twisting the digital crown, be flexible and accurate screen zoom and scroll, crown and can be used as a button; 4, built-in speaker and microphone; 5 Linear actuator: to generate tactile feedback; 6, heart rate sensors: can help estimate the activity intensity, thus enhancing the overall situation with the measure calorie consumption level; 7, GPS, in order to achieve positioning and distance measurement; 8, the acceleration sensor control: to track physical activity throughout the day, and calculate motion steps to help measure calorie consumption; 9, a charging device; 10, the operating system. AC induction (eg transfer heartbeat); 10, by measuring heart rate, body sensing user activity, measured calories, and set moving target, and through collaboration with iPhone users view the activity log and view the progress of activities; 11, built Siri voice control This device; 12, through the built-APP realize calendar, Passbook (boarding passes, tickets, membership cards, coupon management software), edit iTune library, remote iPhone camera, stopwatch, timer, alarm clock, stocks, weather, and other functions; 13 , by third-party developers to develop applications to further implement other innovative features. When users buy Apple Watch equipment customers through the initial setup, the device is connected to the user’s iPhone immediately to implement the main features of the product include: 1, answer or reject calls; 2, by touching or dictation receive information; 3, receive, edit the message; 4, record voice memos; 5, the media access is stored in the iPhone (including pictures, music and video); 6 , function-based Global Positioning System (GPS) procedures; 7, set to the user’s iPhone; 8, graffiti screen and instantly share with other Apple Watch user; 9, by a linear actuator with a friend (others)

This product has a variety of functions, according to the General Rules of classification and 6.0, according to a communication device included in tariff codes 8517.62 |

| Item image |  |

|---|---|

| Issued Country | USA |

| Reference | NY H87395 |

| Issuing date | 2002-02-12 |

| Item name | Quartz analog wristwatch and multi-function pocket knife |

| Classified HS code | 9102.11 and 8211.93 |

| Details & Customs Opinion | The submitted wrist watch and multi-function pocket knife are classifiable under two separate headings or subheadings of the tariff. GRI 3 applies when goods are put up for sale collectively and are classifiable under two or more headings of the tariff. GRI 3(b) covers goods put up in sets for retail sale. Explanatory Note X to GRI 3(b) defines “goods put up in sets for retail sale”. Such goods: (a) consist of at least two different articles that are classifiable in different headings, (b) consist of products put up together to meet a particular need or carry out a specific activity, and (c) are put up in a manner suitable for sale directly to users without repacking. The submitted items fail, in our opinion, to constitute a set for tariff classification purposes. They meet the criteria of elements (a) and (c) above. The wrist watch and multi-function pocket knife do not consist of products put up together to meet a particular need or carry out a common specific activity. Having failed as a set in accordance with GRI 3(b) the wrist watch and multi-function pocket knife must be classified separately.

The applicable subheading for the wrist watch will be 9102.11.25, Harmonized Tariff Schedule of the United States (HTS) The applicable subheading for the pocket knife will be 8211.93.0030, Harmonized Tariff Schedule of the United States (HTS) |

| Item image |  |

|---|---|

| Issued Country | Poland |

| Reference | PLBTIWIT-2019-000261 |

| Issuing date | 2019-03-19 |

| Item name | Wrench including Pliers |

| Classified HS code | 8203.20 |

| Details & Customs Opinion | Pipe wrench made of chrome-vanadium steel, used to work under heavy load in plumbing. The wrench has a worm mechanism with a screw, regulating the opening of working jaws and a strong clamp, properly reinforced with long wrench arms. Solid “teeth” prevent the key from slipping on oval objects, pipes, valves or bolts. The jaws of the key are set at an angle of 45 degrees to the handle. The key length is 430 mm.

The tariff classification of the goods was determined on the basis of rules 1 and 6 of the General Rules for the Interpretation of the Combined Nomenclature, note 3 d of Section XV, note 1 (a) to Chapter 82 of the Common Customs Tariff and is consistent with the wording of heading 8203 WTC and TARIC code 8203 20 00 00 including pliers (including cutting pliers), pincers, tweezers and similar tools. |

Here are HS code list of Automotive parts retrieved from Customs Ruling records.

| Description | hs code | Image |

| Air conditioners | 8415.20 |  |

| Alternators | 8511.50 |  |

| Antennas | 8529.10 |  |

| Antifreeze | 3820.00 |  |

| Batteries | 8507.10 |  |

| Bearings, ball and/or roller | 8482.40 |  |

| Bearing housings and housed bearings | 8483.20 |  |

| Bearings, plain shaft type | 8483.30 |  |

| Belts of rubber | 4010.35 |  |

| Bodies (including cabs) | 8707.10 |  |

| Bolts & other fasteners of iron or steel | 7318.29 |  |

| Brake friction material of mineral substance | 6813.81 |  |

| Bushings (if plain shaft bearings) | 8483.90 |  |

| Cable, electrical (insulated) | 8544.30 |  |

| Cable, non-electrical, of steel | 7312.10 |  |

| Capacitors | 8532.22 |  |

| Camshafts & crankshafts | 8483.10 |  |

| Carpets, tufted | 5703.20 |  |

| Carpets, woven, not tufted or flocked | 5702.42 |  |

| Chain of iron or steel (including timing chain) | 7315.11 |  |

| Chain sprockets | 8483.40 |  |

| Chassis fitted with engine | 8706.00 |  |

| Cigarette lighters | 9613.80 |  |

| Circuit breakers | 8536.10 |  |

| Clamps of iron or steel for hoses | 7326.20 |  |

| Clutch friction material of mineral substance | 6813.89 |  |

| Compressors | 8414.80 |  |

| Control Boxes & panels | 8537.10 |  |

| Decals | 4908.90 |  |

| Defrosters & demisters | 8512.40 |  |

| Distributors & ignition/starting equipment | 8511.40 |  |

| Engines, diesel | 8408.20 |  |

| Engines, gasoline | 8407.34 |  |

| Engine parts, not provided for elsewhere | 8409.91 |  |

| Fans & Blowers | 8414.59 |  |

| Filters | 8421.23 |  |

| Fittings & mountings of base metal | 8302.30 |  |

| Fittings & mountings of plastic | 3926.30 |  |

| Fittings of iron or steel for pipes & tubes | 7307.23 |  |

| Flexible tubing of base metal | 8307.10 |  |

| Floor mats of rubber | 4016.91 |  |

| Pulleys | 8483.50 |  |

| Fuel injectors | 8409.99 |  |

| Punps for piston engines | 8413.30 |  |

| Fuses & similar electrical apparatus | 8536.10 |  |

| Gears | 8483.40 |  |

| Gauges | 9026.20 |  |

| Generators | 8511.40 |  |

| Handles & knobs of plastic | 3926.30 |  |

| Rubber parts and accessories | 4016.99 |  |

| Harnesses, electrical | 8544.30 |  |

| Heaters, electrical | 8516.29 |  |

| Horns & other sound or visual signaling equipment | 8512.30 |  |

| Hoses of rubber | 4009.12 |  |

| Hydraulic cylinders | 8412.21 |  |

| Integrated circuits | 8542.31 |  |

| Lamps | 8539.32 |  |

| Lenses of glass, signaling & optical | 7014.00 |  |

| Lighting equipment | 8512.20 |  |

| Locks & keys | 8301.20 |  |

| Magnets & electromagnetic articles | 8505.20 |  |

| Manuals & other printed matter | 4901.10 |  |

| Mirrors | 7009.10 |  |

| Motors, electric | 8501.31 |  |

| Motors, hydraulic or pneumatic | 8412.39 |  |

| Nameplates, signplates, etc.parts thereof of base metal | 8310.00 |  |

| Nuts & other fasteners of iron or steel | 7318.16 |  |

| Pins, cotter or dowel, & fasteners of iron or steel | 7318.24 |  |

| Printed circuit boards, blank | 8534.00 |  |

| Printed circuit boards, populated | 8537.10 |  |

| Vacuum pumps | 8414.10 |  |

| Pumps for liquids | 8413.30 |  |

| Radios, with tape & CD players | 8527.91 |  |

| Relays & similar electrical apparatus | 8536.49 |  |

| Resistors, electrical | 8533.21 |  |

| Rivets of iron or steel | 7318.23 |  |

| Rivets of base metal | 8308.20 |  |

| Screws & other fasteners of iron or steel | 7318.15 |  |

| Seals of plastic | 3926.90 |  |

| Seals of rubber | 4016.93 |  |

| Seats, cushions & other articles of furniture | 9401.20 |  |

| Crankshaft | 8483.10 |  |

| Sparkplugs | 8511.10 |  |

| Speedometers & odometers | 9029.10 |  |

| Springs of steel | 7320.20 |  |

| Springs of copper | 7419.99 |  |

| Studs & other fasteners of steel | 7318.15 |  |

| Switches & similar electrical apparatus | 8536.50 |  |

| Tape & CD players without a radio | 8519.81 |  |

| Thermostats, without valves | 9032.10 |  |

| Tires | 4011.10 |  |

| Tool (Hand tools) Kit | 8206.00 |  |

| STATIC CONVERTERS | 8504.40 |  |

| Turbochargers | 8414.59 |  |

| Universal joints | 8483.60 |  |

| Valves | 8481.30 |  |

| Washers & other fasteners of iron or steel | 7318.22 |  |

| Windshield window safety glass | 7007.11 |  |

| Windshield wipers | 8512.40 |  |

| Wrenches | 8204.11 |  |

Retrieved from:European Union Website , U.S. Customs and Border Protection

*When consulting the above list, please keep in mind that it is being offered for

reference purposes only and does not guarantee accuracy of classification.

The above data are retrieved from the Customs Ruling Database from all over the world.

If you usually struggle with HS classification, I highly recommend using Customs Ruling

Database.

But before using Customs Ruling Database to search HS code, it is necessary to understand the fundamentals of HS classification.

If you are not familiar with HS classification Please refer to the two below articles before searching from Customs Ruling Database otherwise you fell in a pit hole of HS classification.

Search HS code from Customs Ruling Database

Some customs provide their own Ruling database on the internet.

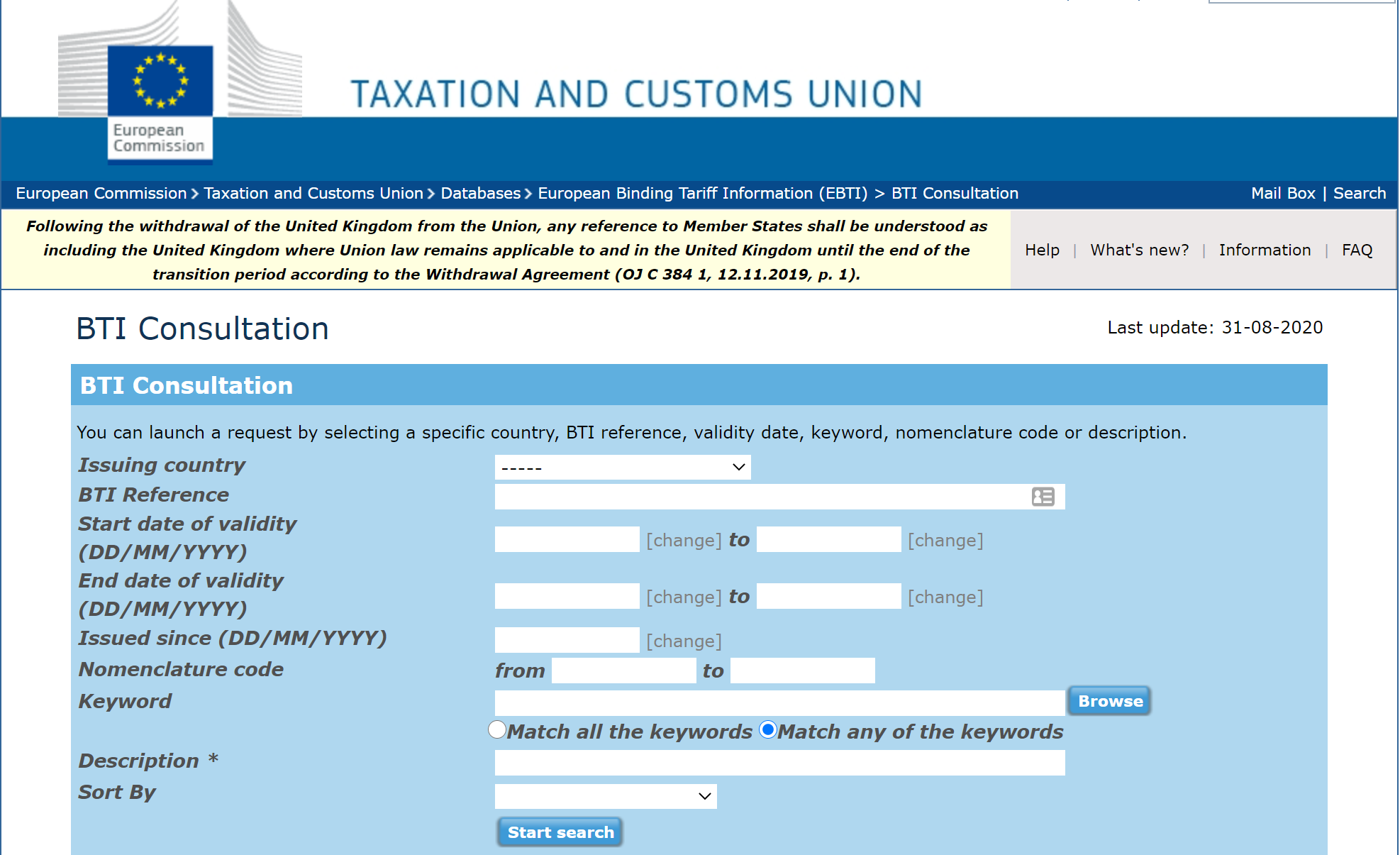

among them, two big databases are US customs “CROSS” and EU taxation and customs union “BTI Consultation”

US customs “CROSS”

EU taxation and customs union “BTI Consultation”

The above two big databases contain more than 500 thousand ruling records.

If you look for a ruling record of a general trade item, most of the cases you would be able to find it from two of them.

So let’s take a look at how the search process works.

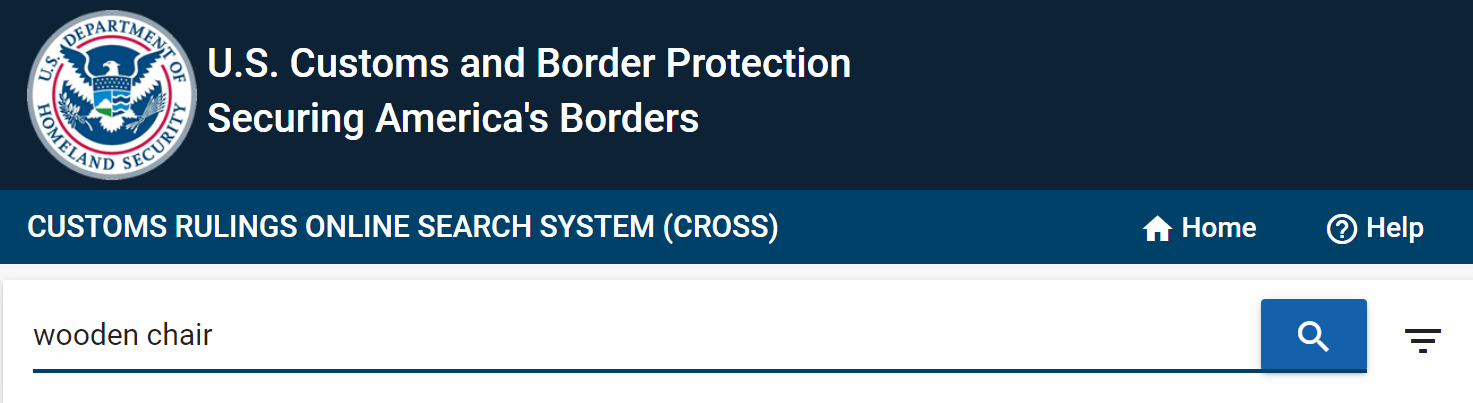

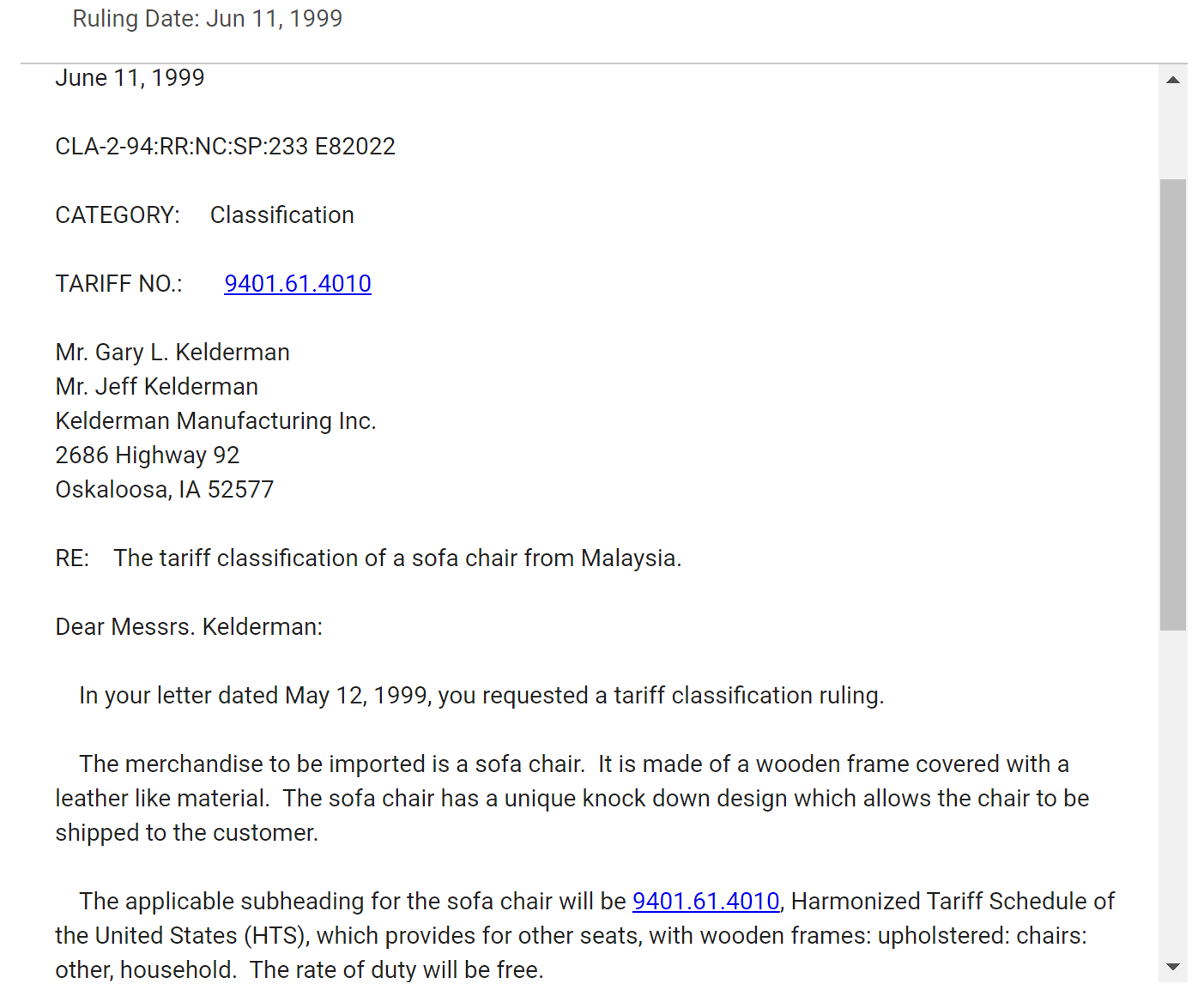

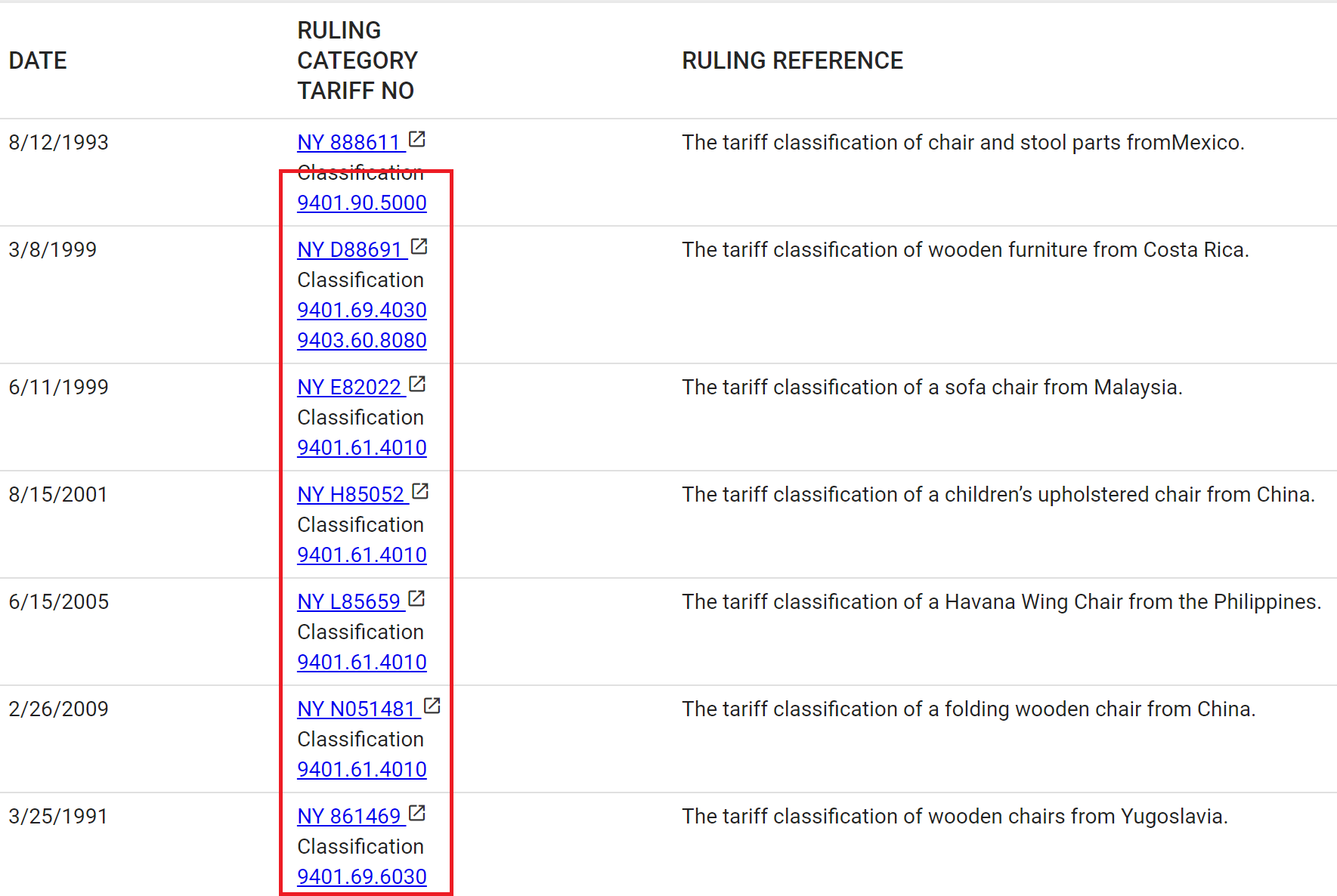

Suppose you are looking for HS code of “Wooden chair”, just type in the search bar “Wooden chair”.

Then you can see many ruling records of “Wooden chair” and HS codes.

When you need to see the details of the record, click referential NO.

Then you can see the details of the record.

Complex search

CROSS is a searchable database of CBP rulings that can be retrieved based on simple or complex search characteristics using keywords and Boolean operators.

Here are tips you can use when searching the database.

Keyword Input

Searches can be performed utilizing keywords, multiple keywords, phrases, and combinations of each.

-

Single keyword = doghouse

Search results will include records with the keyword doghouse in the document.

-

Multiple keywords = dog house

Search results will include records with both the keywords dog and house in the document.

-

Phrase = “dog house” enclosed in double quotes.

Search results will include records with the exact phrase “dog house” in the document.

-

Search by tariff number

– Simply enter 6204.43.4040 to retrieve rulings that contain this tariff number.

– 6204.43.4040 6104.43.2020 6110.30.3055 will find rulings that reference all these tariff numbers.

-

Search by regulatory cite or statutory cite

– Since there are a variety of ways these are expressed, the following techniques will yield favorable results: By breaking this cite into two phrases, “19 C.F.R.” “102.11(b)” will return rulings with 19 CFR § 102.11(b), 19 CFR 102.11(b), 19 C.F.R. 102.11(b)

– The search phrase “19 U.S.C.” “1401(a)” or the search phrase “1401a” will return results where the search target may appear as 19 U.S.C. 1401(a)(b) or 19 U.S.C. 1401a(b). If parentheses are part of the phrase to be searched, they must be enclosed in quotes. Note that periods are used in the acronym, i.e., C.F.R. is used rather than CFR.

-

Search by ruling number

– Enter 083536 to retrieve all rulings that reference that number.

– Hint: to search for a specific ruling, make sure that the collection option is set to ALL and the date sort is set to descending.

– Hint: if you are searching using a ruling number and do not get a hit by typing in the requested number, try adding a “W” in front of the number, for example W563543.

Punctuation marks such as the period (.), colon (:), semicolon (;), and comma (,) are ignored during a search.

BooleanOperators and Wildcards

Boolean operators are tools used to narrow your search results. They include AND, OR, and NEAR. The wildcard operator ( * ) is used to expand your search.

- AND connecting two or more keywords or phrases will only match records containing all keywords or phrases. AND is the default operator when two or more keywords or phrases are entered without an operator.- dog AND “chew toy” is the equivalent of dog “chew toy”.- dog AND house is the equivalent of dog house.

- AND NOT forbids the word or word phrase that follows it from appearing in the search result set.- red handbag AND NOT leather will find records containing words red and handbag and screens out records with the word leather.- dog AND NOT “chew toy” will return records with the word dog but not the phrase “chew toy”.- light emitting diode AND NOT “semi*” will find records containing words light, emitting and diode and screens out records with words starting with semi (such as semiconductor).- red handbag AND NOT leather AND NOT plastic AND NOT pink will find records with the words red and handbag but screens out records with the words leather or plastic or pink.

- OR connecting two or more keywords or phrases, will match records containing any of the keywords or phrases.- dog OR “chew toy” returns records containing the keyword dog or the phrase “chew toy”.

- A string of letters or digits followed by the wildcard (*) will match all records that contain keywords starting with the same pattern. This search type is especially useful when you don’t know the spelling of a particular keyword, or when you want to include all variants of a keyword in your search.- comput* returns records containing the words computer, computing, computation, etc…

- Multiple operators can be used in a single search to create very specific result sets.- dog OR house AND wood matches records containing both the keywords house and wood, as well as records containing the keyword dog.

Correct Syntax

- Two operators are not allowed next to each other.

- No operator is allowed to start or end a query except the wildcard (*).

- CROSS Search is not case sensitive and views mike, MIKE, and Mike as equivalents when searching.

- Keywords can be any string of more than one letter and/or digits; but, cannot include non-alphanumeric characters such as: `~ ! @ # $ % ^ & and white space (tabs).

Image search

CROSS provides detailed information regarding each individual item, it must be a great source for determining HS code but sometimes information is so detailed that you could be overwhelmed and to be uncertain if that information really refers to the item you want to inquire.

Please be noted that CROSS mostly provides text information while EU taxation and customs union “BTI Consultation” provide many images.

If you are overwhelmed with CROSS’s tons of texts, I recommend you to search item images from “EU BTI Consultation” based on information retrieved from CROSS.

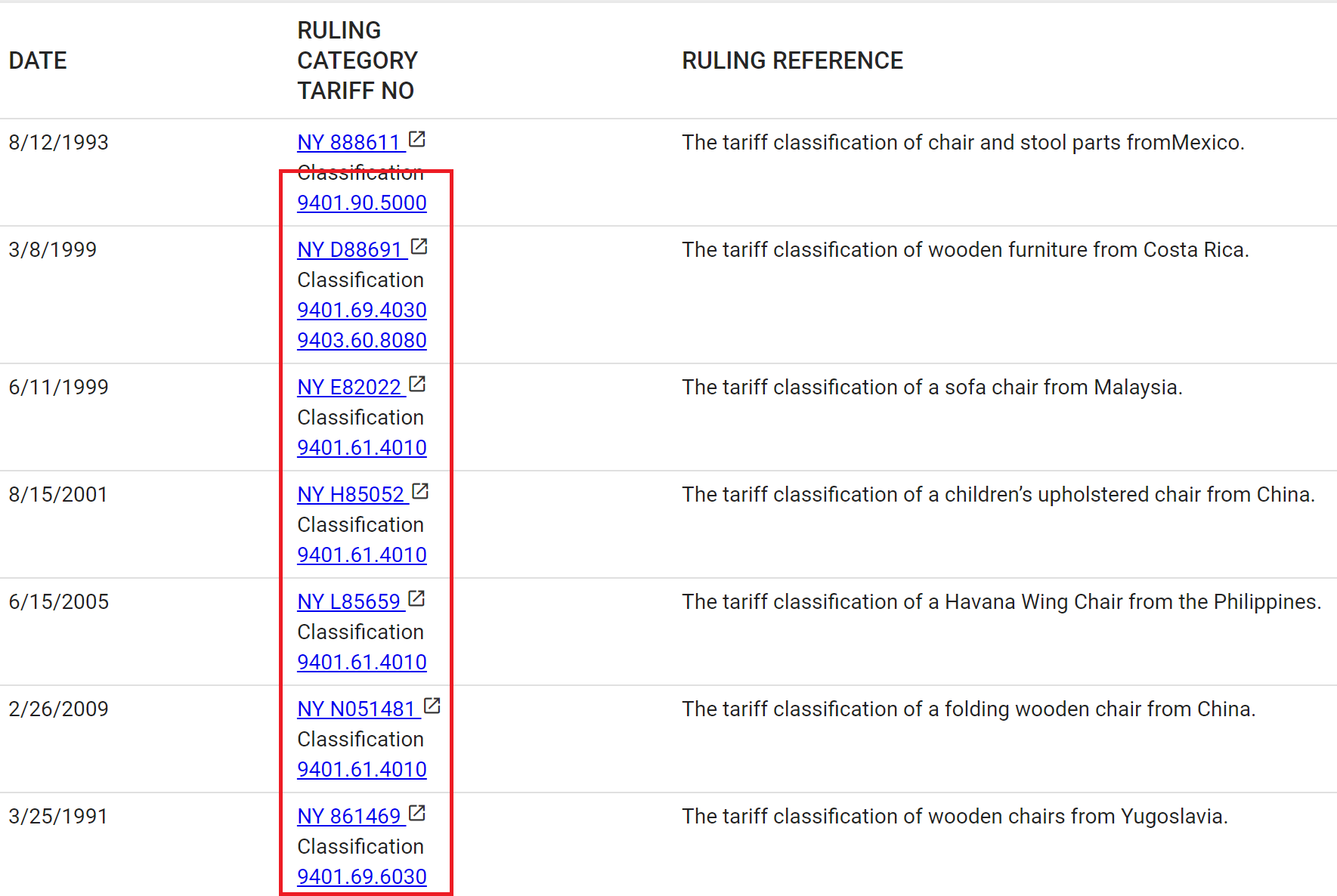

Let’s say you are looking for HS code of wooden chair at CROSS.

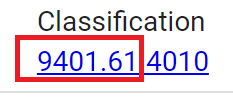

And when you are certain that wooden chiar’s HS code is 9401.61.4010.

Then copy the first 6 digits of the HS code.

Because the first 6 digits of the HS code is common anywhere in the world.

In order to see the item’s image from “EU BTI Consultation” you can only use the first 6 digits of the HS code to search. The full digit of “9401.61.4010” is used only for the US.

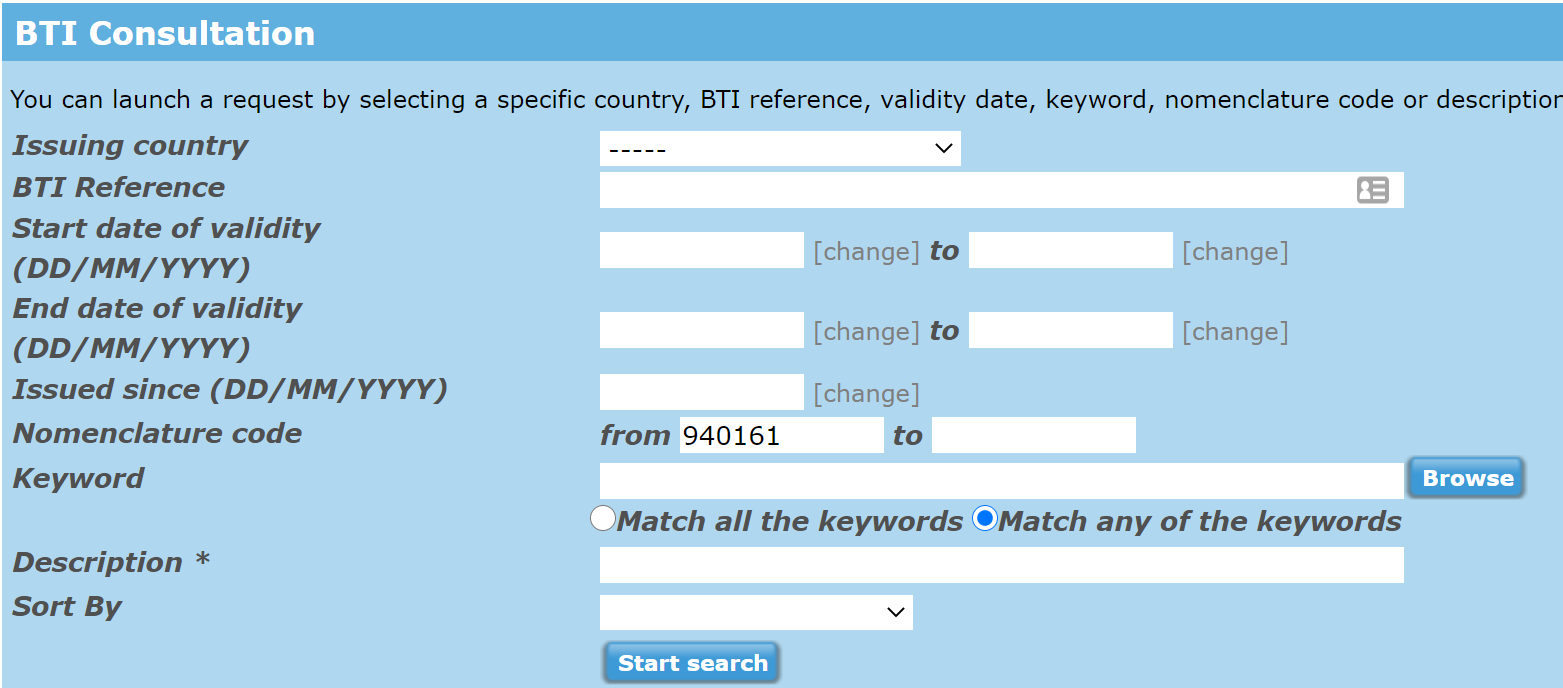

Go to BTI Consultation and put 6 digits of “940161” in “Nomenclature code” form and search.

“Nomenclature code” is almost the same meaning as “HS code” or “HTS code”

In the result page, select the radio button of “Thumbnail View”.

Then you can see many kinds of item’s images based on the HS code you specified.

One more example.

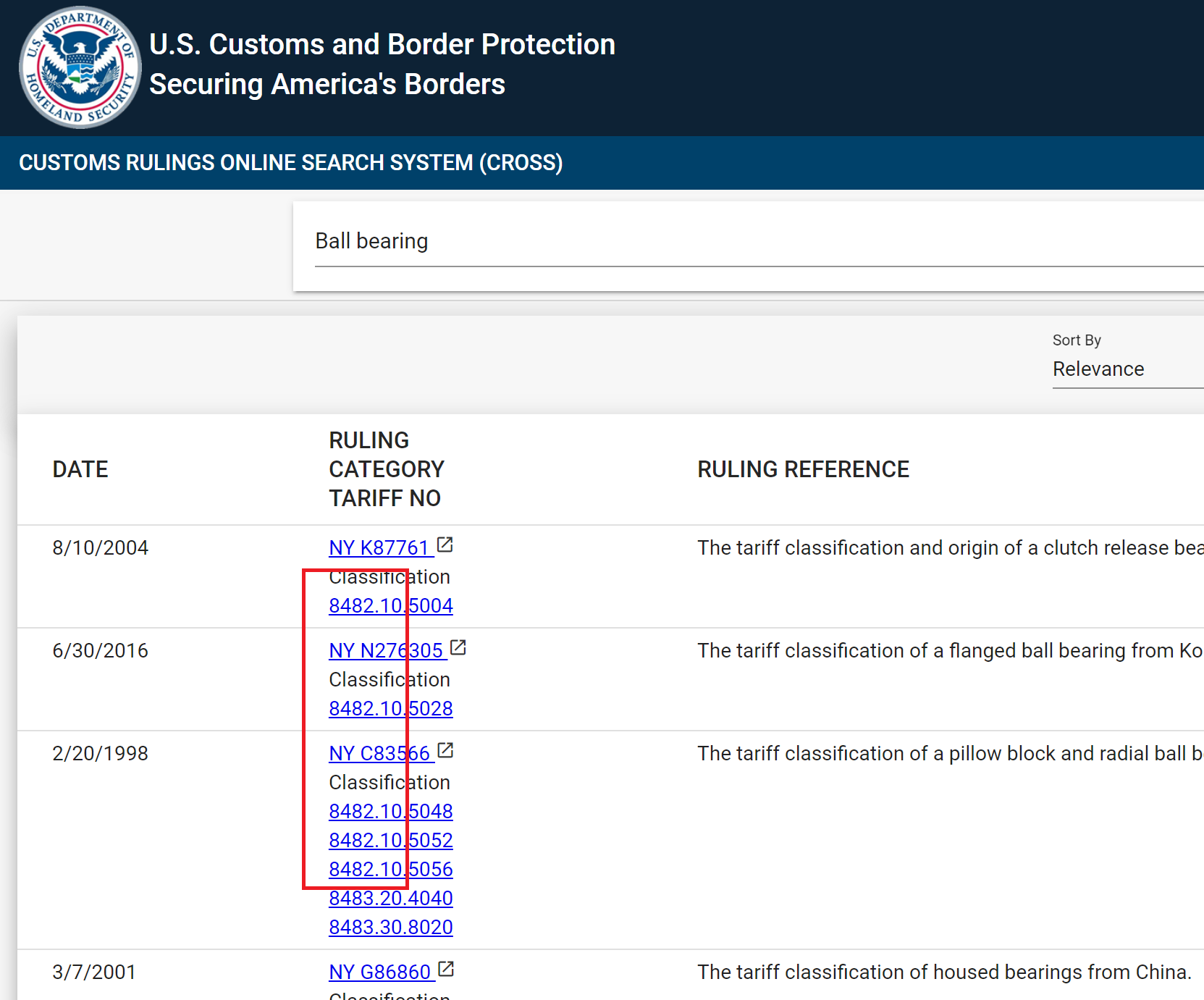

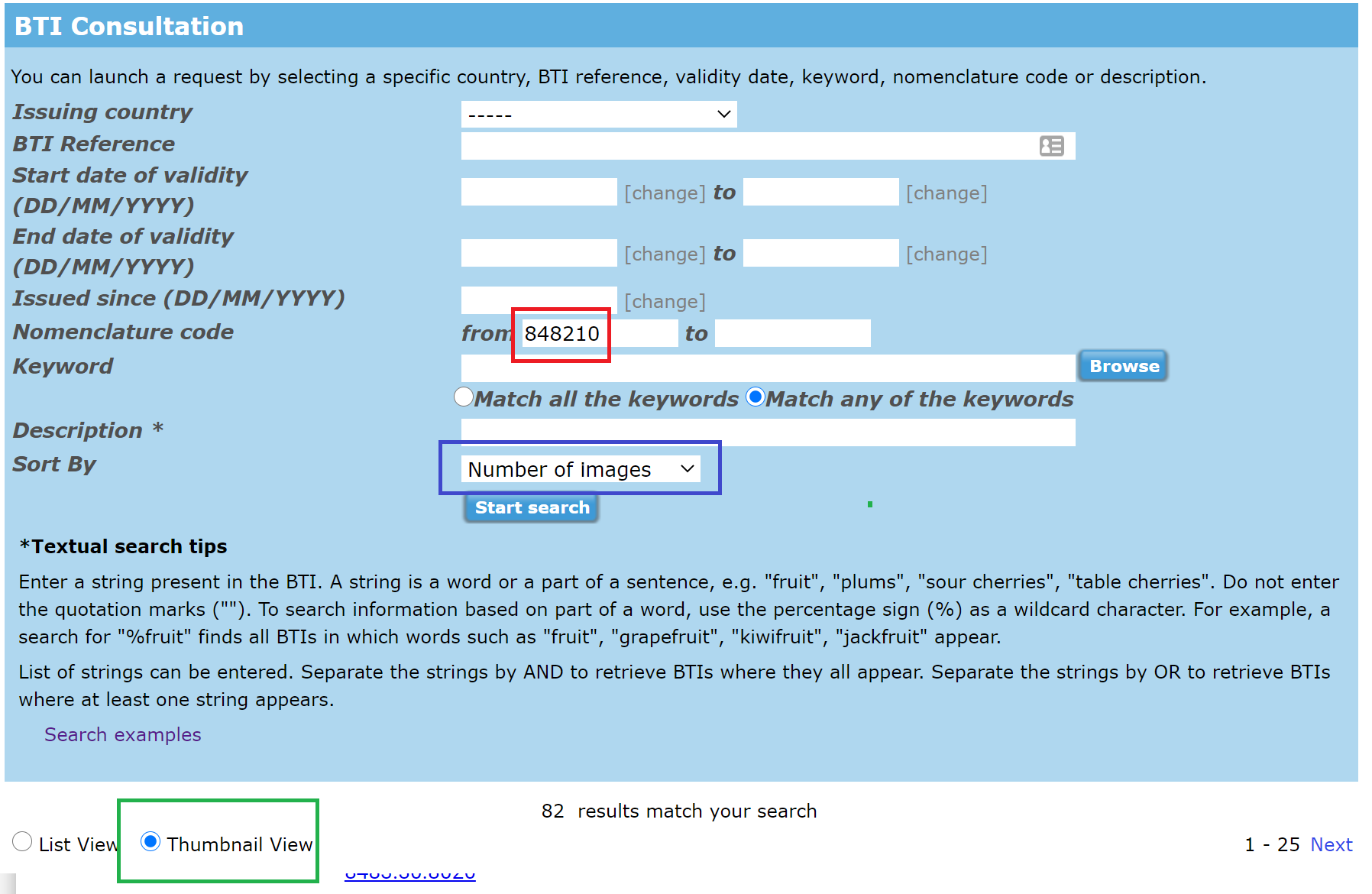

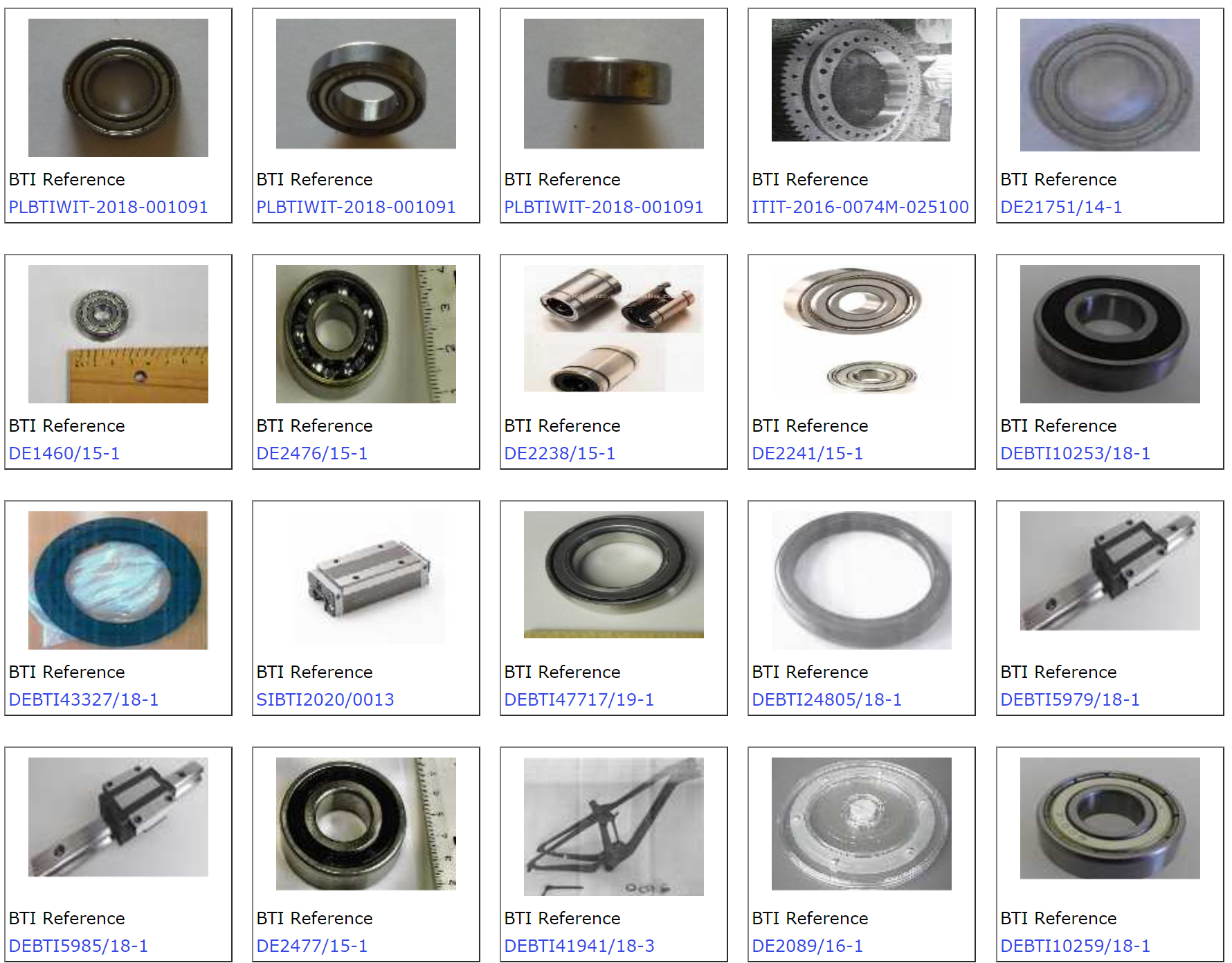

Let’s say you are looking for HS code of “Ball bearing”, go to CROSS and type in the search bar “Ball bearing”.

Then you could expect that HS code of “Ball bearing” could be 8482.10 but not certain.

In order to see the Items’ example image, go to BTI Consultation and type 6 digits number of the HS code retrieved from Cross.

To make it clear, results should be sorted by “Number of images” and apply Thumbnail View.

Then you can be more certain that HS code of 8482.10 is appropriate for your targeting item with those images.

When it comes to HS classification you can get a clear view from those images.

Therefore you can be more certain than just classify with text information.

BTI Consultation is very powerful when it comes to search items image but it’s not a useful tool when it comes to text search because BTI Consultation contains the database of many EU countries and they consist of many languages.

In BTI Consultation database English is not a common language.

Some data has an English keyword but it’s not so detailed to be searched.

Therefore I recommend using Cross to search text-based information with English keyword to specify 6digits of HS code and using BTI Consultation to search image information to be more certain that the specified HS code is appropriate for your target item.